Asia remains a pretty good place for investment

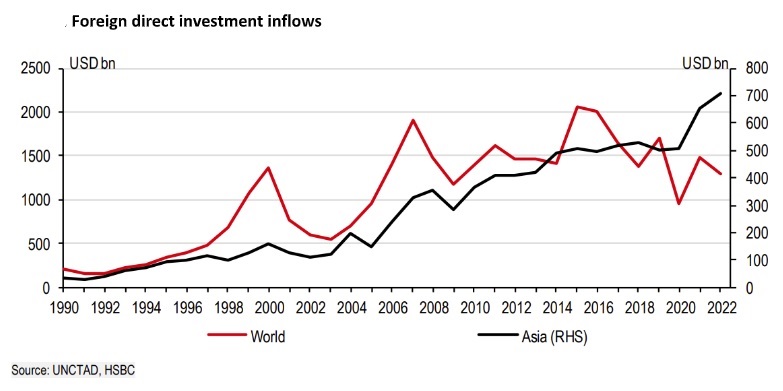

For all the hullabaloo about dimming growth prospects and deglobalisation, foreign direct investment continues to pour into Asia.

Workers assemble equipment inside a wind turbine tower at a CS Wind Corp. factory in Tan Thanh, Ba Ria-Vung Tau Province, Vietnam

>> Vietnam remains ideal destination for global giants

Much of this, moreover, is manufacturing focused, which should cement the region’s position as the centre of global trade. Also, it’s not as if flows to mainland China are collapsing: FDI has hit another record over the past year. Still, ASEAN has pushed past mainland China for the second year in a row, and India has nudged up as well, especially when it comes to new, rather than repeat, investment.

At the same time, manufacturers from mainland China are increasingly investing in other economies as well, notably in ASEAN. Relative to the size of economies, inflows are especially large in Vietnam, Malaysia, Australia, and New Zealand; far less so in Korea, mainland China, and Japan. Still, across the board, the pandemic hasn’t put much of a dent into Asian FDI flows. … Turns out it’s a pretty good place for investment, all those headlines notwithstanding.

HSBC said the foreign direct investment flows for world has been sliding for a while now after peaking in 2015; part of the chatter about “deglobalisation” and “geoeconomic fragmentation”. However, the FDI flow for the Asia keeps on pushing higher, with a notable jump over the past three years. The pandemic, it turns out, did little to curb flows into the region – on the contrary. A pretty robust picture, with FDI inflows into Asia more than doubling since 2010.

It’s worth taking a closer look, however. As an FDI destination, mainland China is used to receiving the lion’s share of inflows. Again, last year, the economy received a record amount despite subdued demand and the attendant challenges of ‘zero-COVID’. But inflows into ASEAN have jumped, with the region receiving more than mainland China for the second year in a row. At the same time, inflows into India are trending up as well, but are far lower in aggregate.

As always, nuances apply, however. First, headline FDI numbers include both capital for entirely new investments, and re-invested earnings, such as for an expansion of an existing operation. And it is here that a notable shift is occurring.

>> Vietnam will continue to be prime destination for FDI: VinaCapital

Greenfield investment is deemed to be entirely new, the establishment of operations which had not existed before. In mainland China, there has been a notable drop, but greenfield investments into India have jumped, now approaching even ASEAN, which has held up decently enough. All this means that new investment is heading mostly to Southeast Asia and India. At the same time, companies are not ‘abandoning’ mainland China: record overall FDI last year suggests that those already with a foothold in the market are continuing to expand operations.

But how important are FDI flows in the grand scheme? In HSBC’s view, it is pretty important. For one, cross-border investment helps with the diffusion of technology, raises productivity in both destination and source economies, and helps drive trade and international connectivity. FDI also directly contributes to GDP in the form of investment spending.

In Vietnam, Malaysia, New Zealand, Australia, and the Philippines, FDI inflows top 2% of GDP. By contrast, in Korea, Japan, mainland China, and Bangladesh, inflows are around 1% of GDP or less.

Still, the overall picture is not one of collapse … some shifts perhaps, but overall FDI inflows have stayed remarkably resilient.