What is the 4Q21 Vietnam' economic outlook?

The delayed manufacturing revival could pay the way to a rather gradual economic growth recovery in 4Q21.

Vietnam eventually saw an economic re-opening from 1 October 2021. Photo: Quoc Tuan

After four months of lockdowns in Vietnam’s commercial hub, Vietnam eventually saw an economic re-opening from 1 October 2021. People’s mobility has rebounded sharply from its trough of 66% below the pre-pandemic levels to -33% in late October, paving the way for a recovery domestic demand.

While retail sales still saw a notable decline of 28% YoY in October, headline weakness was off a high base last year. The retail sales level was 88% of January 2019’s level, a big improvement from only 74% in September. However, the recovery was mostly confined to the consumption of goods, given lingering restrictions on services, such as dining out, entertainment, and travel.

Unlike domestic improvements, the recovery in Vietnam’s external engine was rather slow. While export growth escaped a negative territory in October, it barely grew (0.3% YoY). Textile and footwear shipments posed a smaller drag than in September, but they were still down 19% YoY from last October.

Meanwhile, phone exports fell 4% YoY, but this was due largely to base effects, while computer electronics continued to see growth, albeit slower than that before the Delta wave. This is also evident in the industrial production data: IP improved from -7% in 3Q to -5.7% in October. However, manufacturing output still saw a 45% YoY reduction in HCM city.

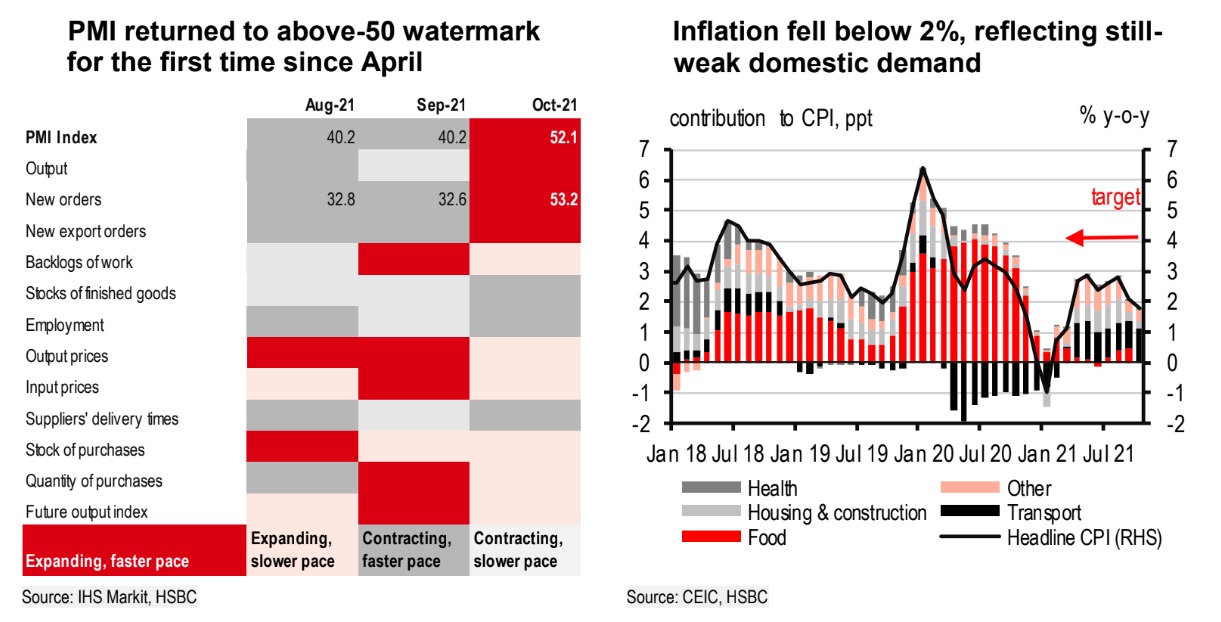

Mr. Yun Liu, Economist, The Hongkong, and Shanghai Banking Corporation Limited said the slow start to Vietnam’s supply chain recovery would reflect a widespread shortage of labor, particularly in labor-intensive sectors. Pou Chen, the world’s largest shoe contractor, serving global brands like Nike and Adidas, opened on 6 October – but lacking 70% of its workforce. While Nike is reported to resume operations in all of its factories across Vietnam, it did not mention at what capacity they run. This is also a significant issue stressed by manufacturers in the PMI survey, even though headline PMI jumped back above the 50 watermarks for the first time in six months.

“We maintain our view that we will see a rather gradual growth recovery of 3.8% YoY in 4Q21, taking into account a delayed manufacturing revival”, Mr. Yun Liu said.

In the meantime, inflation momentum fell 0.2% MoM in October, translating into YoY growth of only 1.8%. This was a big downside surprise to the market (HSBC: 2.2%; Bbg: 2.5%), driven mainly by subdued demand-led price pressures, another reflection of a slow economic recovery. Food prices also fell 1.3% MoM, equivalent to only 0.1% YoY, contributing only minimally to headline inflation. Despite muted price pressures, one issue worth monitoring is surging energy prices. Indeed, transport costs rose rapidly by 2.5% MoM, serving as the main driver for inflation.

“We believe a slow recovery in domestic demand is likely to more than offset higher energy prices, and we expect inflation to rise only 2.1% for 2021. As the economy normalizes, recovering domestic demand is likely to push inflation to 3.5% for 2022”, Mr. Yun Liu forecasted.