Controlling corporate bond maturity pressure

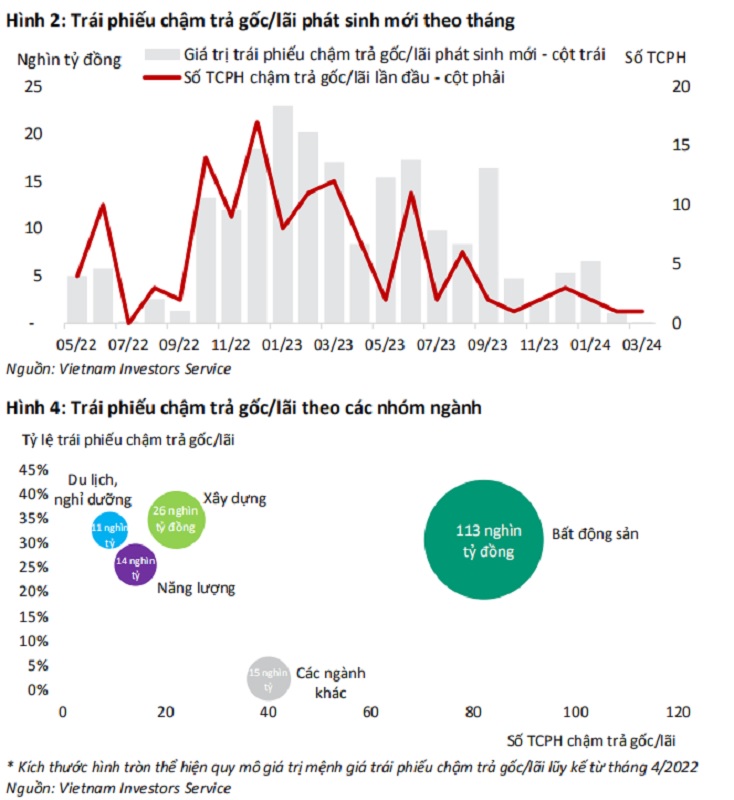

The Vietnamese corporate bond market is gradually showing clearer positive signals, especially as the rate of delayed bond repayments decreased in March compared to the previous month.

According to VIS Rating, in March 2023, the Vietnamese corporate bond market witnessed many positive developments thanks to an improved credit outlook, with new instances of delayed principal/interest payments decreasing, and an improvement in debt restructuring and new issuance values compared to February 2024.

The corporate bond market is becoming more positive. (Illustrative image)

Specifically, it was observed that the sole company with delayed bond repayment, worth 97 billion VND, was Thủ Thiêm Real Estate Investment and Business Company Limited. This bond lot, which had a face value of VND 1,000 billion, was issued in 2021 and was secured by many real estate properties from a Sunshine Homes project. VIS Rating data indicates that this issuer has a history of on-time interest payments and an early 90% principal buyback in October 2023.

A few previously delayed bond repayment enterprises have paid their bondholders. For instance, Hung Thinh Investment JSC paid the bondholder the entire principal balance of VND 2 trillion, increasing the rate of late debt recovery to 13% by the end of March 2024, according to Mr. Nguyen Ding Duy, CFA Director - Senior Analyst and partners in the Research Team of VIS Rating.

By the end of March 2024, the market-wide delayed bond payback rate remained at 15% from February 2024. The real estate industry accounted for over half of the delayed principal/interest bond repayments, with a 30.7% delayed repayment rate.

Additionally, experts predict that the April 2024 maturity date of high-risk bonds will have a lower value than the 2023 monthly average. More specifically, compared to March 2024, it is predicted that 10% of the bonds due in April 2024, or around 3 trillion VND, are high-risk. 15% of the 235 trillion VND worth of business bonds that will expire over the course of the next 12 months are high-risk, the analysts noted.

According to a different calculation, bonds worth over 135,000 billion VND are expected to mature in the real estate industry alone in 2024. If the VIS Rating projects that 15% of corporate bonds are high-risk, the value would be around 35,250 billion VND.

In contrast to bond data from issuers that will not have made their payments by the end of 2023, this rate is thought to be rather low. The Real Estate group continued to hold the greatest share, accounting for 70% of the delayed payment value, while MBS estimated at the time that the entire value of corporate bonds with delayed payment obligations was around 192.6 trillion VND, or roughly 19% of all market debt.

The pressure on bond issuers to pay off maturing bonds is therefore extremely high in the upcoming year, even "tighter" than in 2022–2023, but on the plus side, the market is starting to feel more confident as many issuing businesses are still making timely payments, building their credibility, repurchasing bonds before they mature, and making up for previously delayed bonds. In addition, the real estate market is progressively rebounding and market information is becoming more clear and transparent—all of which are seen as critical components of the market's recovery.

According to the Maybank Investment Bank (MSVN) study team, the value of new issuances was much greater in March 2024 as compared to the prior month.

MSVN stated, citing statistics from HNX, that in March 2024, the corporate bond market had 11 issuance deals totaling 10.8 trillion VND, with interest rates varying between 6.2% and 12% annually. In particular, the value of the issue in March was only around one-third of what it was in March 2021–2023, but it was still far better than it was in the previous two months (January: 2.15 trillion VND; February: 2.165 trillion VND).

Nonetheless, the market witnessed 18 new bond issuance lots by 15 companies at the end of the first quarter of 2024, with a value of 18.75 trillion VND, a 36% decline from the same time the previous year. With issuance value accounting for almost 55% of the total value, the issuers were mostly real estate development firms, followed by financial services (8%), construction and building materials companies (24%) and construction companies.

In the context of increasingly unfrozen credit capital and firms considering capital absorption, this is explained by the cautious approach to fundraising requirements and the capacity to arrange cash in the debt capital market.

The MSVN analytical team anticipates that the next issuance period will be more favorable because of low interest rates, a more stable macroenvironment, and market participants getting used to the new restrictions.

With 42% of bonds going to real estate development enterprises in the final nine months of 2024, the strain of bond maturity is anticipated to be manageable at the same time.