What outlook for BAF?

According to MBS, the net profit of BAF Viet Nam Agriculture JSC is expected to reach VND 685 billion in 2025, a 116.2% year-over-year rise, mostly due to a 43% increase in the amount of pig sales and a 10% increase in swine pricing.

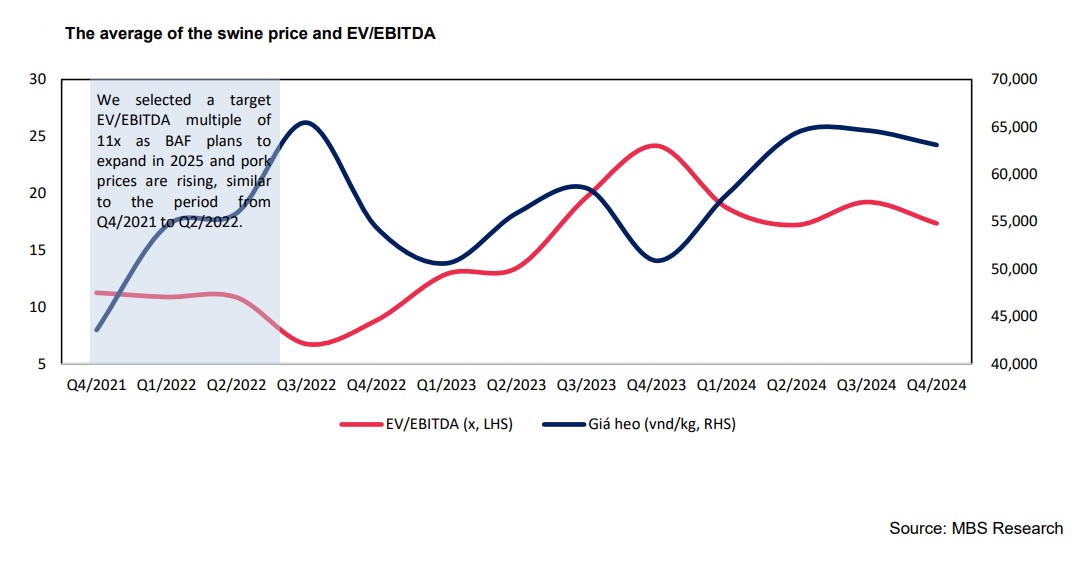

Due to livestock restructuring and supply shortages brought on by ASF outbreaks, swine prices are predicted to stay high in 2025–2026. The early selling of piglets prior to the Lunar New Year and supply problems caused by sickness caused hog prices to soar to VND 80,000/kg in the first two months of 2025.

A reduction in supplies from small-scale household farms has also resulted from the Livestock Law 2025's acceleration of the farming model's transformation toward larger, more professional enterprises. Since demand is still high and family output is steadily declining, we anticipate that hog prices will stay high in 2025–2026 at VND 65,000–70,000/kg (10% over 2024).

Many analysts believe that BAF's strategy of growing livestock farms and increasing its hog herd will be the primary engine of profit growth in 2025–2026. During this time, the company intends to expand to 50 farms, with a goal of 90,000 breeding sows and 1,000,000 commercial hogs by 2025.

Furthermore, the integrated 3F model (Feed-Farm-Food) developed by BAF enables improved control over input costs, especially feed costs, which make up 60–70% of total COGS. To lower disease risks and boost operational efficiency, the company recently inked a strategic agreement with Muyuan, a well-known Chinese cattle company, to transfer high-tech farming practices. BAF is anticipated to maintain robust profit growth in 2025–2026 with an aggressive expansion plan and a cost-optimization strategy, further solidifying its position in Vietnam's cattle sector.

Based on the following, MBS suggests ADD with a target price of 35,500 VND/share:

First, BAF has complete control over farming, meat distribution, and feed manufacturing because of its well-integrated 3F (Feed – Farm – Food) value chain and efficient business model. The business may secure input sources and reduce the risks associated with price fluctuation thanks to this methodology. High-tech farming technologies also guarantee farming efficiency and lower the risk of disease.

Second, as supply improves, swine prices may slightly decrease in Q2 2025 after rising 7% in the first three months of 2025 compared to the start of the year. MBS still anticipates that prices will stay high in the first two months of the year, between VND 65,000 to 70,000/kg, driven by growing demand for consumption and supply problems.

Third, the market share transition from smallholder farms to large-scale businesses is being accelerated by the new Livestock Law, which goes into force in 2025.

Fourth, BAF's net profit is predicted to increase by 116.2% from 2023 to VND 685 billion in 2025. It is anticipated that net profit will increase by 38.5% year over year in 2026 as BAF's pig farming operations reach a stable scale.