Will retail stocks "boom" by year-end?

One industry that outperformed many others in both the non-financial and financial banking divisions in Q3 2024 was consumer retail.

This trend is expected to create a "launchpad" for retail stocks to rise by the end of this year.

This trend is expected to create a "launchpad" for retail stocks to rise by the end of this year.

A "Launchpad" for Business Results

Compared to the previous two quarters, the market's overall after-tax profit grew by 21.6% year over year, according to Q3 2024 financial reports from more than 1,060 listed businesses (which account for 98.5% of the market's capitalization).

Consumer products (retail, food, livestock), exports (seafood, clothing), raw materials (rubber, fertilizer), energy, and industrial real estate accounted for the largest increase in profits by industry. FiinTrade research shows that MSN and MWG drove an amazing 233.4% rise in retail alone.

Within the retail consumer sector, leading companies reported strong Q3 growth, reflecting a positive recovery in domestic consumption.

- MSN: Its consumer retail ecosystem posted Q3/2024 net profit growth of nearly 1,400% YoY, with WinCommerce reporting a quarterly profit for the first time. For the first nine months, MSN achieved VND 2,726 billion in net profit before minority interest (NPAT Pre-MI) and VND 1,308 billion in net profit after minority interest (NPAT Post-MI), surpassing its annual target by 130.8%.

- MWG: Also exceeded its annual profit target, with Q3 after-tax profit reaching VND 800.15 billion, up 1,965.48% YoY. For the first nine months, revenue reached VND 99,767.23 billion (14.86% YoY), while cumulative profit hit VND 2,874.86 billion (3,613.73% YoY).

According to MAS analysts, MSN and MWG are both "super stocks" and are listed among the 29 "hottest" equities. Their inclusion was predicated on factors like the gross profit margin (GPM) in Q3 surpassing the margin in Q2 and the margin for the entire year 2023. These stocks contribute significantly to the VN-Index and have excellent liquidity.

Outlook Ahead

The majority of analysts anticipate that top consumer retail companies like MSN, VNM, and MWG will continue to have positive improvements in their business results in December and Q4 of 2024. Notwithstanding its poor performance in the third quarter of 2024, PNJ reported a little increase in its nine-month cumulative profits and is expected to have excellent results throughout the year.

Seasonal considerations are responsible for the anticipated growth; year-end holidays cause Q4 to be the peak shopping and consumption time. Retail and consumer products companies typically notice a spike in sales and earnings during this quarter.

Government policies supporting domestic consumption—such as the VAT reduction effective July 2024 and the basic salary increase mandated by the National Assembly—also play a role. Additional measures to boost credit, particularly consumer credit, further support spending.

Company-Specific Highlights

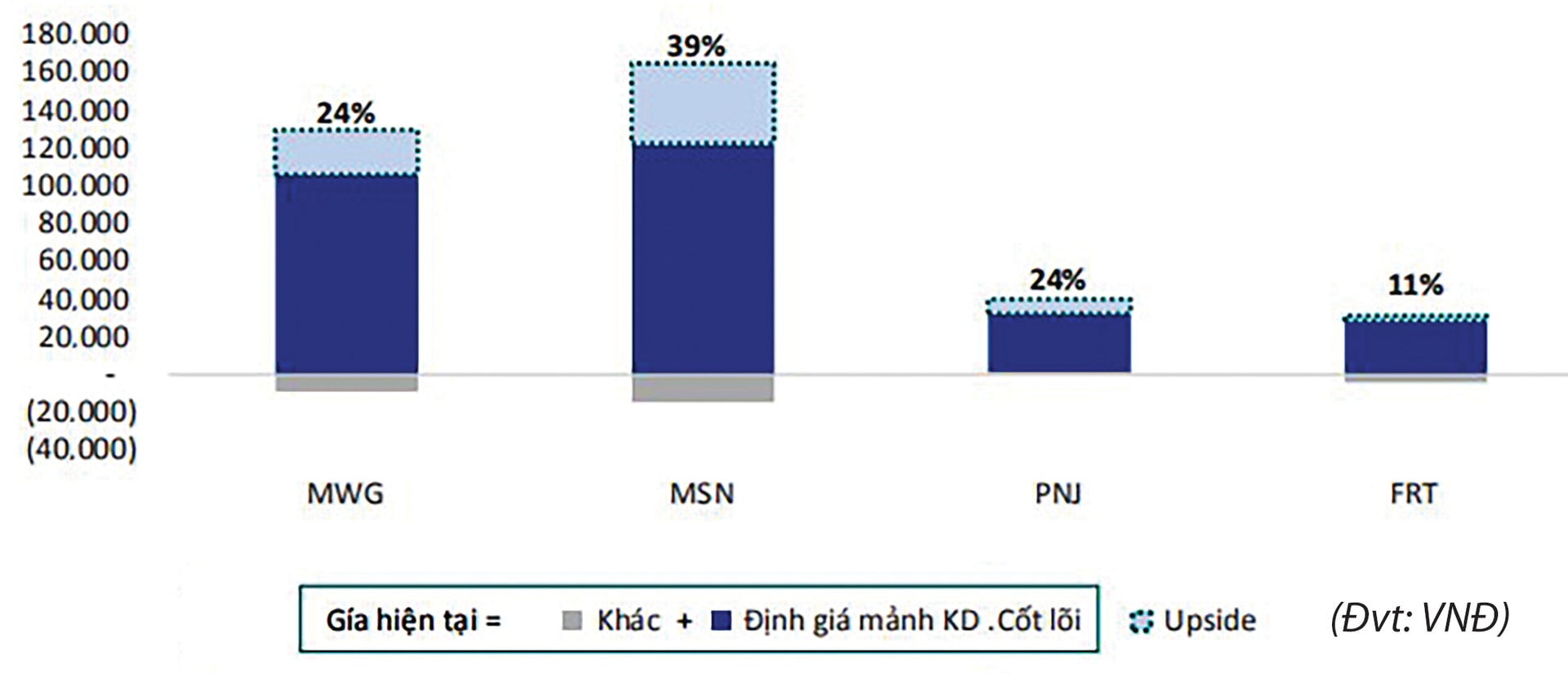

According to BSC, the outlook for leading consumer retail companies in H2/2024 remains positive. Recommended stocks include MWG, PNJ, MSN, and VNM, based on two main criteria:

- Stocks with a valuation upside are driven by promising business prospects.

- Stocks are trading near attractive valuation levels after significant corrections.

Key insights include:

- VNM: Positive market share expansion (1.4% in July 2024), steady growth in international revenue, and improved GPM due to a balanced product mix.

- MSN: The core consumer segment (TCX) expected to grow double digits, while WCM is likely to turn profitable, driven by 7% and 10.6% YoY same-store sales growth (July and August 2024, respectively) and strategic store network expansion. Additionally, reduced exchange rate pressures and lower financial leverage are expected to boost net financial income.

- MWG: July and August 2024 revenue rose 12.3% YoY, driven by The Gioi Di Dong (TGDĐ) and Dien May Xanh (ĐMX) expanding market share. Meanwhile, Bach Hoa Xanh showed promising FMCG and fresh produce growth. Although short-term profitability faced pressure from closing underperforming stores in Q3/2024, operational efficiency improved due to cost optimization.

- PNJ: Retail segment revenue continued to grow, offsetting a decline in gold bar sales caused by market volatility. Despite a slight GPM decline from marketing costs in Q3/2024, these investments aim to boost retail sales during Q4's peak season.

Broader Market Considerations

Analysts continue to predict double-digit growth for consumer retail companies in Q4 2024–2025. The expected "boom" in retail stocks, however, is contingent upon the state of the market as a whole, which is subject to short-term concerns.

Additional curiosity is added by unique stories inside the industry, such as MWG's Bach Hoa Xanh growth potential or MSN's MCH listing. However, the overall state of the market and the economy ultimately determine how well stocks do.