Corporate bond maturities are under significant strain

In April 2024, the value of new delayed principal/interest payments for corporate bonds was low. Issuers repaid a portion of the bond principal.

According to VIS Rating, this was a bright spot of the corporate bond market in the first month of Q2 2024.

The corporate bond market in April showed more positive signs: New delayed principal/interest payments decreased; restructuring of delayed bonds stabilized; high-risk bonds reduced; new issuances increased

In particular, the rate of delayed bonds continued to fall, with only one bond delayed for the first time, valued at 47.3 billion VND and belonging to ADEC Joint Stock Company (JSC). This bond was issued in 2021 for 430 billion VND and is backed by shares and real estate assets of ADEC JSC's subsidiary, My Xuan Shipbuilding and Port Services Joint Stock Company. This issuer lowered the existing bond amount through several early redemptions and received bondholder approval to extend the principal repayment period by one year till April.

On April 10, 2024, ADEC JSC notified via HNX that it would be unable to settle the outstanding bond principal of 47.3 billion VND.

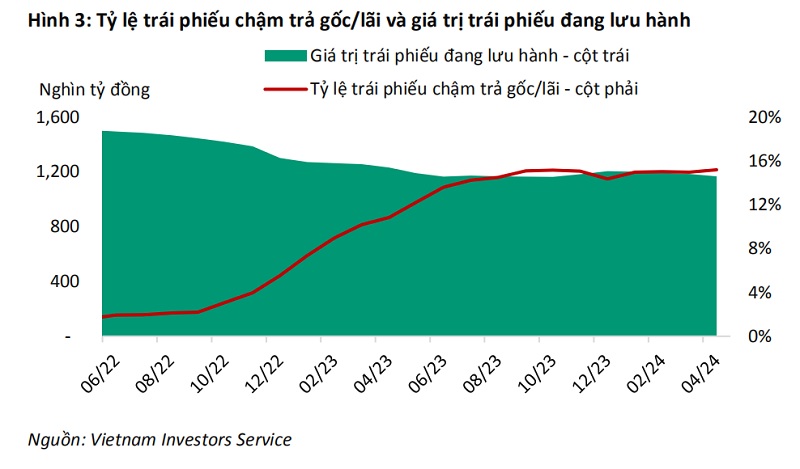

"At the end of April 2024, the market-wide delayed bond rate remained steady from March 2024, at 15%. According to the VIS Rating report, the residential real estate sector accounted for more over half of all delayed principal/interest payments, with a 30% delinquency rate.

In terms of debt restructuring, the residential real estate and construction sectors were both mentioned, with corporations partially repaying delayed debts.

In April 2024, Novaland Group transferred assets to partly repay bond obligation. Novaland transferred a portion of its project property rights to bondholders in order to repay 1.82 billion VND in principal from a bond series that had been delaying principal/interest payments since February 2023. We estimate the recovery rate of this bond series to be 25%, taking into account all payments made by Novaland following delayed principal/interest payments, as disclosed by senior analyst Nguyen Dinh Duy, CFA, Division Director.

Aside from Novaland, Saigon Glory, which has five bond series, S-Homes Real Estate Business Investment JSC, IMG Hue Investment JSC, Signo Land Company, and others were included in the group restructuring delayed bonds by partial payments. Notably, only one bond series of Novaland and two of Saigon Glory were backed by securities; the remainder were unsecured. Furthermore, TVSI provided advice on the majority of these firms' bonds.

VIS's aggregate data show that six issuers from the residential real estate and construction industries repaid a portion of their bond principal to bondholders. The overall payback amount was 21 billion VND, which accounted for 0.2% of the group's total outstanding bonds. After failing to repay the principal in 2023, most bonds' maturities were extended to the end of 2024 or 2025.

In May, VIS Ratings predicted that 28 bond series from 24 issuers totaling 15 trillion VND will mature. In May 2024, about 4.7 trillion VND, or 30%, was at danger of being delayed in repayment.

"Of the 4.7 trillion VND worth of high-risk bonds, around 4 trillion VND come from corporations that have deferred coupon interest payments in 2023. We believe that these issuers are very likely to postpone principal repayments due to poor cash flow and reduced cash reserves. The remaining 0.7 trillion VND in high-risk first-time delays come primarily from residential real estate issuers. Over the last three years, these issuers' average EBITDA margin has been less than 10%, if not negative, and their finances for debt repayment have run out", stated the VIS Rating report.

Within the following 12 months, nearly 19% of the existing bonds, worth 221 trillion VND, will maturity. Analysts believe that 10% of these are at high risk of first-time delays, especially in the residential real estate sector. At the end of April 2024, the market-wide recovery rate for delayed bonds was 13%, unchanged from the previous month.

The government reported on the execution of the 2024 socioeconomic development plan, indicating that financial and monetary markets, as well as the banking sector, remained risky; the bad debt ratio increased to 4.92% at the end of February.

Furthermore, the corporate bond market remained tough, with issuance volume in the first four months falling 43.4% from the same time in 2023; bond maturity pressure in 2024 was severe.

The National Assembly's Economic Committee reviewed this issue, noting that the financial and monetary markets still faced risks and challenges, with the bad debt ratio rising, forcing credit institutions to tighten lending controls to reduce risks (the average bad debt ratio in the commercial banking system at the end of February 2024 was 4.86%).

Regarding corporate bonds, the National Assembly's Economic Committee stated that the maturity pressure for corporate bonds was high, with the volume of privately issued corporate bonds maturing in 2024 around 300 trillion VND (the highest in the previous three years), with the real estate sector accounting for approximately 44.2%.

The National Assembly's Economic Committee stated that the corporate bond market had not fully recovered, with investors losing trust, putting further strain on debt payments for many maturing bonds, notably in the real estate industry, affecting business operations.