Will inflationary pressure reverse the SBV's monetary policy?

According to VNDirect, the State Bank of Vietnam (SBV) could maintain its accommodative monetary policy until at least the end of 2Q22.

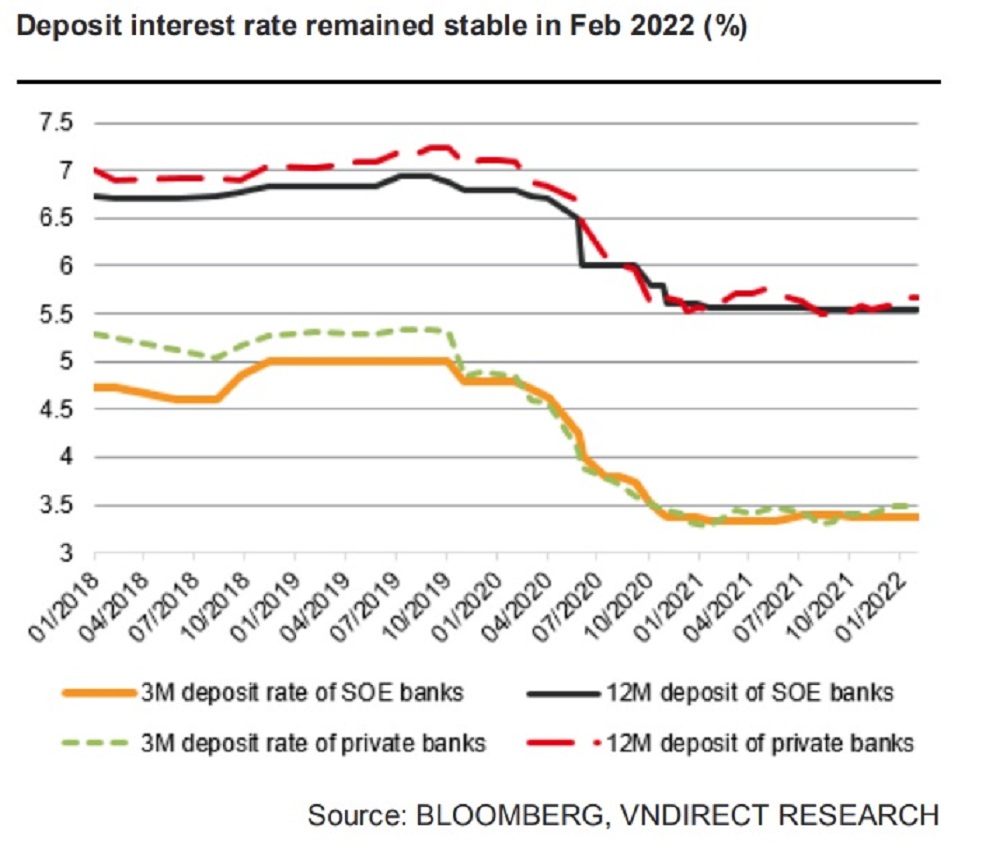

The deposit interest rate is unlikely to remain at the historic low in 2022.

Interbank interest rate to keep rising

In February 2022, interbank interest rates continued to rise, especially for long-term loans. According to Bloomberg, the overnight interest rate stood at 2.3 percent /year on February 28, up 26 basis points (bps) from the end of January 2022. When compared to late January 2022, the interbank interest rate for 1-week to 1-month periods climbed by 18-34 basis points, while rates for 2-month to 1-year durations jumped by 47-66 basis points.

Interbank interest rates, contrary to VNDirect's previous prediction that they would decline following the Lunar New Year vacation, continued to rise in February 2022 due to three factors: (1) Credit increased 2.5 percent ytd on February 25, 2022, a significant improvement over the 0.7 percent yoy growth rate in 2M21; (2) deposits grew at a slower rate than credit, increasing only 1.3 percent ytd on February 25, 2022 (vs. 1.0 percent ytd in 2M21); and (3) inflationary pressures are expected to rise significantly in the coming months due to a sharp increase in commodity prices due to the Russia-Ukraine crisis.

Monetary policy remains accommodative

Mr. Dinh Quang Hinh, a VNDirect analyst, believes the State Bank of Vietnam (SBV) will maintain its accommodative monetary policy until at least the end of 2Q22 because (1) while inflationary pressures are expected to rise in the coming months, the average CPI is still below the government target of 4%; (2) domestic demand has not yet fully recovered to pre-pandemic levels; and (3) SBV continues to place a high priority on maintaining low lending interest rates in order to help businesses and the economy recover.

"Although we do not expect the SBV to lower its key policy rates in 1H22F, we do not expect it to raise them either, in order to keep the economy afloat. Nonetheless, we expect the SBV to engage in money market actions such as foreign exchange purchases and credit growth ceiling lifting. In 2022, we expect loan growth to climb by 14% year over year", Mr. Dinh Quang Hinh stated.

For the following reasons, the deposit interest rate is unlikely to remain at the historic low in 2022: (1) increased demand for fund raising as credit expands; (2) increased inflation pressure in Vietnam in 2022; and (3) fierce competition with other investment channels such as real estate and securities to attract capital inflow.

State-owned banks' 3-month and 12-month term deposit rates were steady as of March 2, 2022, compared to the end of 2021, whereas private banks' 3-month and 12-month term deposit rates increased by 7 and 13 basis points, respectively, as of March 2, 2022.

"Deposit rates would climb by 30-50 basis points in 2022. By the end of 2022, commercial banks' 12-month deposit rates are predicted to rise to 5.9-6.1 percent per year, still below the pre-pandemic average of 7%", Mr. Hinh stated.

Meanwhile, the SBV is launching a VND3,000 billion interest rate compensation scheme. For firms severely impacted by the COVID-19 pandemic, it offers credit rates of only 3–4% per year. Furthermore, the government intends to increase the size of the interest rate compensation package for businesses to VND40,000 billion, with a focus on a number of priority audiences, including (1) small and medium-sized enterprises, (2) businesses involved in a number of key national projects, and (3) businesses in specific industries (tourism, aviation, transportation).

"In 2022F, the interest compensation package is expected to lower loan rates by 20-40 basis points on average. However, if commercial banks raise lending rates on other traditional loans to balance the increase in deposit rates, the actual impact of the interest rate compensation package on businesses and the economy could be lessened", Mr. Hinh said.