What are the prospects for Vietnam’s inflation?

Vietnam’s 9M2021 inflation rates remained relatively low. Will this trend keep intact by the end of 2021 and in 2022?

The headline inflation rate rose 2.51% in 3Q2021, slightly down from 2.67% in 2Q2021.

Main impacts on CPI

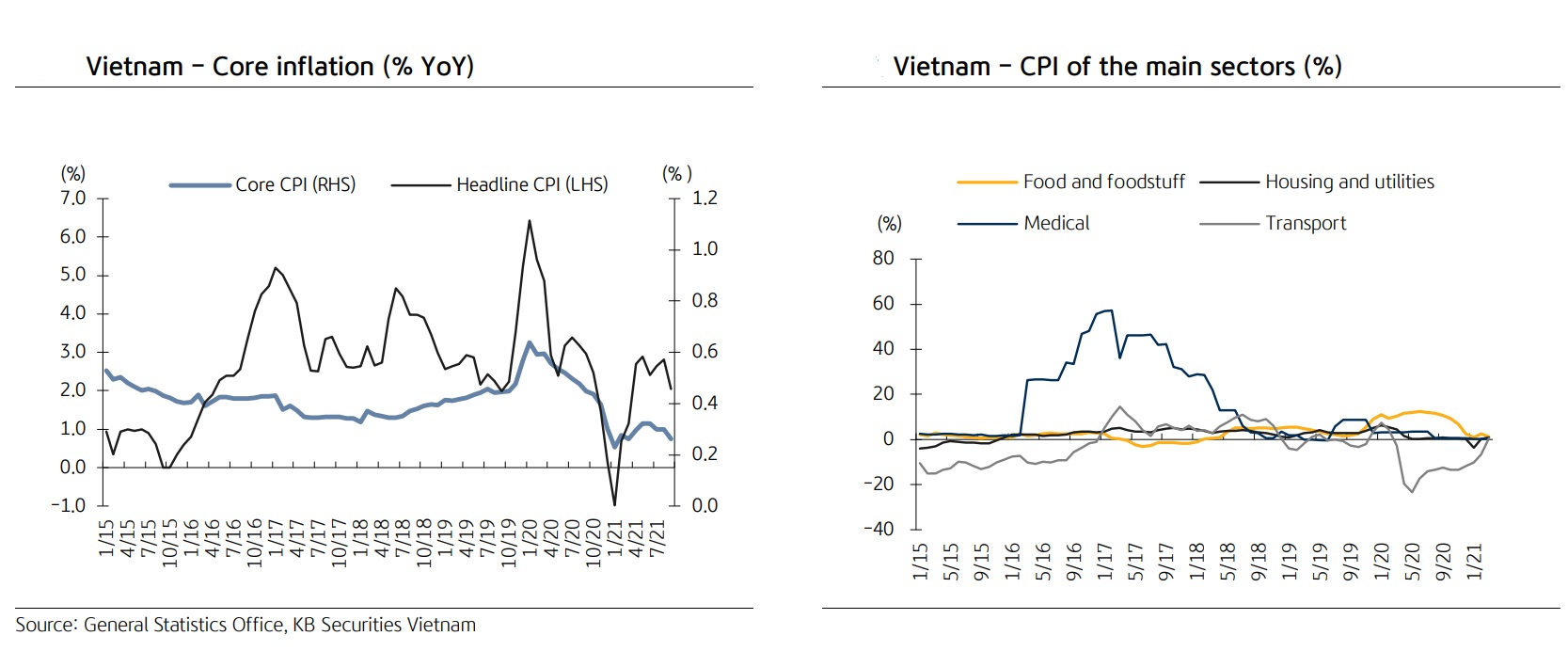

Headline CPI in the first nine months of the year gained 1.82% YoY, the lowest level in the past five years and safe compared to the target of less than 4% set by the government in Resolution 01/NQ-CP at the beginning of the year. The headline inflation rate rose 2.51% in 3Q2021, slightly down from 2.67% in 2Q2021. However, the increase in CPI tends to be stronger as the world consumption demand recovers quickly thanks to accelerated vaccine rollout, while the broken supply has not yet recovered. The trend of core inflation is similar to headline inflation as the average core CPI increased by 0.88% YoY.

KB Securities said there would be some main factors affecting 9M21 CPI. First, food prices decreased 0.29% YoY, causing the headline CPI to fall 0.13 percentage points. Second, the government offered support packages for people and producers facing difficulties amid the pandemic. For example, the Electricity of Vietnam (EVN) reduced the average price of electricity for the first 9 months of 2021 by 0.99% over the same period in 2020, lowering headline CPI by 0.03 percentage points. Third, domestic pump prices rose 24.8% YoY, causing headline CPI to gain 0.89 percentage points. Fourth, gas prices increased 21.7%, raising headline CPI 0.32 percentage points. Fifth, the prices of educational services rose 3.76% YoY after the tuition fee increased for the new school year 2020-2021 according to the roadmap of Decree No. 86/2015/ND-CP, making CPI go up 0.2 percentage points.

Inflation outlook

KB Securities lowered its 2021F inflation rate to 3% from 3.2% (in 2Q report), reflecting weak domestic demand in 3Q due to the Coronavirus as mentioned above. The uptrend of commodity prices slowed down and diverged after a strong increase early this year to mid-2Q2021. Meanwhile, lightweight hog prices also continued to fall deeply.

Commodity prices recovered significantly from mid-2020 until mid2Q this year with the main driving force coming from China's push to import energy, metals as a result of increased investment in infrastructure and agricultural commodities to ensure food security. Since then, the upward momentum has shown signs of slowing down and moving sideways, only the prices of energy products like oil, gas, coal increased at the end of the third quarter due to the energy crunch in the UK and China.

Liveweight hog prices dropped to the lowest level of around VND43,000 - 48,000/kg in the Northern region over the last two years, from the peak of 94,000 VND/kg more than a year ago. This partially comes from the weak demand amid the pandemic that made gathering activities, catering services, and tourism restricted. Besides, the increase in the export supply while China was struggling against the pork crisis where pork production increased by 35.9% YoY also led to the decrease in pork prices. With a high comparison level in the same period last year, even if pork prices recover in 4Q, the impact on CPI will not be large.

KB Securities assessed that the inflation would be under control for the rest of 2021 because 9M inflation rates remained relatively low. However, the inflation risks are obvious in 2022 when the prices of some commodities, especially energy products, are increasing considerably compared to the low comparison level early this year. Meanwhile, the prices of pork and domestic products may also bounce back when the domestic demand for consumer spending and consumption increases after the lockdown.