A big bull expected for Vietnam stock market

The breakout appeared in June as VN-Index closes above 1,080 pts and 1,100 pts. That implies a bullish market.

>> Accumulating stocks in the new cycle

Net sell of foreigners

There is evidence that demand may be recovering, but there is still strong foreign selling pressure and outflow. Foreign trading activity's trading volume continued to decline in May 2023.

Most notably, supply remained close to the level of the previous month while demand continued to decline, hitting the 5-month low, causing the market to wind up being net sold. Vietnam was divested for two months in a row due to the influx of ETFs, but foreign interest is beginning to revive.

A Path to a better future

Despite a recession in the economy, Vietnam is gradually recovering as a result of improved FDI and increased retail sales. Since April, FDI has increased, signaling a resurgence in inflows as multinational corporations increase their production capabilities. Since the reopening of tourism, retail sales have increased as well, with a considerable contribution from Chinese visitors.

While tourism-related income drives domestic spending, it is anticipated that overseas spending will fuel future growth. These encouraging patterns point to a bright future for Vietnam's economic recovery.

Breakout after consolidation phase

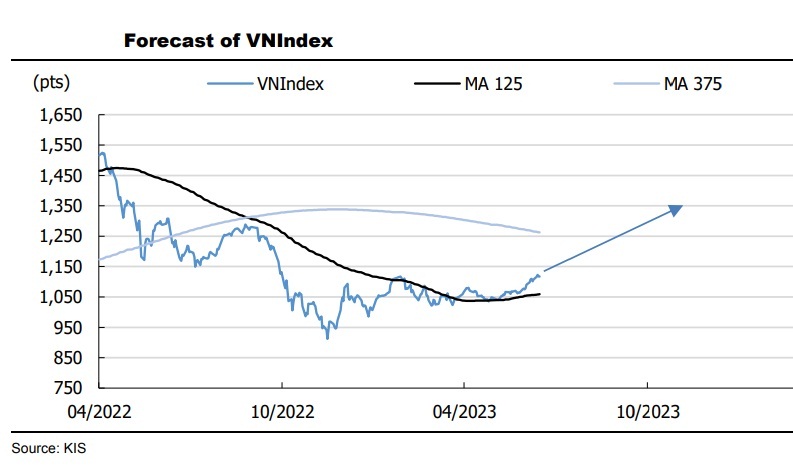

Since January, the VNIndex has fluctuated within a small band of 1,020 and 1,080 points, exhibiting a consolidation phase or rectangle pattern. Therefore, the next breakout or collapse of the index determines the following trend. The breakout consequently occurred in June when the index closed above 1,080 points and 1,100 points. A bullish market is implied by that.

“Based on the breakout of the rectangle pattern, the short-term target is between 1,140-1,160 pts. The high liquidity since May is the confirmation signal”, said Kis Vietnam.

>> Shares rebound after four-day decline

Wait for large triangle pattern

From November 2022 to June 2023, a triangular pattern appears with a 1,100–1,120 point upper bound. According to Kis Vietnam, this is a neutral pattern, and the breakout point of the pattern determines the trend. The pattern will be confirmed at the target price of 1,300-1,350 points if the VNIndex closes above 1,120 points. This pattern will probably be developed shortly thanks to the accumulation phase signal mentioned previously.

Eighth 3-year cycle?

There are two possible outcomes for the seventh 3-year cycle of the VNIndex: (1) a bullish outcome and (2) a negative outcome (see prior reports). As a result, under the optimistic scenario, we expect the seventh 3-year cycle's bottom to occur in November 2022. Thus, a significant rise will emerge in 2H23. On the other hand, the bearish scenario has not yet formed the bottom of the seventh 3-year cycle.

Based on the previous one-year bottom, which occurred in July 2022, Kis Vietnam anticipates this bottom to occur between May and September 2023. The target price range for the bottom of the upcoming one-year cycle is 780 to 910 points; more information can be found in the January month's strategy.