Will the VN-Index go sideways this week?

The positive thing is that the cash flow is still moving in the market, so many analysts said that the VN-Index would balance and go sideways this week.

The VN-Index broke through 1,300 points on Wednesday and stayed there for the rest of the last week, including the modest correction on Friday. 1,300 was the top of the 2024 range but no longer appears to offer much resistance, which suggests c.1,340 as the next hurdle. The week’s solid ADT (US$1bn, 44% WoW) and the heaviest FINI net buying since 2022 increase confidence. Tariffs could re-emerge as a headwind in weeks ahead (July 9 is the “deadline”), but we retain our bullish view for 2025. The VN-Index has bounced 19% from the April 9 low, and Yuanta Vietnam’s target of 1,539 implies, 18% upside.

ADT soared to US$1,018mn (44% WoW) with three days of $1 billion-plus turnover and the weakest turnover day (US$868mn) occurring during Friday’s modest share price correction. Increased turnover driving shares higher and softening volume on the pullbacks are positive indicators. Weekly breadth was again very positive across the VNI (251 gainers / 114 losers) and VN30 (27 gainers / 3 decliners).

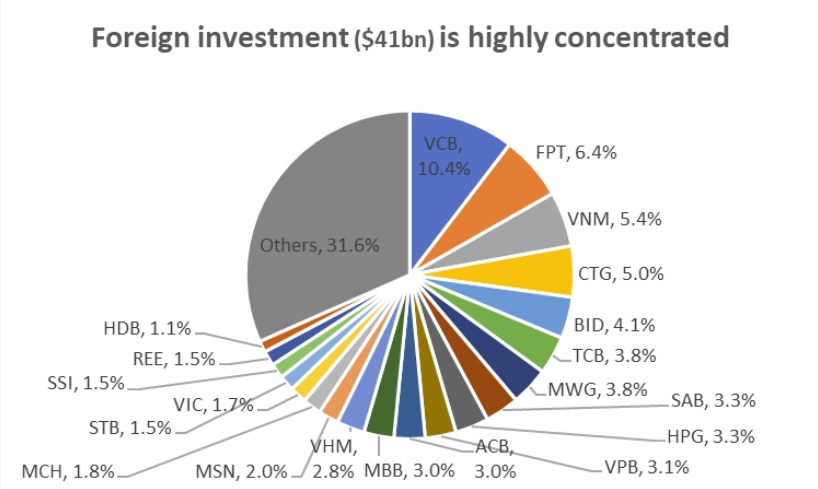

Weekly foreign net buying was the highest since December 2022 at US$224mn. The second sequential week of net inflows brings net buying in May to US$319mn. YTD net outflows are still US$2.8bn, but perhaps we’re finally seeing signs of seller exhaustion. Net buying last week was focused on MBB (US$42mn), MWG (US$34mn), FPT (US$24mn – perhaps FINIs don’t hate compounders as much as Yuanta Vietnam thought?), PNJ (US$17mn), & VPB (US$16mn). Foreign stock ownership is very concentrated. Including strategic stakes, foreigners own around US$41bn of listed Vietnam equities, or about 15.9% of total market cap. VCB alone represents 10.4% of foreign investment in Vietnamese stocks. The top-10 most-owned stocks account for 49% of the total, and the top20 account for 68% of total foreign ownership of the Vietnam stock market.

SBV’s Circular 3/2025/TT-NHNN, which is set to come into effect on June 15, 2025, reduces the paperwork burden to open accounts that have resulted in most foreign investors remaining on the sidelines. Having said that, FINI trading accounts in April increased by 28 MoM – the highest monthly net increase of 2025 – to reach 4,681 accounts (up by 39 accounts YTD).

On the daily chart, the RSI indicator is forming a peak in the high zone, and the MACD indicator is also gradually breaking sideways, so fluctuations during the session are normal, especially when the market has been increasing continuously for 2 weeks. The /-DI line is anchored above the 25 mark; however, the ADX line is below this mark. Vietcombank Securities Company (VCBS) said there would be a high probability that the VN-Index will continue to fluctuate within an amplitude of about 10-15 points this week, but it can be seen that this is a correction phase to test short-term momentum in the medium-long-term upward trend of the market.

The market recorded fluctuations and decreased by nearly 12 points, close to the 1,300 mark in today's session after two weeks of almost non-stop increases, so this is a necessary correction to stabilize the momentum as well as test the supply and demand of the VN-Index . “The positive thing is that the cash flow is still moving in the market, so it is expected that the VN-Index will balance and accumulate around the 1,300 mark. VCBS recommends that investors calmly monitor the general developments, follow the cash flow, and select stocks with increasing signals from the support zone with good increased buying liquidity to disburse for short-term goals this week”, said VCBS.