What are the prospects for Vietnam rice exports in 2H2021?

Vietnam’s competition with India in rice export could increase in 2H2021, so Vietnam’s rice export price will likely drop to ensure a high level of export volume, said VDSC.

Rice exports in 1H2021 decreased

According to the General Department of Customs, in 1H2021, rice export volume fell by 14% yoy, to 3.03 million tons. The Philippines - the most important export market, reduced its import volume to 1,093 thousand tons (-21% yoy). Similarly, the Malaysian market also recorded a sharp decline of 56% yoy, to 151 thousand tons. According to VDSC, two main reasons leading to the decline in volume: (1) the Philippines actively reduced its imports as they have a bumper crop this year, it is expected that the total domestic rice production of the Philippines will reach 12.4 million tons (4% yoy); (2) there were not enough containers for export.

In contrast, exports to China, Ghana, Singapore, Bangladesh and Hong Kong recorded growth over the same period. Bangladesh which used to be self-sufficient now has to import rice in large quantities as the previous year's crop was devastated by floods.

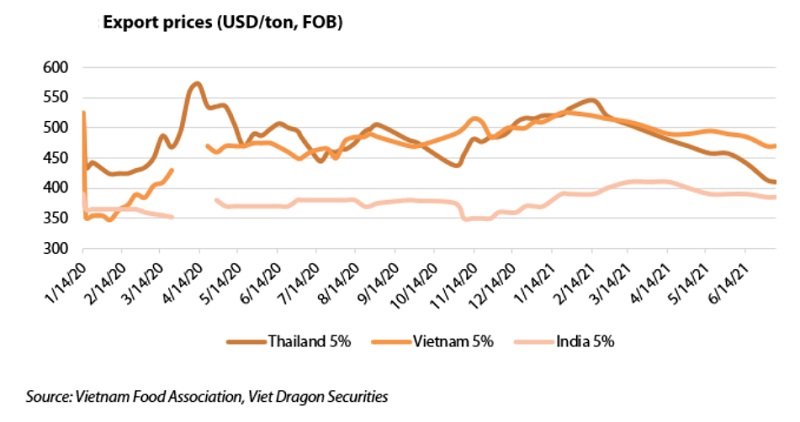

Meanwhile, rice export price increased by 12% yoy, to USD 545/ton thanks to (1) the portion of fragrant, high-quality rice increased and has a higher selling price and added value; (2) the domestic demand was higher as the old rice in stock is not much, so stocks need to be replenished and (3) the demand of other countries for Vietnam winter-spring rice increased sharply in 1Q and early 2Q while the supply was not much due to late planting. Thus, the harvesting the winter-spring crop was in May and June. Therefore, the price remained at a high level until the end of April.

It is noted that Indian rice prices continued to remain relatively low due to an abundant supply as they are having a bumper crop and the government released rice reserves to support people affected by Covid-19. Thai rice prices rose sharply earlier this year due to the concern about lower supply, then fell significantly as the Bath value dropped sharply against the USD.

|

Higher competition with India in 2H2021 The United States Department of Agriculture (USDA) forecasted that due to a bumper crop, India's rice supply will continue to be abundant (harvested volume will reach 122 million tons, up by 2.6% yoy), helping to maintain prices at a low level. “India's export competition increases and Vietnam's domestic supply is more abundant after the winter-spring season harvest, so to maintain export volume, Vietnamese rice export price may decrease in the 2H2021. Lower export price will reduce the farmers' spending on agricultural materials”, VDSC forecasted. The Philippines is the biggest export market of Vietnam as it accounts for 36% of total export volume. Therefore, any changes from the Philippines' rice demand will significantly affect Vietnam's export. In VDSC’s view, in 2H2021, the competition of exporting rice to the Philippines will increase because: First, the Philippines’s import volume could decrease by 14% yoy, to 2.1 million tons as they are having better rice seasons this year (USDA forecasts that the domestic production of the Philippines will reach 12.4 million tons, up 4% yoy). Second, the Philippines Government has reduced the MFN tax (Most Favored Nation - applicable to India) from 40% in the quota and 50% outside the quota to 35% - equal to the tax rate applied to ASEAN countries. The aim is to diversify the rice supply, so they can import rice at lower price, to control inflation. However, VDSC said, there would be still bright sides to Vietnam’s rice exports in 2H2021. It is expected that rice export volume in 2021 will reach 6.3 million tons (2.2% yoy) thanks to increased demand in China, Bangladesh and South Korea. Specifically, the rice import of Bangladesh and China will increase by 1,680 thousand tons and 600,000 tons yoy, respectively, due to the decrease in domestic supply and the need to hoard food as the Covid-19 is still unpredictable. In particular, Bangladesh will mostly import Indian rice (due to geographical factors and selling price), but they also plan to import from Thailand and Vietnam to diversify the supply and reduce the risks. Korea will also import 22,222 tons of rice from Vietnam which are expected to be delivered in September, October this year. This is a positive signal because, in 2020, Korea did not import rice from Vietnam, VDSC stressed, adding that competition with Thai rice is not high because the supply of rice in Thailand is limit ed due to the effects of drought and the Thailand export price is not as competitive as the Indian one. |