VSC gets advantages from M&A

Vietnam Container Shipping Joint Stock Corporation (Viconship, HoSE: VSC) is actively engaging in mergers and acquisitions (M&A) to expand its business scale.

VSC intends to acquire capital contributions from Nam Hai Dinh Vu Port LLC's capital contributors in order to grow its ownership share to as much as 100% of the company's charter capital.

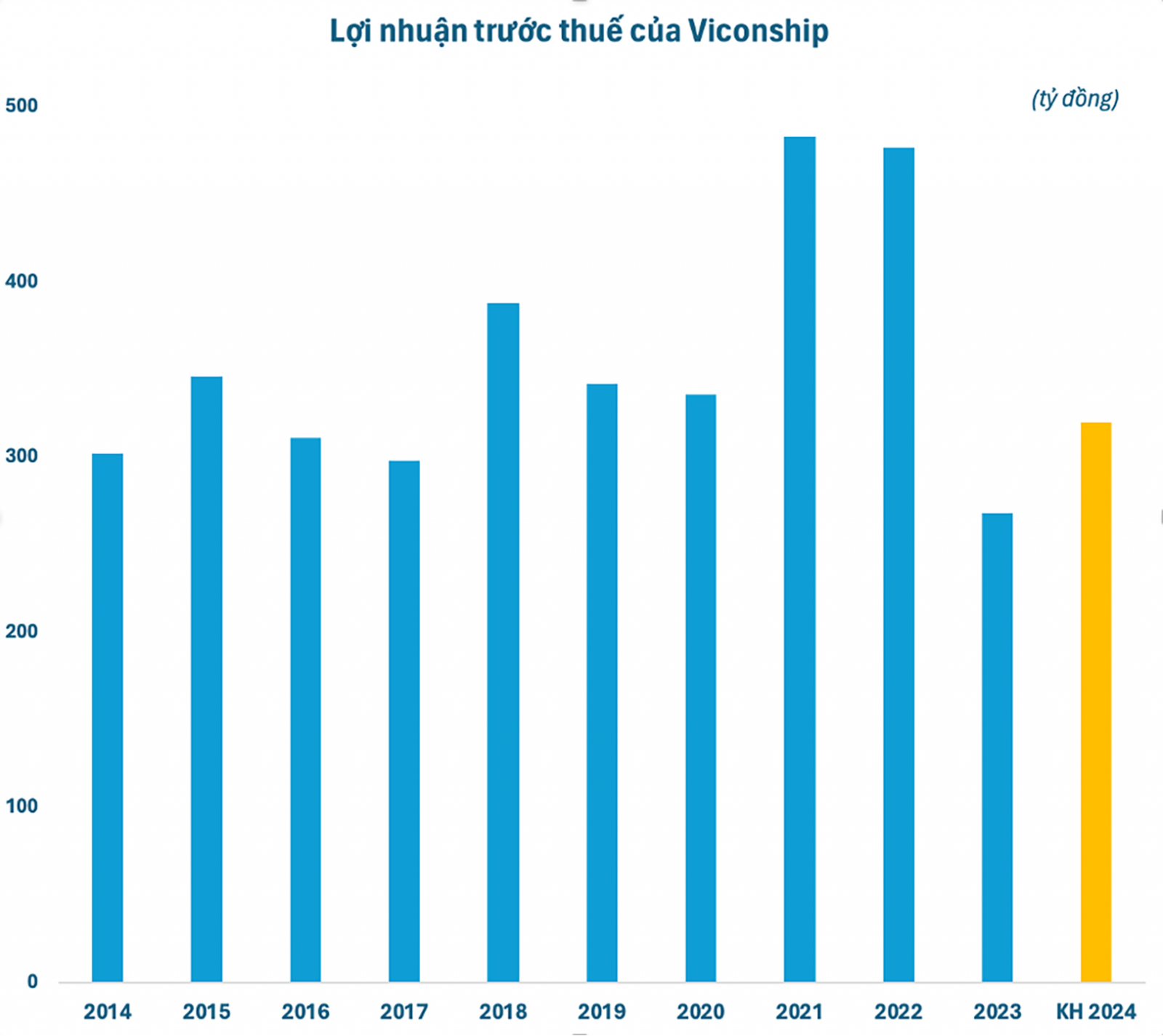

VSC's pre-tax profits over the years

Expanding Influence

In 2023, VSC completed the acquisition of 35% of the capital at Nam Hai Dinh Vu Port LLC (owning Nam Hai Dinh Vu Port in Hai Phong).

Not stopping there, VSC continues to plan to acquire an additional 44% of the charter capital at Nam Hai Dinh Vu Port to increase its ownership to 79% of the charter capital.

To fund the above M&A activities, VSC recently completed the procedures to request the State Securities Commission to extend the certificate of public offering registration issued on December 29, 2023, for an additional 30 days from March 28, 2024. Previously, on January 18, 2024, VSC finalized the shareholder list for a share issue to shareholders at a ratio of 1:1, with a price of VND 10,000/share and a total of more than 133.3 million shares offered.

VSC aims to raise more than VND 1.333 trillion from the share offering. Of this, the company will use VND 1.320 trillion to acquire up to an additional 44% of the charter capital at Nam Hai Dinh Vu Port LLC from existing capital contributors (Doan Huy Trading and Investment LLC and Huy Hoang Import-Export Metal Trading LLC). The remaining VND 13.96 billion will be used to supplement working capital.

Realizing Ambitions

The issuance of such a large number of shares also presents a significant challenge for VSC. However, if the issuance and acquisition are successful, VSC will increase its ownership from 35% to a maximum of 79% of the charter capital at Nam Hai Dinh Vu Port LLC, helping to increase VSC's total capacity to over 2.6 million TEUs.

VSC expects to gain momentum from M&A activities. (Illustrative image)

Owning Nam Hai - Dinh Vu Port enables VSC to create a seamless 800-meter port system, including Nam Hai - Dinh Vu Port and Green VIP Port. This port system could extend up to 1,500 meters if including VIMC Dinh Vu Port. This will significantly reduce the operational costs of the ports, decrease outsourcing costs, and increase flexibility in ship reception.

Particularly, by increasing its market share in the Hai Phong port cluster, VSC will benefit from the growth prospects of Vietnam-China trade and FDI flows into Hai Phong city. The Hai Phong port area is one of the three regions (along with Vung Tau and Ho Chi Minh City) with the largest container throughput, accounting for 27% of the total container volume. In the first two months of 2024, container cargo throughput at the ports was estimated to exceed 4 million TEUs, a 27% increase compared to the same period last year. The Hai Phong area alone is estimated to grow by 40–60% compared to the same period last year.

Outlook for 2024

VSC recorded revenue growth for the second consecutive quarter compared to the same period in 2022, with Q4/2023 revenue reaching VND 625.9 billion, an increase of 20.4%. Selling and administrative expenses were recorded at VND 50.5 billion, a decrease of 4.9% compared to the same period in 2022. However, short and long-term debt increased by 72.3% from the beginning of the year to VND 1.565 trillion, leading to a tenfold increase in debt service costs compared to the same period last year, reaching VND 44.1 billion. As a result, pre-tax profit only increased by 4.8%, reaching VND 96.1 billion.

For the entire year of 2023, VSC recorded a revenue of VND 2,180.9 billion, an 8.6% increase, and a pre-tax profit of VND 268 billion, a 44.6% decrease compared to the same period in 2022, completing 96.9% and 103.1% of the annual plan, respectively. Notably, the significant profit decrease was due to the impact of operating costs and debt service costs to finance M&A activities. Operating expenses were recorded at VND 227 billion, a 23% increase, and debt service costs were recorded at VND 170.5 billion compared to VND 1.1 billion in 2022.

With such prospects, Mirea Asset Securities predicts a significant improvement in VSC's gross margin for 2024 from 30% to 32%; the M&A strategy will keep financial costs high, reaching over VND 205 billion, a 20% increase; and selling and administrative expenses are expected to increase by 5% and 8%, respectively. Accordingly, VSC is expected to achieve a net revenue of VND 2.508 trillion, a 15% increase, and a net profit of VND 397 billion, a 97.2% increase compared to 2023.