Steel and bank stocks lead Q2 ETF inflows

In the Q2/2025 rebalancing period, two foreign ETFs — VNM ETF and FTSE ETF — made significant purchases in steel and banking stocks.

These include HPG (Hoa Phat Group Joint Stock Company - steel stock), EIB (Vietnam Export-Import Commercial Joint Stock Bank), NAB (Nam A Commercial Joint Stock Bank), and SHB (Saigon - Hanoi Commercial Joint Stock Bank).

MBS forecasts that VIC shares will be sold off by more than 2 million units, and VHM by over 2.5 million. Meanwhile, the FTSE ETF will buy 3.8 million shares of SHB and 1.4 million shares of EIB.

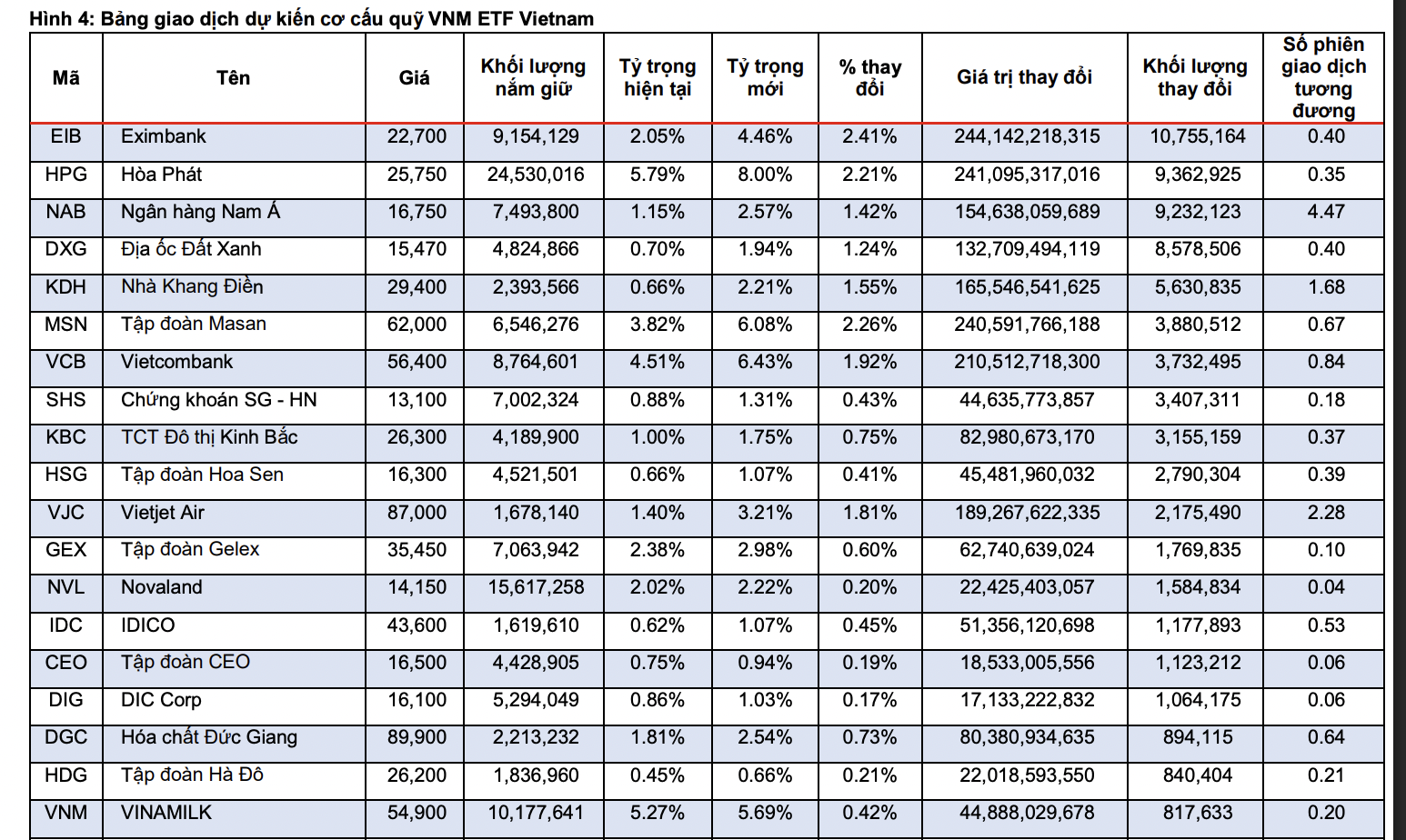

The VNM ETF is expected to reduce its holdings of VIC and VHM — the two top stocks being sold off — with 7.2 million shares of VIC and 5.1 million shares of VHM being sold. VND and VCI are also being offloaded. On the other hand, the fund will net-buy 10.7 million shares of EIB, 9.3 million shares of HPG, and over 9 million shares of NAB.

Regarding HPG — the only steel stock to be net-bought this time — VCBS Securities noted that the company’s Q1/2025 revenue rose sharply by 21.9% to VND 37,622 billion, driven by a 24.8% increase in steel sales to VND 35,715 billion. The growth in steel revenue was mainly due to a strong increase in domestic consumption of construction steel and hot-rolled coil (HRC).

As a result, HPG’s parent company posted after-tax profit of VND 3,344 billion (up 16.5%, completing 22% of its annual plan). Total sales volume is estimated to have grown 24% to nearly 2.5 million tons, with domestic sales of construction steel and HRC up 84%. However, export volume fell, reaching only 382,000 tons across most product segments.

VCBS believes HPG will benefit from a strong recovery in demand, particularly in construction steel and HRC. The anti-dumping tariffs effective from March 7, 2025, have supported positive HRC sales. The Dung Quat 2 (Phase 1) HRC plant is expected to operate at 55% capacity, and the combined Dung Quat 12 at 78% in 2025. Steel demand is projected to rise with increased government public investment in transportation infrastructure and a rebound in residential construction thanks to loosened legal bottlenecks and an improved business climate.

As of now, Dung Quat 2 (Phase 1) has been completed and is operating near its designed capacity. HRC output began in March and orders have been secured through mid-year. Phase 2 is expected to finish in October, with the second blast furnace scheduled to begin operation in Q4/2025. The production of high-quality steel is a strategic move for HPG to diversify and reduce reliance on the cyclical construction steel segment. The rail steel plant at Dung Quat 2 has a total investment of VND 14,000 billion, with an annual capacity of 500,000–600,000 tons.

Vietnam’s total steel demand for railway projects is estimated at 10 million tons. HPG is fast-tracking a high-quality steel casting and rolling project, having signed a contract with Primetals Technologies for a 500,000-ton/year steel line producing tire bead wire, sidewall steel, cold stamping steel, and prestressed steel. The project is expected to be completed by the end of 2026.

Regarding the Phu Yen steel plant (500ha), HPG plans to develop a project with a design capacity of 6 million tons/year and a total investment of VND 86,000 billion. The product type is still under research. If HRC is chosen, it could still be absorbed by the domestic market, which demands about 13 million tons (Phu Yen HRC output is estimated to be over 3 million tons). According to VCBS, this is the reason why HPG — the only steel stock in the VN30 index — was favored by foreign funds.

As for the EIB and SHB stocks, foreign ownership increased due to their strong business performance.

SHB recently announced its Q1/2025 results, with total operating income reaching VND 6,051 billion, up 3.6% YoY. Pre-tax profit was VND 4,371 billion, an 8.8% increase YoY, setting a new quarterly record. The bank has set a pre-tax profit target of VND 14,500 billion for 2025, up 25% from 2024.

Thus, SHB has achieved 30% of its full-year profit target. As of June 6, SHB stock reached VND 13,700/share, marking its highest point YTD.

EIB reported Q1/2025 pre-tax profit of VND 832 billion, up 25.8% YoY. Net interest income remains the main revenue source, reaching VND 1,354 billion. Non-interest income improved significantly, especially foreign exchange trading, with a net profit of VND 201.7 billion, up 141% YoY.

Banking services brought in VND 146 billion (up 32.2%), while other activities generated VND 109 billion. Total operating income surpassed VND 1,800 billion, up 14.6% YoY, showing clear progress in revenue diversification.

By the end of Q1/2025, EIB’s total assets reached VND 251,133 billion, up 4.74%. Customer loans hit VND 180,336 billion, up 9.2%, while the total system credit balance was VND 182,258 billion, up 8.34%. Credit is being allocated to key areas such as retail, SMEs, FDI firms, and large corporate ecosystems, aligning with SBV’s credit orientation.

EIB continues to maintain healthy financial ratios: the short-term capital usage for medium/long-term lending is 23–25% (well below the SBV limit of 30%), the loan-to-deposit ratio (LDR) remains under 85%, and the capital adequacy ratio (CAR) is approximately 12%, exceeding the minimum 8% requirement. On June 6, EIB shares closed at VND 24,100/share, nearly 40% higher than at the start of the year.