ASEAN perspectives on recovery of job and purchasing power

While broad-based consumer-friendly policies are unlikely, a continued recovery in the job market will support consumption.

Labour market continues to recover closer to pre-pandemic levels

>> ASEAN perspectives: The magic of consumers

We look at what fuels consumption in the first place – one’s job and the wage one gets from that job. The more people work and the more they earn, the more resources there are in the economy to spend. Of course, this is an overly simplistic view, but it is important to note that labour usually follows a trend. Labour supply depends on a slew of factors, such as pay, preferences, and non-labour income.

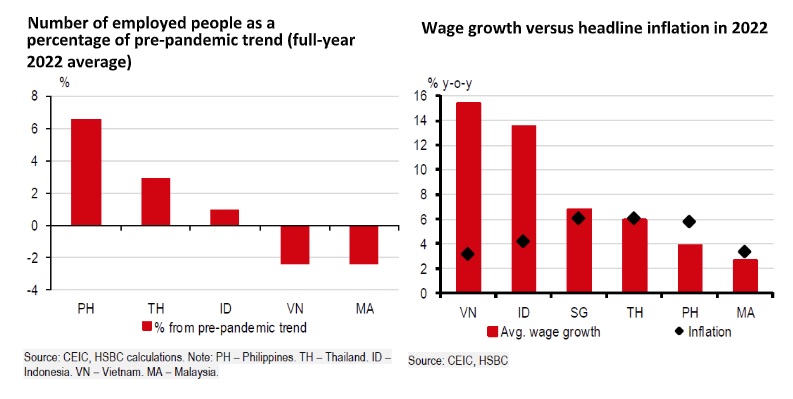

However, one major factor is population – the potential supply of labour increases alongside the growth of the working age population, resulting to labour supply following some form of natural trend. And putting this into the context of a postpandemic recovery, we can surmise that labour supply has more or less normalised when employment returns to this natural trend. If employment is still below trend, then there may still be some room for labour to recover.

That said, HSBC thinks consumption in ASEAN will slow in 2023 but in varying degrees; consumption in the Philippines will likely slow down the most, while Vietnam, Malaysia and Singapore may show some resilience.

We can see that labour in the Philippines and Thailand already exceeded their respective trends, supporting the consumption recovery seen in both economies last year. However, in 2023, cyclicality should not be in their favour. The job recovery may have already been exhausted in 2022 and it will be difficult to add more jobs in the economy to boost household consumption further in 2023. Unlike the Philippines, however, Thailand can still rely on the expected tourism boom in 2023 to create jobs or replace old jobs with better paying ones.

>> Decisive factors for Vietnamese consumers to purchase electric vehicles

On the other hand, there is still room for a recovery in Vietnam and Malaysia, which should, in turn, support household consumption to some extent. However, HSBC also noted that there are downside risks as these economies are heavily exposed to the global trade slowdown. Indonesia’s labour market recovery also supported consumer spending. In particular, urban wage growth (covering 57% of the population) was stronger than rural wage growth, although it remained below pre-pandemic levels as higher inflation impacted some of the gains.

However, what about the income people get from their jobs? Did it increase amid the inflation wave of 2022? HSBC said it would be a mixed picture: Vietnam and Indonesia gained, whereas Malaysia and the Philippines saw the prices of goods and services rise faster than wages in 2022 – eroding the purchasing power and curtailing consumption in the foreseeable future. Inflation usually works with a lag and households will likely continue to readjust their expenditure throughout the year in consideration of the steep rise in the cost of living.

However, yet again, the extent of deterioration varies across ASEAN. The purchasing power of wages did not decline as much in Malaysia, where labour market continues to recover closer to pre-pandemic levels, while the purchasing power in Vietnam actually increased, providing the economy with a boost of resilience in 2023.

The Philippines, however, saw the purchasing power of its wages decline significantly, wherein the rise in the cost of living almost doubled compared to the rise in wages. This deterioration will likely take a toll on consumption in 2023 as households find their way around to make ends meet amid the squeeze in household budgets.