What will be the core industries in 2H2022?

Although several industries are rebounding, they have not yet returned to their pre-COVID-19 levels of growth.

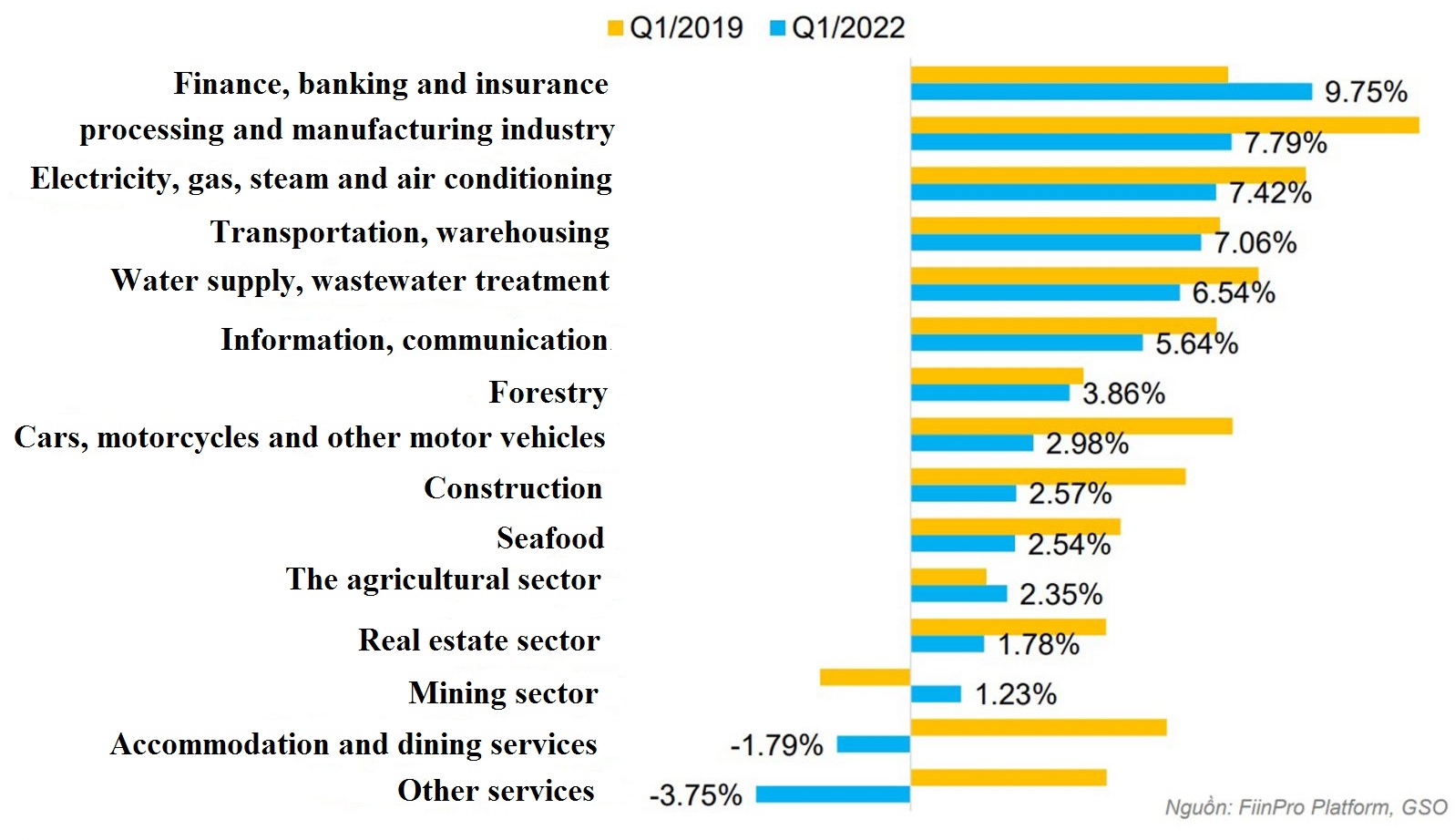

The finance, banking, and insurance sectors saw a growth of 9.75 percent in the first quarter of 2022

>> FDI flows strongly into real estate

According to the statistics, a lot of industries have grown more rapidly than they did before to the COVID-19 epidemic. For instance, the finance, banking, and insurance sectors saw a growth of 9.75 percent in the first quarter of 2022 compared to 7.75 percent in the same period in 2019. Similar to how the mining and agriculture sectors rebounded, so did the production of numerous commodities like copper and tungsten. Some businesses, such transportation, warehousing, and forestry, have nearly recovered to pre-pandemic levels.

Notably, some industries, including aviation, international tourism, and materials, saw a relatively gradual recovery. This element will encourage faster economic growth, particularly since that interest rates have "bottomed out" and inflation may exceed forecasts.

FiinGroup identified two industries from the aforementioned industry groups that are highly widespread in the economy. It presents significant issues for the residential real estate sector in the near future. The effects of policies and credit tightening in the short term are risk factors for the property industry with significant potential and promising long-term prospects. The real estate sector's challenges will have an effect on a variety of adjacent industries, most notably the banking sector as well as the construction and building materials sectors.

A lot of industries have grown more rapidly than they did before to the COVID-19 epidemic.

Despite experiencing strong development during the COVID-19 epidemic and continuing to grow well in the first quarter of 2022, the banking sector's biggest risk is dependent on the real estate sector.

>> Banking shares plummet to attractive prices

Mr. Nguyen Quang Thuan, General Director of FiinGroup, said the challenges facing the real estate sector would alter how the banking industry is perceived over the course of the next two to three years. Changes in policy must take into account the consequences on the real estate and banking sectors, as well as the ripple effects on the Vietnamese financial market and adjacent industries. Vietnam today has excellent connections to the stock market, bond market, money market, and credit from banks.

Although revenues from Vietnam's commercial banks continue to make up a sizable share of the group of capitalized stocks and the total profit of listed firms, banking stocks have actually lost their "golden" status since the beginning of 2022.

Although the stock price movement is not correlated with the stock market outlook, investors can still benefit from the economy's pillar industries' pervasiveness when assessing the stock market as long as it is positive.