Is there still room for the stock market to climb?

Although the VN-Index slipped below the 1,500-point mark at the beginning of this week, the stock market remains in an uptrend, presenting opportunities for investors to either take profits or accumulate.

On Monday, July 21, Vietnam's stock market witnessed a wave of profit-taking that swept across the board, dragging all indices into the red. By the session close, the VN-Index had dropped 12.23 points to 1,485.05. The HNX-Index declined by 1.98 points to 245.79, while the UPCoM-Index fell by 0.59 points to 104.11.

Profit-Taking Intensifies Amid Lack of Catalysts

Following a robust run in recent months, the VN-Index has struggled to break past the 1,500-point barrier due to rising selling pressure. Mr. Nguyen Viet Duc, Director of Digital Business at VPBank Securities (VPBankS), said the market is still "hot," with capital focused in VN30 stocks, particularly those projected to gain from Vietnam's probable market classification upgrade.

“Our VPBankS ePortfolio focused on upgrade beneficiaries has surged 18% this past month alone, compared to a typical annual return of just over 10%,” Mr. Duc noted. “That’s why we’re seeing heavy profit-taking around the 1,500 level.”

Mr. Duc cited investment legend Peter Lynch to explain that market P/E (price-to-earnings) ratios typically range between 10x and 20x. Previously, Vietnam's market P/E ratio was about 21x in 2018 and 19x in 2021-2022. The current P/E ratio is just over 16x, which is still roughly 20% lower than previous peaks. With corporate earnings forecast to climb 15% in the coming year, the market's P/E ratio might fall even more.

“This gives us reason to expect that the VN-Index could reach at least 1,800–1,900 points,” he added. As George Soros once said, "A market going sideways will keep going sideways, but once an uptrend starts, positive sentiment can sustain it for quite a while.”

Although FOMO (fear of missing out) is a factor to watch, Mr. Duc believes the market is not yet at its peak—which he would expect to see at a P/E ratio around 19–20x.

1,500 Points: Profit-Taking or Accumulation Opportunity?

When asked why the VN-Index has struggled to break through the 1,500 level and whether a breakout is imminent, Mr. Duc stated that the current slump provides an ideal entry position.

He stated that VinGroup-related equities (VRE, VIC, VHM) and the real estate sector have been driving the market's performance. VIC shares, for example, have quadrupled year to date, rising from roughly VND 40,000 to VND 120,000. He compared this to HPG's six-fold rally in 2021.

“In 2021, HPG began to lose steam after peaking, and the market rotated into other leading sectors like securities and consumer banking,” Mr. Duc said. “We’re now seeing a similar transition. VIC is in a hot phase, and its peak may not be far off. We’re beginning to see other potential leaders emerge.”

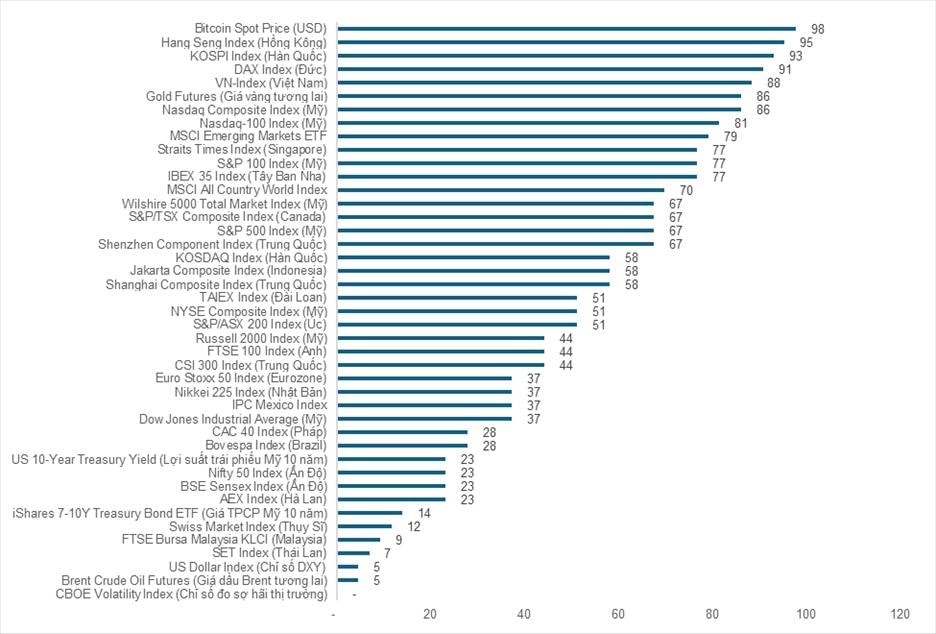

Commenting on Vietnam’s overall market outlook, Mr. Nguyen The Minh, Head of Retail Research at Yuanta Vietnam, emphasized that Vietnam’s stock market has outperformed regional peers and remains in a strong growth phase — suggesting a more sustainable medium-term uptrend.

Mr. Minh also noted that the technology and telecommunications sectors currently dominate market capitalization, mirroring historic U.S. market cycles where a leading sector defined each phase. Understanding these cycles, he said, is key to successful asset allocation.

“History doesn’t guarantee the future, but past patterns show that leadership often shifts after technological breakthroughs or economic realignments,” Minh said. “Today, tech’s market cap share is comparable to that of energy during its peak in the 1950s. However, it could soon be rivalled by sectors like transport, finance, or real estate.”

The energy sector’s relative valuation to the VN-Index remains low — below the 2022 bottom — and individual energy stocks (e.g., PVS, PVD, GAS, BSR) are trading near 2020 lows. Mr. Minh sees this as a possible short-term speculative opportunity but emphasized the need for supportive policies and economic recovery to unlock longer-term potential.

Despite current undervaluation, fundamental scores for upstream and oilfield services remain weak (30 and 57 points, respectively), indicating the need for catalysts to support revaluation.

In contrast, the technology sector continues to attract substantial capital and has significantly outperformed traditional cyclical sectors (finance, energy, materials) and defensives (utilities, consumer staples, healthcare). This focus mirrors the Dot-com era, when investors concentrated heavily on a single sector.

While tech valuations remain elevated, they’re still below Dot-com bubble levels. Still, this valuation gap could pave the way for rotations into more fundamentally sound sectors — particularly if the economy recovers and capital flows normalize.