Will the USD/VND rate continue its uptrend?

The USD/VND exchange rate would countinue to rise slightly thanks to stable USD supplies.

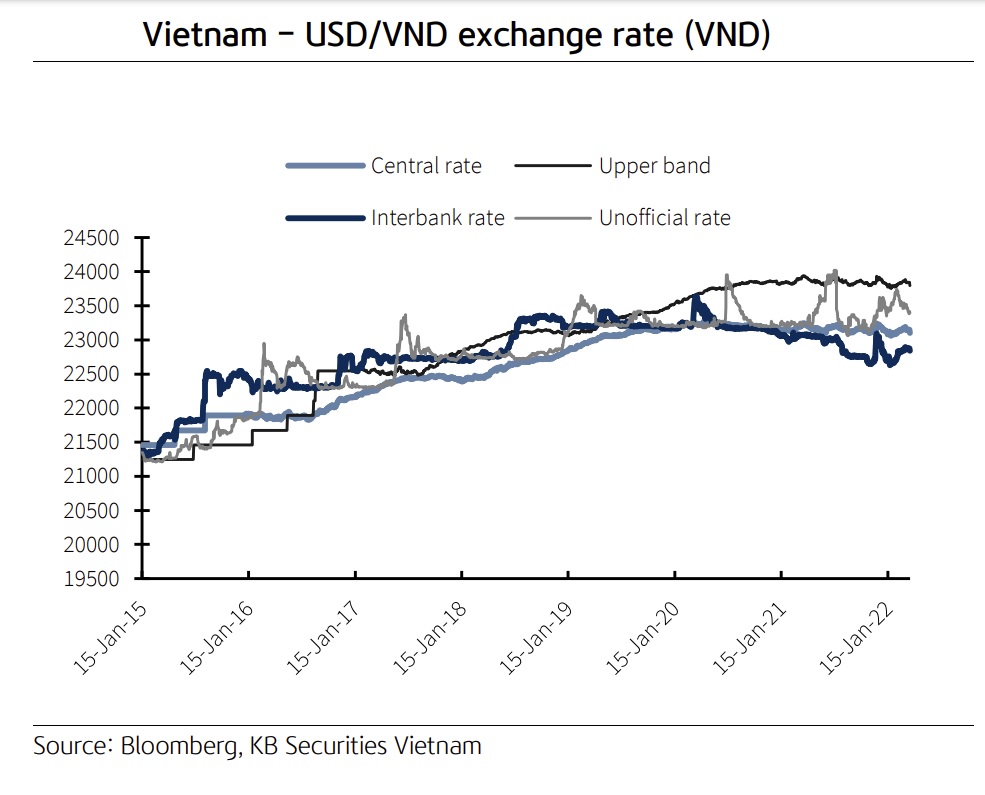

The USD/VND exchange rate remains stable at around 23,120.

The USD/VND exchange rate remains stable at around 23,120, contributing to macro stability and helping businesses hedge against risk exposure associated with the exchange rate. Furthermore, USD supplies remained plentiful as a result of remittances, FDI, and trade surpluses, allowing the USD/VND interbank exchange rate to remain around 22,850 (0.05% YTD).

Meanwhile, the unofficial rate moved sideways at high levels in the first quarter of 2022 as the gap between domestic and global gold prices widened, leading to rising gold smuggling. The gap was once as much as VND13 million/tael but narrowed to VND11 million/tael as of March 31. During the first quarter, the unofficial rate inched down 0.8% to 23,400 from 23,590.

The NEER and REER showed opposite trends. Specifically, as of the end of March 2022, the NEER increased 3.44% YTD due to USD appreciation (similar to stronger VND against the currency basket of trading partners). Meanwhile, the REER decreased 0.38% YTD by the end-1Q22 due to soaring global inflation relative to domestic inflation, helping improve the price competitiveness of exports. It is similar to the strong recovery of Vietnam's import-export turnover in 1Q22 compared to 1Q21, reaching USD176.35 billion, up 14.37% YoY. The trade balance was estimated to have a trade surplus of USD809 million.

However, both the NEER and REER have moved within a reasonable range and have not posed pressure on VND devaluation since Vietnam applied the central exchange rate regime pegging VND to a currency basket in August 2014.

Mr. Tran Duc Anh, Head of Macro and Strategy at KB Securities, said the USD supply in 2022 would be equivalent to the 2021 level thanks to the recovery of exports and returns on FDI and remittances into Vietnam. Specifically, exports of major commodities in the first three months of 2022 increased with both higher volume and prices.

"We believe that Vietnamese enterprises will continue to enhance exports to capitalize on preferential tariffs under FTAs in the coming months to bring in a large amount of foreign currency. In addition, the World Bank (WB) and the Global Knowledge Partnership on Migration and Development (KNOMAD) assessed Vietnam as the eighth largest remittance recipient in the world and the third largest in the Asia-Pacific region this year. As a result, we expect remittances to Vietnam to maintain a growth momentum of 5-7% in 2022. In addition, FDI commitments to Vietnam will return to a positive trend as foreign investor confidence improves when Vietnam has fully reopened international trade (as analyzed in 2022F GDP growth)", Mr. Tran Duc Anh said.

In Mr. Tran Duc Anh’s opinion, a stronger USD can lead to a 0.5%-1% increase in the USD/VND exchange rate in 2022, in the context of stable USD supplies. The US Dollar Index (DXY), which measures the strength of the US dollar against a basket of currencies, increased 2.8% year on year to 98,312. It was backed by: (1) geopolitical tensions between Russia and Ukraine; and (2) a future half-point interest rate increase to curb inflation supported by many US Fed officials at the Fed's March meeting.