Where does NKG's growth engine come from?

The domestic market emerges as a key growth driver for Nam Kim Steel JSC (HoSE: NKG), supported by recovering demand and the impact of anti-dumping duties.

In 2024, revenue reached 20,609 billion VND (11% yoy) thanks to recovery of domestic. In terms of sales volume, NKG is projected to reach 1,020 thousand tons (18% yoy). Both export and domestic markets witnessed a strong recovery, increasing by 21% and 15%, compared to the low levels of 2023.

Moreover, as HRC material cost declined more sharply than Hot Dipped Galvanised (HDG) price, the gross margin (GPM) improved 3% pts yoy. Financial expenses are estimated at 477 billion VND (12% yoy) due to pressure from exchange rate losses. As a result, NKG’s NP in 2024 is projected to reach 453 billion VND (287% yoy).

In 2025, the rise of domestic sales (8%) could outweigh the decrease of export volume (2%). As a result, total sales volume in 2025 could increase by 2% yoy. Additionally, because of easing exchange rates and lower transportation costs, financial and selling expenses are expected to drop 16% and 17% yoy. Thanks to these factors, NKG’s NP could reach 681 billion VND (50% yoy).

In 2026, a sharper decline of export sales (-4% yoy) as supply of EU and US recovers. However, domestic sales are expected to be key growth driver (6% yoy). MBS forecasted that NKG’s gross profit margin would rise by 0.3% pts yoy, as prices rise by 5% yoy, outpacing the 3% yoy increase in material costs. As a result, NP is projected to grow 31% yoy.

MBS expects domestic HDG prices to recover from 2Q 2025, driven by strong demand and the impact of AD tax.

First, the AD tax on coated steel would narrow the gap between Vietnamese and Chinese steel, enabling NKG to increase its market share to 19% in 2025 (from around 17% in 2024).

Second, NKG’s net profit is projected to grow by 50%/31% yoy in 2025 and 2026, respectively, due to higher domestic sales volume and improved GPM.

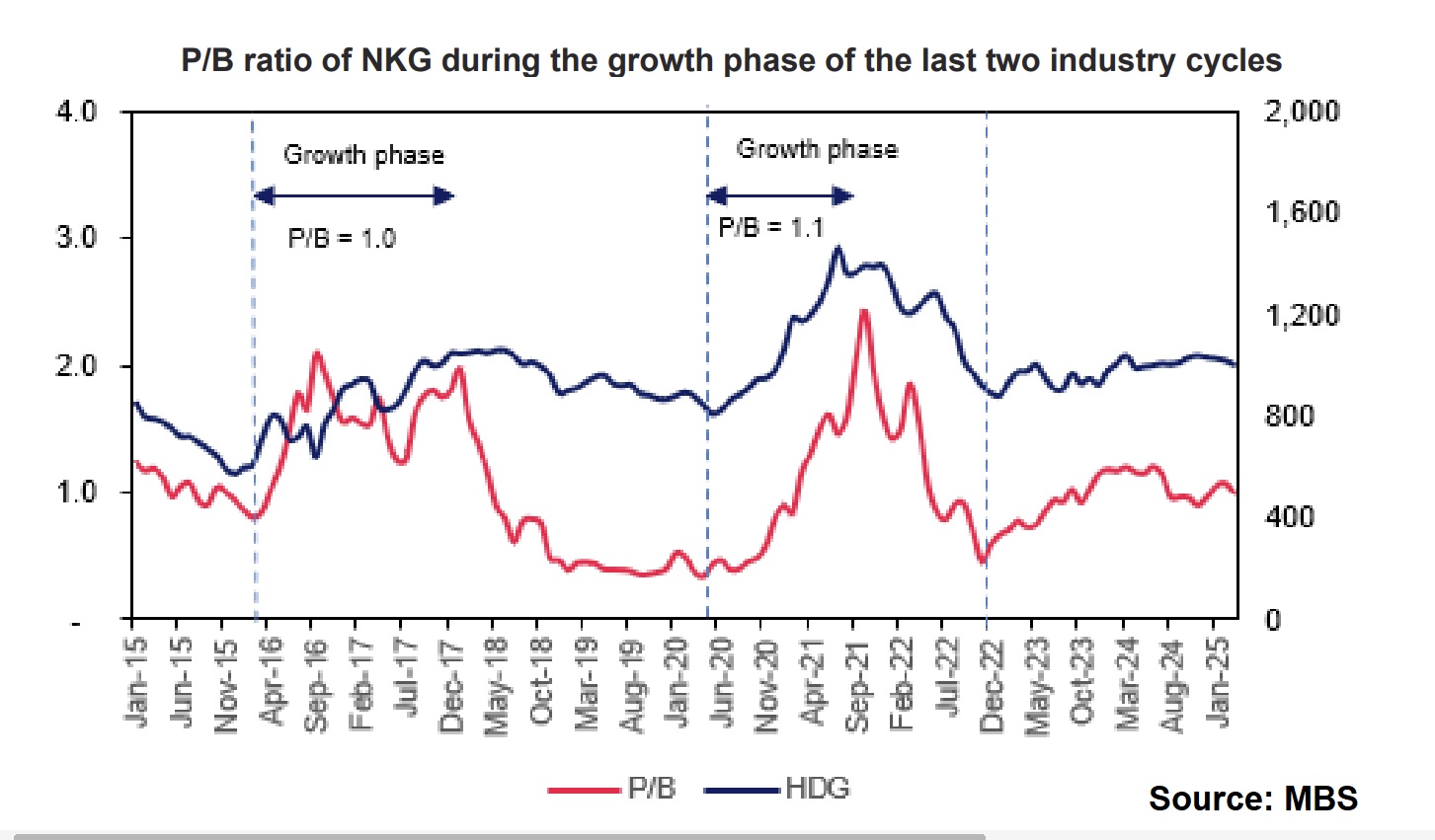

Third, NKG's P/B valuation is currently at 0.9, lower than the 1.05 level during previous growth cycles. MBS applies FCFF and P/B valuation methods for NKG and determines a fair value of VND 19,700/share (9% reduction from our previous target price). It lowered the target price as it revised the P/B valuation down to 1.05 (from 1.15) for 2025, considering the challenging export market and a slower industry recovery cycle.

“These factors led us to adjust our 2025 net profit forecast down by 28% from our previous estimate, although it still reflects a 50% YoY growth. We set a target P/B ratio of 1.05 based on the average P/B ratio during the steel sector's recovery phases over the past two cycles. Therefore, in the context of a recovering steel industry, this valuation is reasonable for NKG in the early stages of its growth cycle”, said MBS.