Is there still room to cut lending rates?

The State Bank of Vietnam (SBV) is continuing its efforts to support liquidity and reduce funding costs for commercial banks in order to promote credit growth and contribute to economic growth.

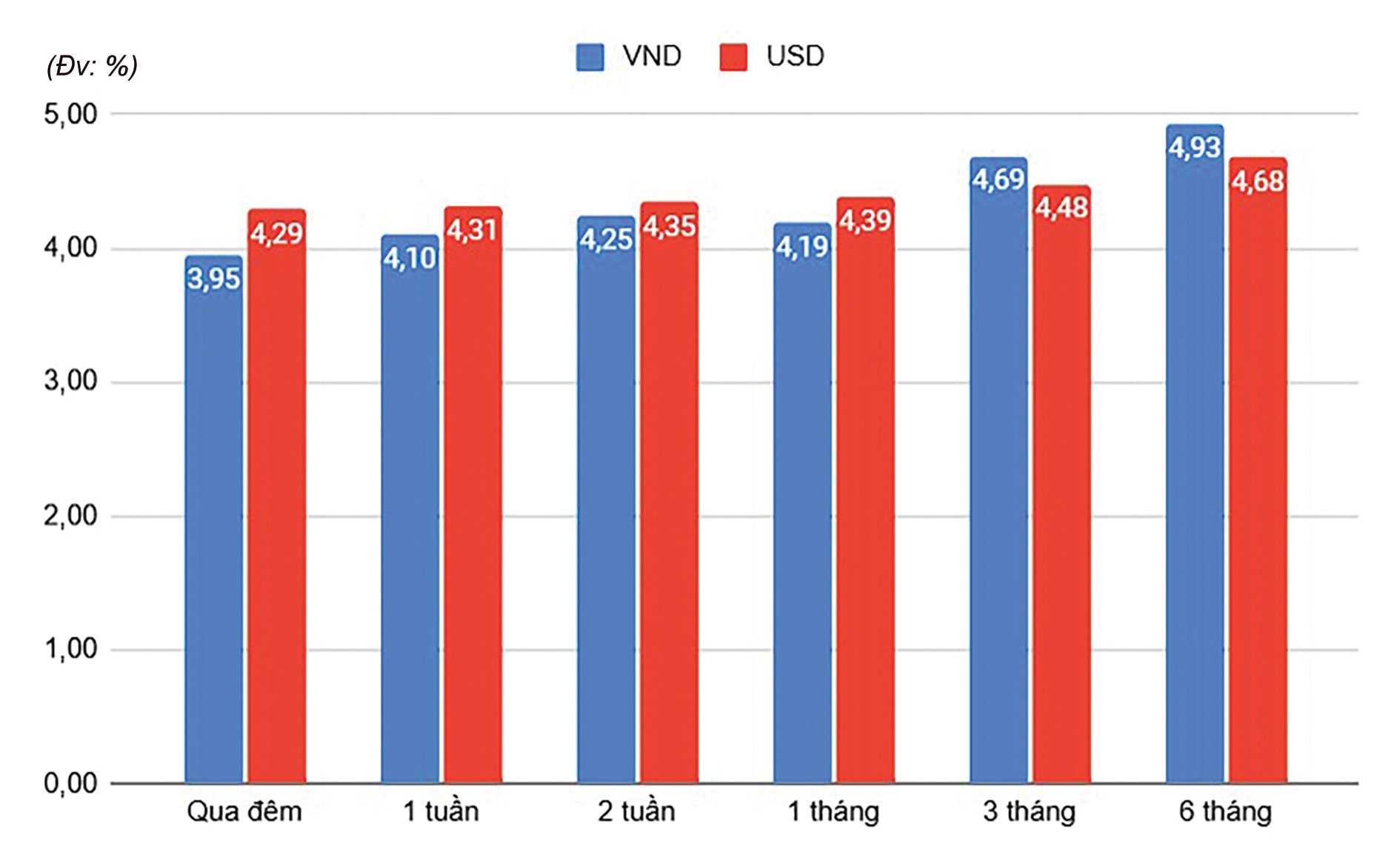

By the end of Q1 2025, VND lending rates recorded a slight decrease of 0.08–0.1 percentage points. (Chart: Average interbank interest rates for key tenors in the week of May 12–16, 2025)

With these moves by the SBV, commercial banks may gain further room to reduce lending rates and support credit expansion in the second half of the year.

Narrower Room for Action

Credit is growing in line with economic expansion. However, during the ongoing National Assembly session, SBV Governor Nguyễn Thị Hồng stated that the credit-to-GDP ratio had reached 134% by the end of 2024. Further increases could pose risks to the banking system and the broader economy, making it difficult to achieve the dual goals of high and sustainable growth. The SBV governor affirmed that the 16% credit growth target for this year will be carefully controlled and adjusted to match real-world conditions.

Moreover, Governor Hồng emphasized that from now to 2030, Vietnam has numerous major projects requiring large-scale investment—such as expressways, the North-South highway, airports, seaports, and the implementation of Power Plan VIII. These require relevant ministries to clearly define sources of capital, borrowing capacity, mobilization mechanisms, timelines, and phasing—so that funding is secured proactively, avoiding project delays and ensuring sustainable high growth.

The SBV’s message is clear: it will continue to respond flexibly to real-world developments, adjusting its policy timing and magnitude appropriately to control inflation, maintain macroeconomic stability, ensure monetary market stability, and preserve banking system safety—all top priorities. In other words, the SBV will not aggressively boost credit at all costs, and the prospect of further policy rate cuts in H2 2025 will depend on various factors.

One such factor is inflation. According to Brian Lee Shun Rong, an economist at Maybank Group, if inflation remains stable, the SBV may consider reducing policy rates to stimulate credit—especially if public investment falls short of expectations. “The SBV may cut rates by another 25 basis points in Q3 2025. However, the Middle East conflict could pose inflationary risks—affecting oil prices, supply chains, and commodity costs (including rising gold prices and pressure on capital outflows and exchange rates), which could temper expectations for further rate cuts,” said Lee.

At the start of 2025, liquidity in the banking system showed signs of tightening, with credit growth at 6.52% outpacing capital mobilization at 5.09%. While the SBV maintained its accommodative monetary stance—cutting the OMO rate by another 25 basis points in March 2025 and remaining ready to support liquidity and reduce funding costs—tight liquidity conditions will need to be reassessed as capital demand picks up sharply in the second half of the year.

Analysts at UOB Singapore remain cautious, noting that while moderate inflation and rising global trade tensions may open the door for policy easing, the current weakness of the VND limits SBV's flexibility. Given this context, UOB forecasts the SBV will keep its policy rates unchanged, maintaining the refinancing rate at 4.5%.

Proactive Access to Preferential Capital Needed

While expectations for policy rate cuts remain uncertain, commercial banks also appear less optimistic about further lowering lending rates—amid concerns over rising bad debt. In early 2025, over 20 commercial banks, in response to SBV guidance, cut their deposit rates, helping bring overall interest rates to relatively low levels. These banks report plans to further reduce operating costs, accelerate digital transformation, and increase the share of low-cost current account savings (CASA) to maintain low lending rates and support businesses and economic growth.

According to an SBV survey, many commercial banks still expect some room to lower lending rates in the second half of 2025, though the extent of the cuts is likely to be limited.

From the business side, Nguyễn Phước Hưng, Vice Chairman of HUBA (Ho Chi Minh City Union of Business Associations), said companies hope that banks will continue to reduce net interest margins (NIM) and implement meaningful preferential credit packages—alongside local government capital incentive programs.

Importantly, regarding the implementation of a 2% interest support policy for green and circular loans and ESG-compliant projects under Resolution 68/NQ-TW, Governor Hồng clarified that this is budget-funded and currently under deployment by the Ministry of Finance through a lending fund. If coordinated with banks, the implementation process will aim to minimize obstacles similar to those seen with previous 2% interest subsidy programs.

The SBV has also proposed integrating this policy with corporate income tax rules for businesses borrowing under Resolution 68/NQ-TW. Therefore, enterprises should monitor developments closely to best meet the conditions for accessing preferential capital effectively.