What are the challenges of Vietnam Textile & Garment sector by end-year

The manufacturing disruption and rising administration cost due to the fourth wave of COVID-19 pandemic might blur the outlook of Vietnam textile and garment industry.

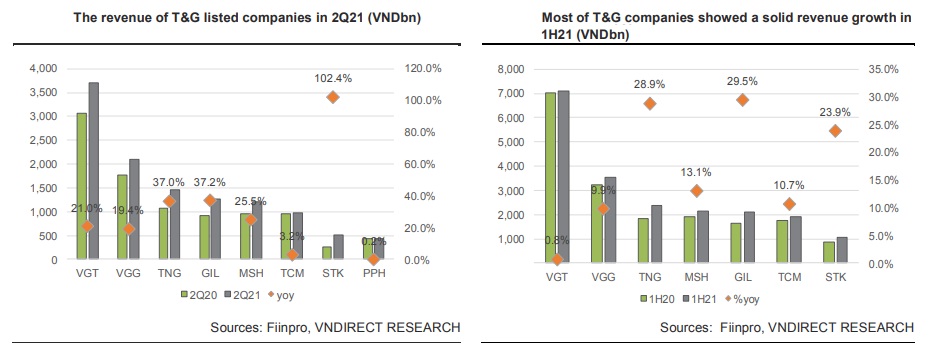

Earnings to grow robustly in 1H21

Based on VNDirect’s estimate, 2Q21 aggregated revenue of listed T&G companies soared 22.1% YoY mainly driven by strong demand from the U.S. and E.U. markets, vs a decrease of 7.6% YoY in 1Q21. Consequently, 1H21 aggregated revenue of listed T&G companies increased 7.3% YoY but slightly fell 12.3% vs 1H19. TNG and GIL posted strong revenue growths in 1H21 with 28.9% YoY and 29.5% YoY, respectively as these manufacturers quickly grabbed orders shifting from competitor countries to Vietnam.

VNDirect sees gross margin improvement across the T&G sector in 1H21. To be specified, STK’s gross margin inched up 11.4% pts YoY to 19.5% in 1H21 thanks to a larger contribution with higher-margin recycled yarn (56% of 1H21 revenue vs 38% of 1H20). VGT’s 1H21 gross profit widened 6.6% pts YoY on the back of FOB orders to be shifted from Myanmar and India to Vietnam, and a larger contribution from yarn which delivered a higher margin.

On the other hand, the gross margin of TNG and TCM softened 3.8% pts YoY and 0.8% pts YoY in 1H21 due to a lack of gauze mask and anti-virus fabric orders and increasing shipping cost from Original Design Manufacturing (ODM) orders.

Overall, sector net profit grew 141.7% YoY in 2Q21, stronger than that of 44.6% YoY of 1Q21.

The gross margin of TNG softened 3.8% pts YoY in 1H21 due to a lack of gauze mask and anti-virus fabric orders...

Demand surge in U.S and E.U. markets

The U.S. and E.U. consumers have shown a strong pent-up demand after lockdown. According to the Bureau of Labor Statistics (BLS), CPI for apparel advanced 1.2% mom and 0.7% mom in May-21 and June-21, respectively. Nearly half of the U.S. population has been vaccinated against COVID-19, allowing Americans to buy personal goods directly in the shop, travel, and attend sporting events. As a result, The US’s T&G import turnover in 1H21 increased by 31.16% YoY to US$50.6bn, in which import turnover for apparel reached US$35.3bn (26.9% YoY).

According to GDVC, E.U.’s T&G import turnover from Vietnam on May 21 and Jun-21 soared 11.9% YoY and 21% YoY, respectively. Furthermore, E.U.'s CPI for clothing and clothing accessories also rose 0.41% and 0.38% MoM in May-21 and Jun-21. VNDirect expects that the U.S. and E.U. are still the two main export markets of Vietnam's T&G industry in 2H21-22.

A chance to grab the market from competitors

Indian T&G exporters are facing the risk of losing most of their orders to competitors such as Vietnam, Bangladesh, Sri Lanka, and Pakistan. Many of India’s garment factories must close or operate at half capacity to prevent new cases of Covid-19. According to the Economic Times, India T&G business in Tamil Nadu and Karnataka fear their orders will be halved within 2H21F as they cannot send samples to help global brands prepare new collections.

Meanwhile, Myanmar’s textile & garment industry is dealing with twin headwinds: increasing infection cases and the political turmoil on Mar 21. In 1H21, employment in T&G companies decreased by an estimated 31% YoY due to factories closure.

Although Vietnam is facing the 4th outbreak of Covid-19, VNDirect expected that the adverse effects of the political situation and the epidemic on Myanmar and India would be opportunities for Vietnam to increase market share in the U.S. and Korea. This stock company also believes TNG, MSH and GIL are likely the key beneficiaries as their factories locate in Thai Nguyen, Nam Dinh, Hue, which are out of the current pandemic outbreak center. The U.S. market is the main export market of GIL, accounted for 70% of GIL's export revenue in 1H21. Whereas TNG and MSH showed a significant earnings growth in 2Q21 partly thanks to FOB orders to be shifted from India and Myanmar to Vietnam. “The increase in orders benefiting from the supply disruption in the Indian and Myanmar markets would contribute 20% and 15% to TNG and MSH's revenue, respectively in FY21F”, VNDirect forecasted.

Challenges for 2H21 earnings growth

The COVID-19 outbreak in the South region could disrupt supply chains again as companies are unable to ship raw materials and lack the human resources to ensure timely deliveries. According to Vietnam Textile and Apparel Association (VITAS), the prolonged social distancing period will greatly affect the business results of T&G companies when 50% of factories are located in the South. Currently, the proportion of factories that have to close has reached 30-35%, mainly small and medium enterprises, due to insufficient funds to implement "3 on-site" for employees.

“Vietnam T&G industry is facing challenges due to a shortage of workers and sluggish vaccination rate for the industry. When the Covid-19 is under control by the end of Aug-21, T&G export turnover in 2021 may only reach US$33bn (-6% YoY), fulfilling 84% of the Vietnam government's guidance for 2021 (US$39bn)”, VITAS said.

Meanwhile, container freight costs increased three times in 1H21. VNDirect thinks that the shortage of empty containers and high logistics costs in 2H21 may affect businesses with ODM and Original Brand Manufacturing orders. Furthermore, VITAS forecasted that if the Covid-19 epidemic is under control by the end of Aug-21, the number of employees would be expected to reach only 60-65%. Therefore, the shortage of human resources is challenging for Aug-21 and 3Q21.