What challenges face the Vietnamese economy?

VNDirect sees mounting internal and external headwinds that could slow Vietnam's economy in 2023.

VNDirect believes that the State Bank of Vietnam (SBV) could keep its policy interest rate unchanged in 2023F.

>> Vietnam rides through economic difficulties

Global demand pullback

Fitch’s latest Global Economic Outlook forecasts consumer spending to grow by 2.5% in 2022 before slowing to 0.9% in 2023F amid the global economic downturn. For the U.S. and EU, Vietnam ‘s major trading partner, the Fed’s aggressive rate hikes will increasingly weigh on job growth and consumer spending in 2023F. Several U.S. tech companies (Twitter, Meta) have recently announced layoffs and other cost-cutting measures, which prompted the rise in jobless claims. Additionally, the U.S.’ two largest retailers - Amazon and Walmart, have posted weak 3Q22 results. Amazon reported 3Q22 revenue and net profit to drop 15.4% year over year and 9.6% year over year, respectively, while Walmart recorded a net loss of US$1.7bn in 3Q22.

The reopening and recovery of domestic demand in China's economy are unlikely to offset weak consumer demand in the U.S. and Europe in 2023F. Therefore, VNDirect expects Vietnam's exports to slow down in 2023F and forecasts Vietnam's export value to increase by 9-10% yoy in 2023, lower than the 14% growth forecast of year 2022.

For imports, VNDirect expects Vietnam’s import value to increase by 9-10% yoy in 2023, backed by the following reasons: (1) Global commodity prices continue to cool down in 2023, (2) a sharp increase in the USD/VND exchange rate could reduce demand for imported consumer goods, (3) lower demand for inputs for manufacturing activities amid a sluggish global economy. "We expect Vietnam’s trade surplus to widen to US$12.0bn in 2023F from an expected trade surplus of US$10.4bn in 2022F", said VNDirect.

Pressure from an interest rate hike

In 2023, VNDirect sees pressure on both interest rates and FX lingering until 2Q23F, then considerably easing following the FED’s more neutral monetary policy.

VNDirect believes that the State Bank of Vietnam (SBV) could keep its policy interest rate unchanged in 2023F as: (1) the Fed slows down the rate hike in 2023F and the dollar index tends to decline (some leading research institutions forecast DXY at 103-106 in 2023), (2) domestic inflation picks up but still remains under control. In the context of lower exchange rate pressure, SBV may consider shifting its target to stabilizing interest rates to support businesses and the economy, especially in the second half of 2023F.

"The refinancing interest rate could remain at 6.0% and the discount rate could maintain a level of 4.5% in 2023. The pressure on VND has cooled down considerably since 2Q23F. The VND will appreciate 1-2% against the US$ in 2023F due to a shift from "tightening monetary policy" to "normalization" by the Fed next year", forecasted VNDirect.

However, we cannot rule out the possibility that the FED will tighten monetary policy more aggressively and for a longer period of time than the market anticipates if inflation falls faster than expected (due to the escalation of the Russia-Ukraine conflict, the food crisis, or supply chain disruption).If that happens, in VNDirect’s view, Vietnam's exchange rate and interest rates could come under more pressure than its expectation in 2023F.

Inflation still under control

VNDirect expects higher inflation pressures for Vietnam in 2023 due to the following reasons:

First, domestic demand will likely soften in 1H23F, but this will be partially offset by international tourism. VNDirect expects retail sales of consumer goods and services to increase 8.5-9% yoy in 2023F, lower than that of 14-15% in 2022.

Second, effective July 1, 2023, the National Assembly has decided to raise the base salary to VND1.8 million per month, a 20.8% increase.In addition, an increase in pensions, social insurance allowances, and job allowances… was approved. Once the base salary increased, inflation also tended to increase due to the psychology of increasing wages associated with the increase in the price of consumer goods in parts of the grocery and retail industries.

>> Economy quite resilient to external shock

Third, though global commodities have peaked out, the effect of rising USD on imported material still lingers until 3Q23F.

Fourth, the government could consider increasing the prices of essential services such as electricity, health care, and education in 2023. Besides, after the temporary suspension of price increases for medical and educational services due to the impact of the COVID-19 pandemic, the government could consider raising the prices of these services in 2023.

A higher interest rate would increase the costs of manufacturing, trade, and logistics businesses, thereby increasing the pressure to raise output prices. Consequences, VNDirect forecasts Vietnam's average headline inflation climbing to 3.8% yoy in 2023F (vs. an expectation of 3.2% yoy in 2022F), fulfilling the government's target of controlling average inflation in 2023F below 4.5%. Factors supporting inflation control in 2023F include: (1) world commodity prices are expected to cool down in 2023F; and (2) the SBV conducts prudent monetary and money supply policies to control inflation.

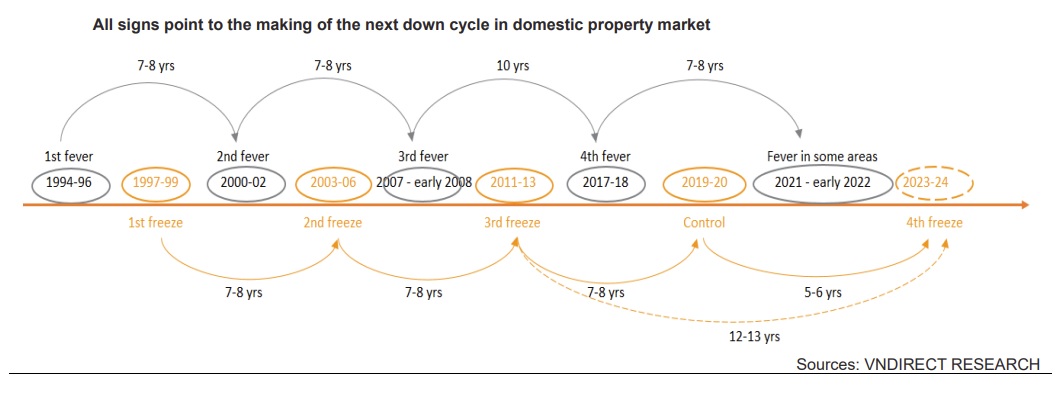

Property market downcycle

All signs pointing to the making of the next down cycle in the domestic property market include: (1) developers having limit ed refinancing opportunity as a result of tighter regulations on corporate bond issuance and credit exposure to property, (2) rising mortgage rates and their drag on housing demand, and (3) a drop in new supply as the project approval process is likely to be delayed while waiting for the amended Land Code. Pre-sales have experienced a downturn since 3Q22 as condo sales volume sharply fell by 40% qoq/128% yoy in both HCMC and Hanoi, according to CBRE. Together, landed hospitality presales volume nearly squeezed out 70.4% qoq/85% yoy.

However, this downcycle is likely different from the last trough period 2011-2013. The listed property developers’ financial health is currently in better shape than the last downcycle period 2011-13. So VNDirect expects less damage and a shorter time to ride out this downcycle. Since 2H24F, the on-schedule Land Law 2023 has been affected to address bottlenecks in the approval of new residential projects, resulting in a recovery in housing supply since 2024-25F.