What is the outlook for Northern property market in 2H21?

The landed property markets at Hanoi’s neighbouring provinces such as Hung Yen are likely in the spotlight in FY21-22F, said VNDirect.

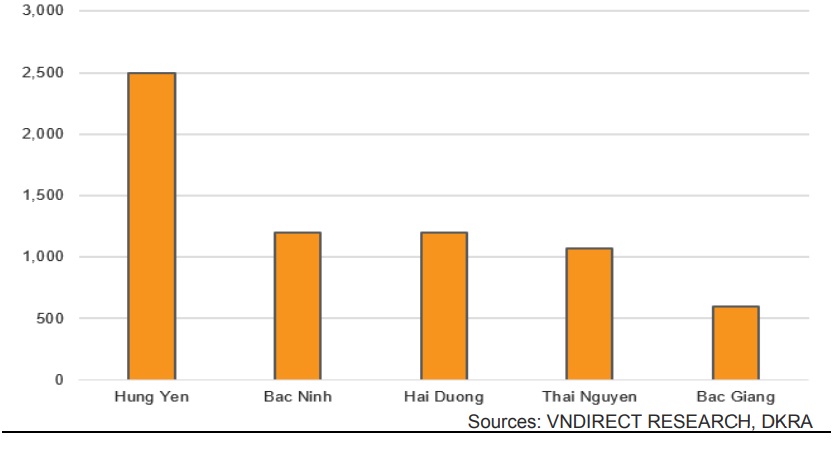

Abundant new products (2,500 landed units) from mega projects should add more excitement for Hung Yen property market in 2021F.

Sales volume of condo in Hanoi slowed down

The 2Q21 Hanoi new condo supply plunged 36.7% yoy to 3,526 units due to COVID-19 wave from May, leading to a drop of 14.6% yoy in sales volume (3,921 units). Mid-end segment also dominated the market, accounting for 78.4% of total new supply, mostly from the West and the East. Take-up rate surged to 111.2% in 2Q21 (28.8% pts yoy), indicating that housing demand remains robust.

VNDirect sees mid-end and affordable segments are the strongest growth among the segments, up by 7-9% yoy, thanks to better location with convenient connectivity in Hai Ba Trung and Bac Tu Liem districts. The Hanoi condo primary price rise 7.0% yoy on average to US$1,472 psm in 2Q21.

Meanwhile, Hanoi land prices slowed down in 2Q21 with secondary prices for landed property relatively flat, inched up 2.5% qoq on average, thanks to tightening land management in tempering areas. Land prices in Dong Anh went down 3.3% qoq in 2Q21 after a dramatical increase of 75.5% yoy in early-2021. Similar to HCMC, land prices in city centre namely Hoan Kiem and Ba Dinh districts also fell by 0.2-1.6% qoq amid the rental market hit hard by COVID-19.

Hanoi condo secondary prices stayed relatively flat in 2Q21, edging up on average of 0.9% qoq. Condo prices in Long Bien district rose the most at 3.8% qoq in 2Q21, thanks to good infrastructure with four bridges projects connecting Long Bien to Tu Lien, Tran Hung Dao, Cau Duong and Giang Bien being built in the upcoming years, said VNDirect.

Ample supply from upcoming mega township projects

VNDirect expects to see a 40% increase in new condo supply in 2021F to circa (c.) 25,000 units, dominated mostly by units in the west and the east of Hanoi, driven by the stable new supply from Vinhomes' massive projects, followed by Sunshine Empire (c.2,200 units) and Gamuda City (c.2,000 units). Meanwhile, landed property markets at Hanoi’s neighbouring provinces such as Hung Yen are likely in the spotlight in FY21-22F. Vinhomes also plans to launch a 460ha mega township in Hung Yen in 2H21F.

Vinhomes Dream City Van Giang, Hung Yen

Hung Yen is expected as one of Northern emerging property markets, along with Bac Ninh and Quang Ninh. This province is situated at the heart of the Northern Delta, having favorable connection to Hanoi, Hai Phong and Nam Dinh. According to CBRE, in 2020, selling prices for landed property in Hung Yen rose 12% yoy, higher than the Hanoi average rate of 7.6%.

“New landed supply in Hung Yen could reach 2,500 units in 2021F, 16.8% higher than that of Hanoi, mostly from mega township projects namely Ecopark (500ha) and Vinhomes Dream City (460ha). We believe these projects will achieve a take-up rate of 70-80% in 2021F, driven by high demand from experts, engineers and workers in this area”, VNDirect forecasted, adding that an upward trend in landed market across Hanoi with secondary land prices rising 14.5% yoy on average in 4M21, especially some areas rose dramatically such as Dong Anh (75.5% yoy), Thanh Tri (25.6% yoy). However, Hanoi land prices showed signs of slowdown in 2Q21 with secondary prices for landed property relatively flat, edging up 2.5% qoq on average. We believe Hanoi land prices will remain to slow down in 2H21 thanks to tightening land management in tempering areas. Meanwhile, we expect condo primary prices in Hanoi will maintain a healthy increase of 4-6% yoy on average in 2H21-22F.