What are the prospects for 3Q21 business earnings?

According to VNDirect, 2Q21 market aggregate earnings surged 66% yoy, lower than that of 92% yoy in 1Q21. What is the outlook for 3Q21 earnings?

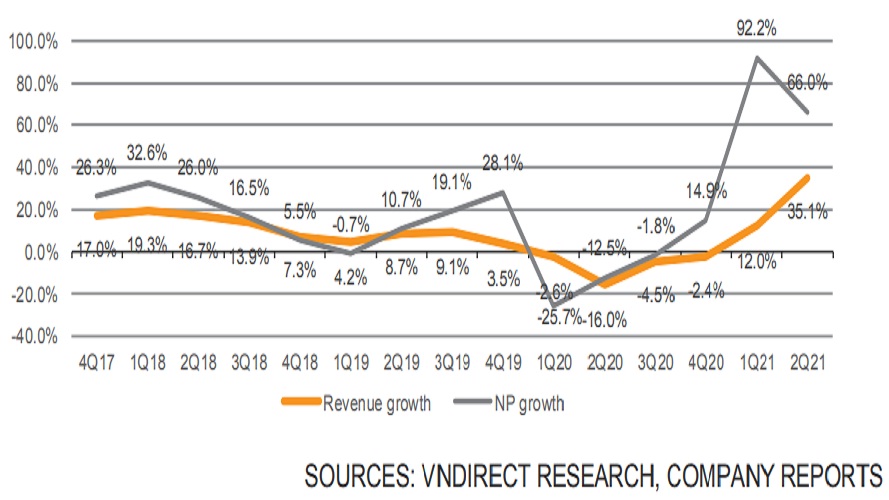

Quarterly revenue and net profit growth on yoy basis (4Q17-2Q21)

As of 03 Aug 2021, 700 listed companies on three Vietnam bourses, representing 85% of market capitalization, have released 2Q21 results.

Positive earnings momentum

Based on VNDirect’s estimates, 2Q21 aggregate earnings of listed companies on three Vietnam bourses (HOSE, HNX, UPCOM) surged 66.0% yoy from the low base 2Q20 (- 16.0% yoy). 2Q21 earnings growth was weaker than that of 92.2% yoy of 1Q21 but still 51% higher than pre-pandemic level (2Q19). Out of the 48 companies under VNDirect’s coverage that have reported their 2Q21 results, 56% were in line with its expectations while 21% beat our forecasts and 23% missed our estimates.

2Q21 VN30 earnings rose 46.1% yoy

19 corporates out of VN30 had shown resilience growth, led by PNJ (606% yoy), MSN (254% yoy), and HPG (254% yoy). The stellar growth of PNJ came from 62.3% yoy revenue growth (from bottom in 2Q20) and 1.5% pts margin expansion. MSN’s strong recovery in 2Q21 was thanks to (1) higher EBITDA margin of Vincommerce retail chains, (2) favorable selling price of Masan Hitech Material, and (3) strong earnings growth of its affiliate- Techcombank (TCB). Among banks, STB recorded the highest earnings growth from low base in 2Q20 (Net profit growth of just 10% yoy).

On the other hand, the laggards are VJC (-99% yoy), VIC (-41% yoy) and CTG (-38% yoy). In 2Q21, VJC no longer recorded significant other income as in 2Q20 (VND1,773bn compared with VND1,014bn in pre-tax profit), while Vinfast’s huge losses in 2Q21 damaged VIC’s net profit growth. Both large banks, CTG and VCB posted negative bottom-line growths on heavy provisioning.

Steel and Financial sectors still shine

Steel manufacturers enjoyed higher average selling price (ASP) and strong sale volume, delivered a 326.4% yoy growth in 2Q21 net profit. In the financial sector, listed brokerage firms recorded 120.8% yoy in net profit growth as 2Q21 appears to be another good quarter for both indexes and market liquidity. 2Q21 net profit growth of listed banks decelerated to 34.1% yoy from 79.0% yoy of 1Q21 as large banks (VCB, CTG) surprisingly posted negative bottom-line growths due to heavy provisioning. Property’s aggregate earnings grew 102.6% yoy, higher than that of 38.2% yoy of 1Q21, thanks to housing selling price hike and stronger sale volume.

Impact of global commodity prices hike

At end-2Q21, S&P GSCI rallied 30.9% ytd and 64.6% yoy, fueling for the earnings growth of some certain sectors, including: Chemical (52.6% yoy), both Oil & Gas and Mining recorded positive net profit versus heavy loss in 2Q20. Food producers show mixed performance: rice exporters and sugar producers are riding on the rice and sugar prices spike, while dairy, animal feed, edible oil, and meat producers’ earnings growth is under pressure from higher material input costs. At all, VNDirect saw that food producers posted a soft recovery of 14.7% yoy 2Q21 earnings growth, slightly higher than that of 13.7% yoy of 1Q21.

Covid-19 to cast a shadow over 3Q21 earnings

VNDirect said, notwithstanding the resilience of listed corporate earnings in 2Q21, the country is currently facing its more serious wave and yet to be brought under control. This is likely to greatly impact 3Q21F earnings. Though Transportation and Retail recorded positive results in 2Q21 (171%/61% yoy, respectively), nationwide lockdown protocols will hinder the recovery momentum in 3Q21. Additionally, Travel and leisure (including airlines) and Beverages will likely have another loss quarter.