A new boost for corporate bond and property markets

The State Bank of Vietnam (SBV) just issued new regulations that are designed to strengthen corporate bond and property markets.

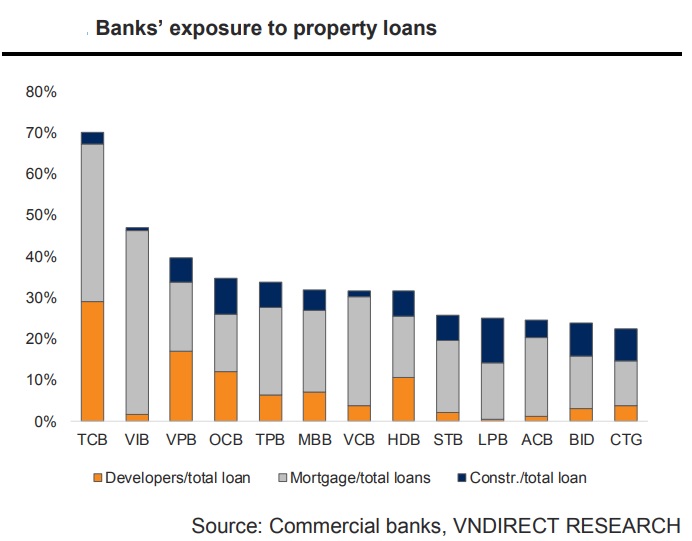

The stagnating real estate market has been a major source of concern for the banking sector's outlook.

>> Social housing: A lifeline for real estate businesses

SBV has issued Circular 02-03/2023, which allows banks to keep debt groups, postpone principle and interest payments, and purchase back corporate bonds. Furthermore, it has released a draft to amend Circular 41/2016, which will recalculate the risk factor of risk-weighted assets for each type of property loan.

More supportive measures to come

Following Resolution 33/2023, the SBV announced additional supportive measures, particularly Circular 02/2023, to guide credit institutions in reviewing and rescheduling principal/interest payments or maintaining debt groups for customers who are (1) experiencing liquidity problems to run businesses and (2) experiencing a decline in demand for consumer loans.

Furthermore, the Circular permits banks to extend the time period for allocating provisions for the aforementioned loans. Overall, this new regulation will help to alleviate the liquidity crisis, particularly for property developers, while also assisting enterprises with strong fundamentals.

Good news for banks

Until now, the stagnating real estate market has been a major source of concern for the banking sector's outlook. The need to build up provisions will be relieved by Circular 02/2023, since banks will be able to re-arrange their provisioning expenditures within two years (2023 and 2024).

VNDirect believes that investors' sentiment will improve for banks with significant exposure to property/consumer finance loans in their credit books, such as TCB, MBB, VPB..., because these banks face higher-than-peers credit-cost rates due to rising credit risk and deteriorating asset quality when compared to other "safe" banks in the current environment.

>> Domestic resort real estate market facing challenges

Corporate bond recovery

Circular 03/0223 has postponed Article 11 Clause 4 Circular 16/2021, which implies that banks can still buy back unlisted corporate bonds they sold/distributed under certain situations. In the context of poor system credit growth (2.06% ytd at the end of 1Q23) and present plentiful liquidity in the banking system, this is one approach for banks to increase their lending activity by purchasing corporate bonds.

Furthermore, this Circular will help boost corporate bond demand, benefiting some active corporate bond market players such as TCB, VPB, and MBB. However, it also depends on each bank's risk appetite, as after the 2H22 turbulence, banks have tended to strengthen their balance sheets rather than chasing growth.

Focusing more on favorable houses

The proposed to amend Circular 41/2016 intends to reduce the risk element of industrial property loans and loans to the social housing group in general, while emphasizing that lending to such sectors is encouraged. This action is strictly in accordance with Resolution 33/2023 (concerning the VND120tr credit package).

According to VNDirect, if this proposal is formally adopted, stated-owned banks (SOCBs) such as VCB, CTG, and BID will benefit. This is also a solution for boosting SOCBs' credit growth in the context of their softer NIM (when the interest rate trend shows signs of reversal, SOCBs' lending rates will likely fall faster than deposit rates, as SOCBs must still heed the Government's call to lower interest rates to support businesses).