Banks continue to ramp up new bond issuance

In June, several banks continued to issue primary bonds to raise Tier 2 capital and improve business capital.

Banks continue to dominate as bond issuers. (Photo: T.L)

According to data from the Vietnam Bond Market Association (VBMA), as of June 30, 2024, there were 30 private corporate bond issuances worth more than VND 40 trillion, as well as three public issuances above VND 2 trillion.

Since the beginning of the year, there have been 102 private issuances valued at VND 104,109 billion and 10 public issuances valued at VND 11,378 billion. Rated bonds accounted for 4.2% of total privately-placed bond value.

Market statistics show that private corporate bond issuances in June continued the pattern from May, with an emphasis on credit institution issuers.

In June 2024, Asia Commercial Bank (ACB) issued a VND 10,000 billion bond in two tranches of VND 5,000 billion each, with a 4.5% interest rate and a two-year period.

MBBank (MBB) raised VND 5,000 billion through three private issuances, with a 5.28% interest rate for the first two tranches totaling VND 4,000 billion and a 2-year term, and VND 1,000 billion for the last tranche with a 7-year term and an annual interest rate of 1.5%. If the issuer does not repurchase the bonds in accordance with the offering's terms, the interest rate will be the reference rate of 2.7% each year beginning with the 21st period.

Bac A Bank (BAB) additionally issued VND 1000, 500, 1000, 900, 600, and 500 billion, for a total of VND 4,500 billion, both privately and publically. Notably, Bac A Bank intends to offer 20,000,000 publicly issued bonds in the second round, phase 1, from late May to mid-June. Bac A Bank plans to issue six bonds over the next three years, totaling VND 9,000 billion at par value.

Additionally, institutions such as HDBank, OCB, BIDV, MSB, and Techcombank aggressively planned fresh issuances in June 2024.

Furthermore, the financial industry recognized Home Credit's need for money in the debt market, with a total issue of VND 1,300 billion, a 2-year term, and an initial 7% annual interest rate, with future periods at the Big4's average 12-month savings interest rate of 2.1% per year.

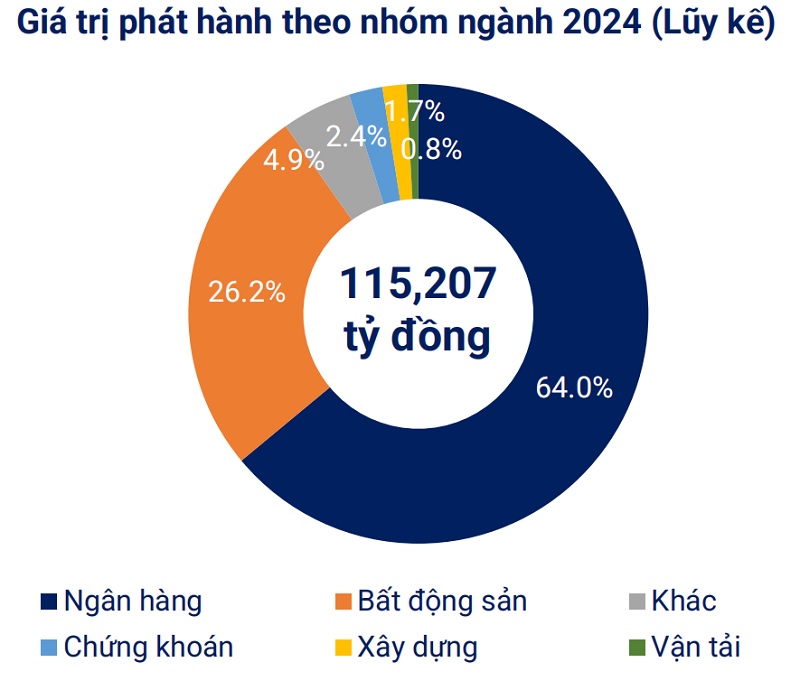

Issuance value by industry group (Source: VBMA)

The real estate industry saw fundraising efforts from IPA Investment Corporation, Trung Minh New Urban Area Corporation, Nam Long, Becamex IDC, and Khai Hoan Land.

In June, the VBMA revealed that firms repurchased VND 13,336 billion worth of bonds before maturity, a 68% reduction from the same time in 2023. In the second half of 2024, it is expected that roughly VND 139,765 billion in bonds would mature, with real estate bonds accounting for VND 58,782 billion, or 42%.

In terms of unusual information disclosure, two bond codes reported principal and interest payment delays totaling VND 980 billion in June, while 13 bond codes extended the payment period.

On the secondary market, the total transaction value of private corporate bonds in June was VND 99,469 billion, averaging VND 4,973 billion per day, a 12.1% rise over the May average.

Regarding planned bond issuances, VMBA stated that two firms will issue bonds. First, GKM Holdings JSC (HNX: GKM) authorized a private bond issue plan for 2024 with a maximum value of VND 44.9 billion. These are "three no's" bonds: non-convertible, without warrants, and unsecured but with payment assurances.

GKM's bond lot will consist of 449 bonds, each with a par value of VND 100 million, intended for debt restructuring. The bond has a 36-month period from the date of issue (Q2 2024). The issuer is APG Securities JSC (HOSE: APG). The estimated annual interest rate for the whole payment duration is 11%.

Furthermore, BIDV (HOSE: BID) authorized a private bond issuance plan for 2024 with a maximum value of VND 3,000 billion to be issued in up to five tranches (each tranche worth at least VND 50 billion). These are non-convertible notes with no warrants or collateral, each with a par value of VND 100 million and a period of 5-10 years, scheduled to be issued between June and the end of November 2024. The issuance's objective is to provide more money for lending to clients in the economy.

In addition, a number of issuers have made significant fundraising efforts. For example, VietinBank intended to sell 80 million bonds in two tranches at a par value of VND 100,000 each. These are non-convertible bonds with no warrants or collateral that fulfill the requirements for inclusion in VietinBank's Tier 2 capital under current legislative laws. The two tranches will have durations of eight and ten years, respectively, with variable interest rates (adjusted monthly) measured as a percentage every year. The interest rate on the 8-year term bonds will be equal to the reference rate of the interest calculation period 1.05% every year, while the 10-year term bonds will be equal to the reference rate of the interest calculation period plus 1.15% per year.

Over the next three years, VIS Rating anticipates the Vietnam banking industry to issue Tier-2 bonds totaling more than 283 trillion VND. State-owned banks will issue around 55% of the new Tier-2 bonds, while their Tier-2 capital will be drastically decreased.