A more sanguine for Vietnamese economy

Vietnam continues to see export growth, thanks to electronics shipments, but caution on the trade turn remains.

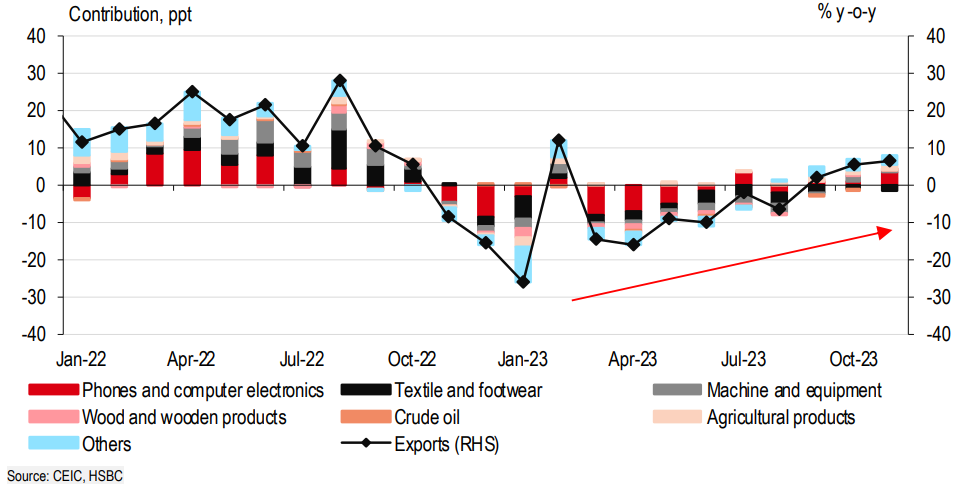

Since 4Q, Vietnam’s exports have been improving

>> Vietnamese Economic Outlook: Projected 5.8% GDP Growth in 2024 Amidst Stable Interest Rates

Since 4Q, Vietnam’s exports have been improving, with November seeing export growth of 6.7% y-o-y. While textiles and footwear remain sluggish, other shipments such as computerrelated parts (20.2% y-o-y) and machinery (5.0% y-o-y) are showing sustained and encouraging signs, albeit in part due to favourable base effects. New areas with export growth potential, such as agricultural products, also continued to show signs of strength in support of a modest improvement towards year-end.

That said, HSBC remains cautious of the trade prospects, as demand for goods in major trading partners remain challenging. In fact, manufacturing PMI contracted further to 47.3 in November, with both output and new orders in contraction.

Meanwhile, domestic activity continues to be a firm pillar for the penultimate month of the year. Indeed, the relaxation of visa policy since August has driven a sustained recovery in international tourists, with November welcoming over a million tourists for the fifth consecutive month. With 11.2m arrivals YTD, the official target of 12-13m tourist arrivals for 2023 looks to be comfortably secured. However, the recovery of Chinese tourists appears to have plateaued, only rebounding to 30% of 2019’s level. What is more, the competition for tourism in ASEAN is set to intensify. After Thailand’s visa exemptions for Chinese and Indian tourists, Malaysia is the next to have followed suit.

>> Strengthening growth momentum for 2024

Elsewhere, inflation has broadly remained in check. Headline inflation rose only 0.2% m-o-m, leading to a moderation in y-o-y inflation to 3.4% in November. While domestic rice prices continued to face spill-over pressures from elevated international prices, falling pork prices have more than offset the former’s rise. Meanwhile, lower oil prices have also kept a lid on inflation.

Vietnam continues to see an improvement in exports

However, the most notable development in November in our view is the first momentum rise in medical costs in four years, as a result of the changes in national medical service pricing. Recall that before the pandemic, the government pushed for its healthcare reform, raising medical costs periodically. After it was disrupted by the pandemic, November marks the resumption of such efforts.

For the State Bank of Vietnam (SBV), signs are positive as inflation looks controlled and the economic outlook, especially on the external front, is stabilising to a degree. But that does not mean that upside risks to prices have dissipated. Vietnam Electricity, the state-owned utility company, raised its power prices by 4.5% in November, which typically is reflected with a onemonth lag in CPI, to accommodate the diminished hydropower production due to the El Nino phenomenon. While keeping attuned to upside risks such as from food and energy prices, HSBC expects the SBV to keep the policy rate steady at 4.50% through 2024.