Which stock groups will the capital flow into?

According to many experts, in the second half of this year, capital flow may head toward certain sectors such as banking, real estate, etc.

Bank stocks attract foreign capital

The reason foreign capital is pouring into bank stocks is that this group is considered defensive and safe in the context of global volatility. Another undeniable reason is that the business performance of listed banks has attracted investor attention.

Explaining the foreign capital flow into bank stocks, Mr. Trần Hoàng Sơn, Chief Strategy Officer at VPBankS Securities, stated that foreign investors have returned to Southeast Asia in particular and Asia in general. According to statistics from the first six months of this year, foreign investors have returned to net buying on the Vietnamese stock market on a scale of up to trillions of dong. This return is due to the easing of US-China trade tensions, a weakening US dollar, and economic stimulus policies in China spreading positive sentiment to neighbouring markets in the region. Moreover, many Asian markets, including Vietnam, have a P/E ratio lower than the 5-year average, etc.

In addition, capital flowing into bank stocks is also due to Decree No. 69/2025/NĐ-CP, effective from May 19, 2025, which adjusts the ownership ratio of foreign investors in commercial banks that are required to take over weak banks. Specifically, the total foreign ownership can exceed 30% but not exceed 49% of the charter capital of these banks, except for commercial banks in which the government holds over 50% of the charter capital.

Real estate stocks stand out

Besides banks, capital also focuses on the industrial real estate group and is showing signs of returning to residential real estate. Although not yet particularly prominent, the residential real estate group is showing positive signs compared to earlier this year, with the average return turning positive at 2.8%. This group is expected to continue performing well thanks to policies promoting both demand and supply.

Mr. Dương Văn Chung, Director of MBS Securities, Northern Branch, said that capital flow is spreading across many sectors, with rotation between the banking and real estate sectors being the most apparent. In addition, the trading proportion of these groups is on the rise, with the banking sector in the VN30 basket still accounting for the majority of market liquidity, thanks to explosive trading in stocks with unique stories like TCB, MBB... Meanwhile, the trading proportion of real estate stocks continues to increase steadily. This indicates that investors are paying attention to this stock group.

Since the beginning of the year, the banking and real estate sectors have delivered superior returns, while the VN-Index has only increased by 4.95%, a comparatively lower performance. Notably, residential real estate has surprised the market as NLG, NVL, DXG, and VHM have maintained strong upward momentum, while small-cap real estate stocks such as DIG, PDR, and DXG have also attracted significant capital inflow.

Sector outlook for the end of the year

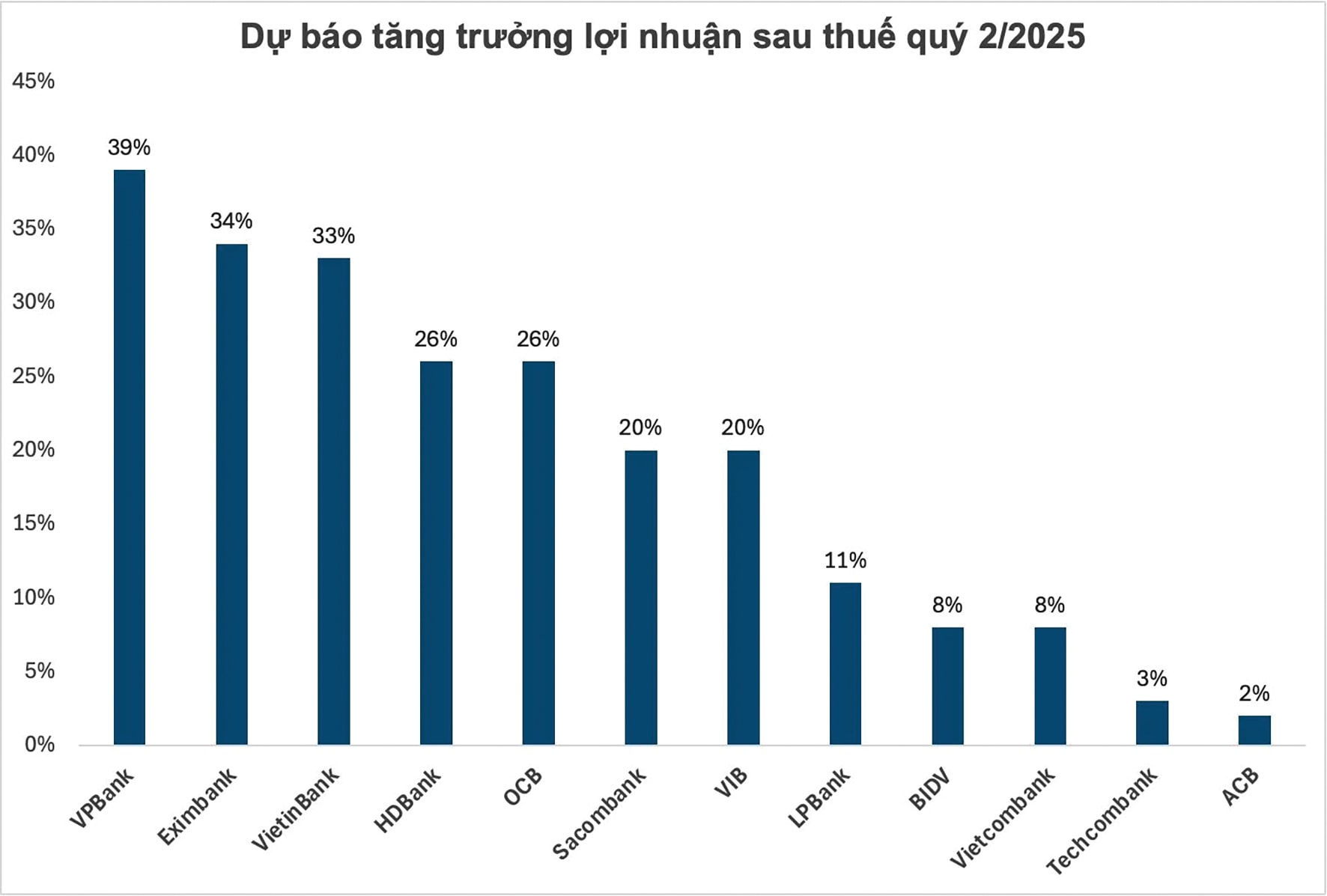

Mr. Nguyễn Anh Khoa, Head of Research at Agribank Securities, expects that profit growth in Q2/2025 may still be higher than in Q1/2025, thanks largely to contributions from the banking, real estate, and securities sectors. Therefore, Q2/2025 business results from these enterprises will play an important role in identifying potential and selecting stocks for strategic investment portfolios in the second half of 2025. For this investment approach, investors should focus on gradually accumulating some stocks from the banking and real estate sectors.

Banking is still expected to be the leading pillar sector for the market, as credit growth remains positive, net interest margins are stable, and valuations are at a considerable discount. Notable stocks include CTG, STB, MBB... due to improved operating efficiency and policy support potential.

Meanwhile, many real estate companies have ongoing projects expected to be handed over in the second half of 2025, such as NLG with the Park Village and The Aqua subdivisions in Southgate; KDH with The Foresta project; PDR with Thuận An 1 & 2. Project handovers will form the basis for expecting positive results in the latter half of 2025 for these companies. According to Mr. Nguyễn Anh Khoa, investors can consider real estate stocks such as NLG, VHM, DXG, PDR, NVL...

In addition, investors may also consider opportunities in the securities sector in anticipation of Vietnam’s stock market being upgraded to emerging market status by FTSE Russell, with candidates such as HCM, VCI..