What is the outlook for Vietnam’s steel industry in 2022?

Due to inflows of public investment in infrastructure, Vietnam's steel consumption output appears to be improving, and civil construction activities have rebounded.

In 2021, the export market is a bright light for Vietnam's steel companies.

Due to a drop in steel demand as a result of the epidemic, domestic steel consumption grew slowly in 2021, barely 8.16 percent year on year. Domestic steel demand is expected to grow in 2022, according to BSC, due to: (1) greater public investment, which is primarily focused on infrastructure, and (2) civil construction activity rebounding after the epidemic is under control.

The National Assembly has adopted a VND 350,000 billion economic recovery package, with VND 113,850 billion set aside for infrastructure development, with an emphasis on critical projects like as the North-South East Expressway, Long Thanh airport, and major logistical ports... As a result, the demand for iron and steel rises.

Meanwhile, in 2021, construction activity were halted for the first nine months of the year to help with disease control. According to CBRE Vietnam's prediction, the supply of apartments would quadruple, and the supply of brothels will expand by 20–30% between 2017 and 2021, both of which are drivers driving domestic steel demand.

The substantial increase in steel selling prices contributes to the business performance of steel firms, despite the fact that consumption production remains unchanged. Steel sales prices, in particular, rose sharply in the first half of 2021 before beginning to fall in the second half. Despite this, the average annual selling price grew by 43% year over year. The drop in iron ore prices (which contribute for 45 percent –50 percent of the cost of creating steel billets) is expected to further correct the average steel price in 2022, according to BSC.

In 2021, the export market is a bright light for steel companies. Steel exports are up 38% year over year in the industry. The principal raw material for Vietnamese firms' main export steel products (galvanized steel), hot rolled coil steel (HRC), is currently more competitively priced than the price sold in the EU, US, and ASEAN markets. BSC predicts that this cost advantage will keep steel export output at the same level as in 2021 in 2022. However, if steel prices in the EU and North American markets continue to fall in the fourth quarter, particularly as competitors increase exports to these countries, enterprises with a large export share will be unlikely to preserve their market share.

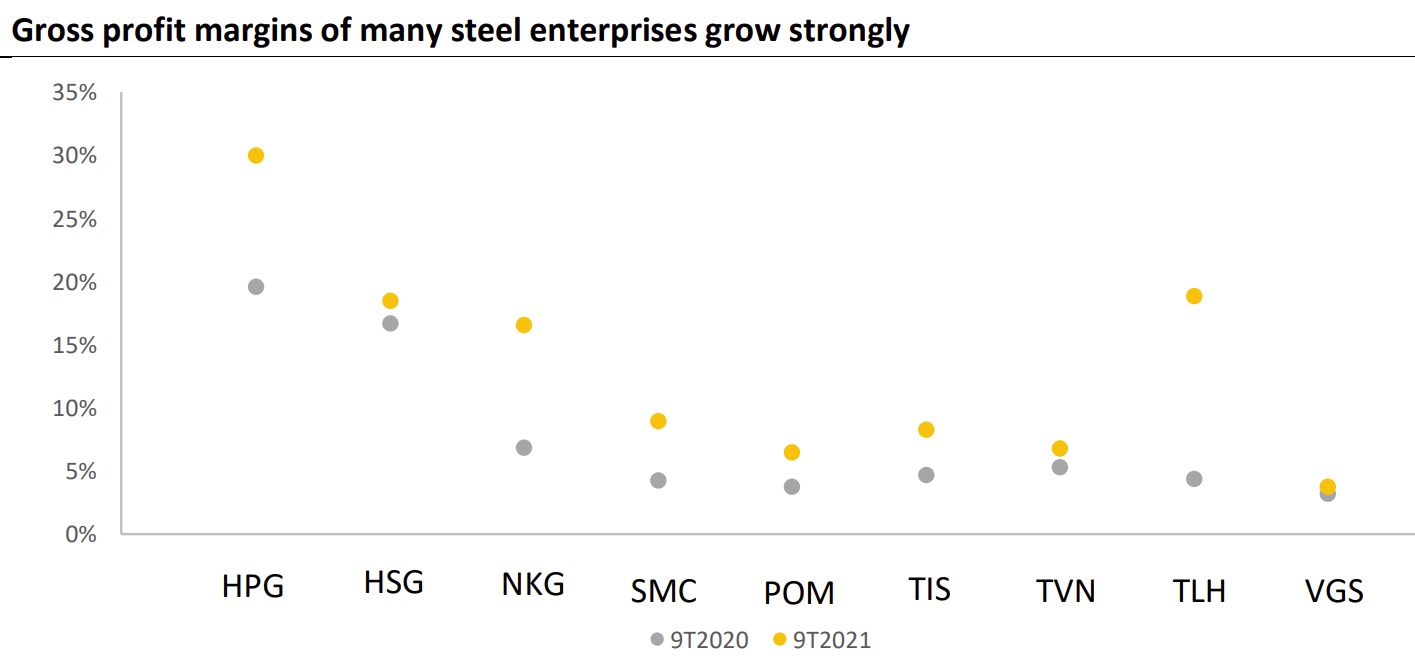

Many steel companies' profit margins improved significantly in 2021 as a result of taking advantage of raw material price variations, building stocks with low capital costs, and profiting from a rapid increase in steel selling prices in the first three quarters of the year. Steelmakers' profit margins are expected to fall from their high base level in 2021, according to BSC, because (1) selling prices tend to fall in lockstep with material price declines, and (2) industry competitiveness has grown.

Besides, tariffs on imports of iron and steel products were loosened when the Regional Comprehensive Economic Partnership (RCEP) created conditions for countries in the group to increase steel exports to the Vietnamese market.

Based on the following perspectives, BSC assigns a neutral rating to Vietnam's steel sector in general in 2022: (1) Positive domestic consumption output as a result of promoting public investment disbursement and construction activities recovering from a low base in 2021; (2) The steel industry's profit margin declined in 2022 due to a decrease in the average steel selling price as the industry's competition became more fierce. "Because of a downward adjustment in valuation, we propose buying HPG shares, although we have neutral recommendations for HSG and NKG," BSC stated.