What stocks stand to gain from the amended VAT Law?

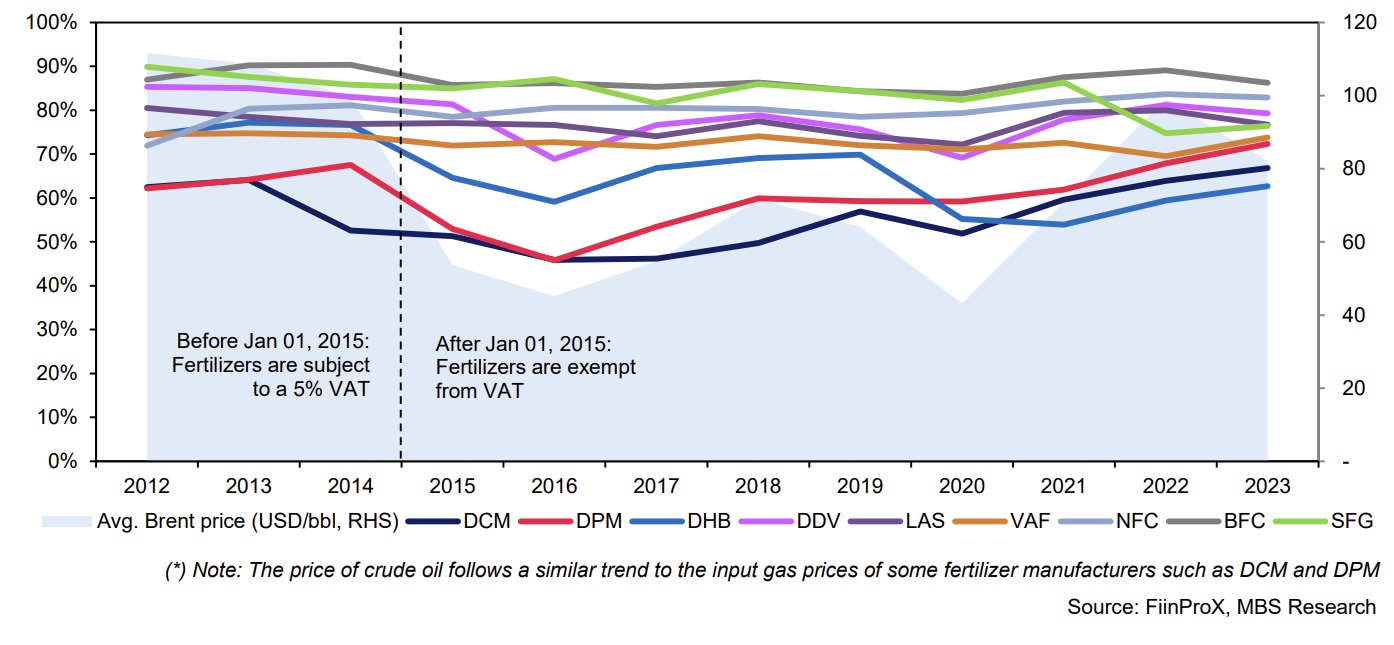

The National Assembly approved the draft amendment to the Value-Added Tax (VAT) Law, which stipulates that, starting from July 1, 2025, fertilizers will officially be subject to an output VAT rate of 5%. Previously, under the amended Tax Law No.71/2014/QH13, which took effect on January 1, 2015, fertilizers were exempt from output VAT.

Since its implementation, Tax Law No.71 has shown several limitations, especially in the fertilizer industry. While fertilizers were exempt from output VAT, the input materials were still subject to VAT. This resulted in domestic companies being unable to claim input VAT refunds, forcing them to raise prices to account for these additional costs. This situation has not only impacted the profitability of domestic fertilizer manufacturers but also placed pressure on end consumers, mainly farmers, who then turned to imported fertilizers, which were cheaper. Most imported fertilizers to Vietnam have already had VAT deducted in the exporting country. As a result, even with a 5% import tax (on urea and phosphate fertilizers), the overall price of imported fertilizers remains lower than that of domestically produced fertilizers.

MBS believed that the imposition of a 5% VAT on fertilizers would allow companies to claim input VAT deductions, thereby supporting the profitability of domestic fertilizer manufacturers. The cost of raw materials used in manufacturing fertilizers often accounts for a significant portion of the total production costs for fertilizer companies, ranging from 50% to 80%. The input raw materials used for fertilizer production are relatively diverse and are often subject to VAT rates ranging from 5% to 10%.

If fertilizers are exempt from output VAT, the VAT on input materials cannot be deducted and must be included as part of the production costs. As a result, manufacturers are forced to increase prices to cover these costs, making it difficult to compete with imported fertilizers on price. In contrast, if fertilizers are subject to a 5% output VAT, input VAT can be refunded, and companies will benefit from reduced costs compared to previous years.

Theoretically, the imposition of VAT will lead to higher fertilizer prices. However, the support for profitability will create an incentive for domestic fertilizer manufacturers to lower their selling prices, thereby increasing competitiveness with imported fertilizers, which previously had a cost advantage over domestic ones. As a result, end consumers will ultimately benefit. It is noted that fertilizer importers will not be significantly affected by this tax law change, as both input and output tax rates are set at 5%, meaning their profitability remains unchanged.

“Companies manufacturing straight fertilizers (urea, phosphate) and DAP fertilizers, such as DCM, DPM, DDV, and LAS, will benefit from this change thanks to the input VAT refunds on raw materials. On the other hand, companies manufacturing NPK fertilizers are unlikely to benefit significantly, as their key inputs are straight fertilizers, and the imposition of VAT on fertilizers has little impact on their profitability. In the context of stagnant domestic production capacity and a lack of clear upward momentum for fertilizer price in the coming year, we believe that the imposition of VAT will drive profit growth for fertilizer manufacturers in 2025”, said MBS.

As mentioned above, MBS expects that profit growth in 2025 of some fertilizer companies producing straight fertilizers and DAP fertilizer will benefit from the amendment in the VAT Law, including: DCM, DPM, DDV, and LAS. However, since the implementation of the 5% VAT on fertilizers (starting from July 2025) will occur later than our previous forecast (January 2025), it lowered its projection for DCM’s net profit in 2025 by 12% compared to the previous one. According to the previous forecast, if the amended VAT law takes effect in January 2025, it could support DCM to reduce input costs by approximately VND 400 billion per year, thereby supporting profit growth in 2025. MBS also adjusted DCM's 2024 profit forecast to reflect the one-off profit from the acquisition of the Han Viet NPK plant at a lower price.