2H22F earnings of listed property companies could bounce back

The top five listed real estate businesses under VNDirect's coverage expect their 2H22F earnings to increase due to robust property handovers.

One of NVL's three projects that are up for acquisition is NovaWorld Ho Tram.

>> No sign of debt crisis among listed property developers

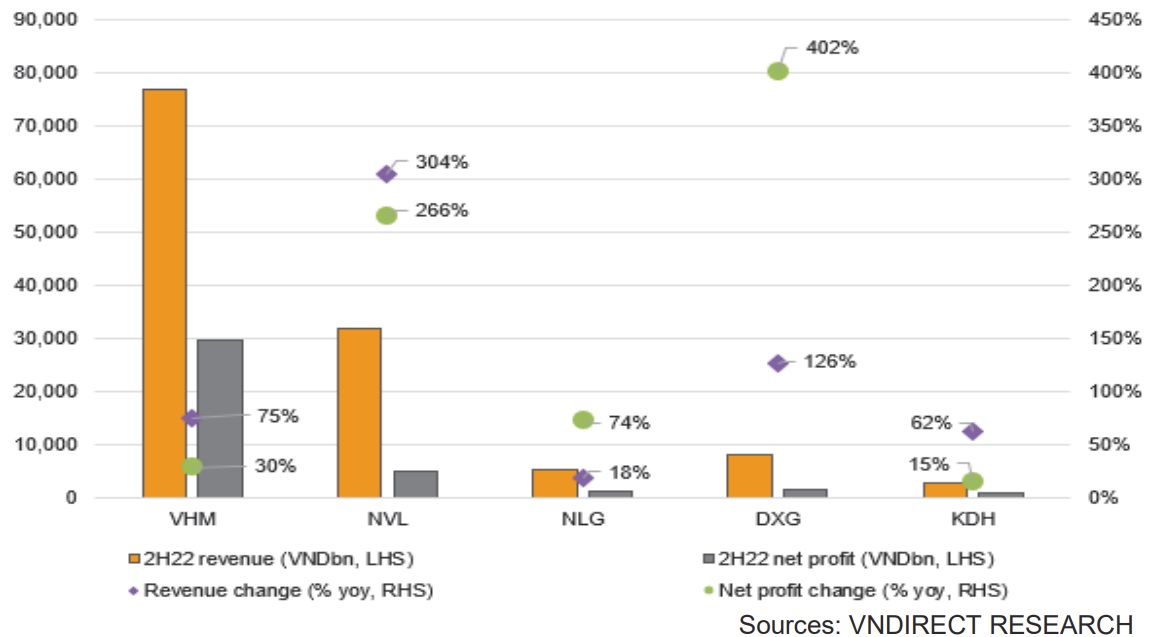

VHM expects its 2H22 income to increase by 75% year over year to VND76,839bn, supported by retail delivery at the projects Ocean Park, Grand Park, Smart City, and low-rise at Dream City. Due to a lack of bulk sales delivery, the gross profit margin for 2H22 will decrease by 12.8% points year over year to 50.4%. Mr. Chu Duc Toan, a senior analyst at VNDirect, predicts that VHM's 2H22 net profit will increase 30% yoy to VND29,790bn as a result.

Since 2H22, NVL's three megaprojects, Aqua City, NovaWorld Ho Tram, and NovaWorld Phan Thiet, are available for acquisition. Its 2H22 revenue is anticipated to significantly increase by 304% year over year to VND31,745bn. We predict that the gross profit margin for 2H22 will fall to 37.1%, down 8.2% points from the high base set in 2H21 by the delivery of high-end, low-rise units at low cost. As a result, Mr. Chu Duc Toan predicted that 2H22 net profit will increase by 266% yoy to VND5,008 billion.

According to VNDirect, the handovers at Valora Southgate and Can Tho 43ha will help NLG record 2H22F income rising by 18% yoy to VND5,390bn. On account of a greater contribution from high-margin property handovers, the gross profit margin for 2H22 increased by 4.1% pts year over year to 39.6%. "We anticipate NLG could complete the necessary legal processes for the stake transfer in Paragon Dai Phuoc to earn a VND350bn one-time gain in 2H22. We estimate that as a result, 2H22 net profit increased by 74% yoy to VND1,148bn, said Mr. Chu Duc Toan.

>> What are the prospects for HCM City’s property market?

DXG's 2H22 revenue is anticipated to increase by 129% yoy to VND8,176bn, mostly due to the handover of Gem Sky World and Opal Skyline. Gross profit margin for 2H22 is expected to remain strong at 55.3% (2.6% yoy). "We expect 2H22 selling expenses to decline by 24% yoy VND972bn due to a decline in marketing and commission costs. We estimate that as a result, 2H22 net profit increased by 402% yoy to VND1,643bn”, Mr. Chu Duc Toan.

2H22F earnings of top five listed property companies under VNDirect's coverage to bounce back on strong property handovers

KDH is likely to open for sales at Classia project in 4Q22F. It is noted that Classia’s construction activities have been completed 80-90% as of Aug 2022, thus the company could hand over this project at the same time in case homebuyers want to receive the house immediately. “We estimate KDH’s 2H22 revenue to increase 62% yoy to VND2,894bn, mostly from Classia projects. 2H22 gross margin is still be high at 55.6% (1.8% pts yoy). We forecast 2H22 net profit to rise 15% yoy to VND840bn on high base 2H21 which was boosted by one-off gain”, said Mr. Chu Duc Toan.

However, Mr. Chu Duc Toan sees property demand, especially in premium, hoarding and speculative properties, still face headwinds in 2H22 due to credit restriction into those. While mid-end and affordable segments might be affected from cost push inflation and expected interest rate hikes. However, he believes low-segment demand could outweigh these pressures in 2H22 in the context of limit ed new supply and high end-user demand. As a result, he forecasts new launches of the top five developers under our coverage are backloaded in 2H22F amounting to VND88,600bn vs. VND159,400bn in 1H22.

Besides, Mr. Chu Duc Toan believes social housing segment could be on recovery driven by flourish supply and Government’s support such as package of VND40tr for social housing loans. The Government have committed to build more than at least 1 million social-housing units and homes for workers by 2030 to meet the demand for middle and low-income households.

“We see some developers have announced to step into social housing projects such as Vinhomes plans to develop 500,000 social housing units in the next five years, Novaland commits to build 200,000 units, Him Lam, Hung Thinh, etc. Given the low profit of only 10%, we think that these developers do social housing projects contributing to social security rather than earning profits”, said Mr. Chu Duc Toan.