Breaking hurdles to corporate credit

Despite enormous efforts by the banking sector to encourage credit growth, corporations continue to face severe barriers to accessing bank loans.

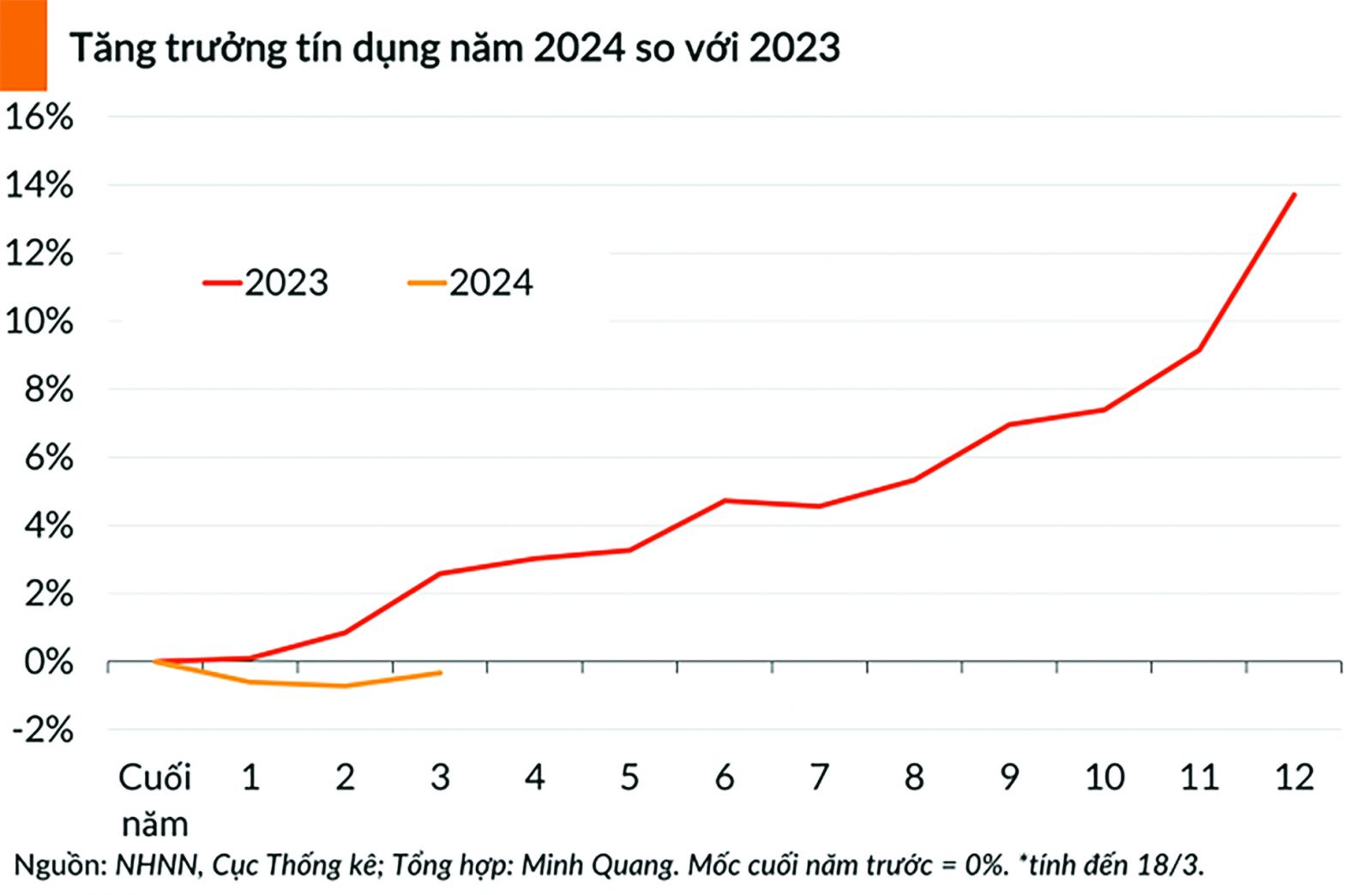

In the first quarter of 2024, the Vietnam banking system experienced two months of negative credit growth and only one positive month, with growth reaching 0.91% at the end of March 2024.

Credit Still Faces Barriers

The banking sector expects credit growth of 3.8% in the second quarter of 2024, which would be a significant increase from the previous quarter, based on the recovery of capital demand and a business environment with historically low-interest rates.

However, according to Mr. Phung Xuan Minh, Chairman of the Board of Saigon Ratings, the aim of 15% credit growth remains quite high for this year. Mr. Minh stated that loan growth is modest, owing to four major factors:

First, because enterprises seldom receive new orders, there is minimal demand for further cash. Second, while policy interest rates and deposit rates have fallen, lending rates have not declined proportionally. Third, market challenges have influenced lending demand in the real estate industry. Fourth, financial institutions are wary of growing outstanding debts as the ratio of non-performing loans continues to climb.

According to Ms. To Thi Tuong Lan - Vice Secretary-General of the Vietnam Association of Seafood Exporters and Producers (VASEP), small and medium enterprises are borrowing at common interest rates of 6-7% per year. For smaller businesses without collateral, the rates are around 8-8.5% per year.

A survey by the Ho Chi Minh City Business Association (HUBA) shows that up to 41% of businesses no longer have legally sufficient collateral to borrow funds. Meanwhile, the valuation of agricultural land is very low, and yearly leased land cannot be collateralized; other assets are downgraded as inflation increases.

Moreover, the real estate market's decline (except for the condominium segment) has caused many businesses to struggle to supplement assets to meet the values previously accepted by banks as collateral when these assets depreciate.

"Banks are also pushing forward with lending, but small and medium enterprises cannot access these funds because they do not meet the collateral requirements or other borrowing conditions," said Mr. Tong Phuoc Thanh - General Secretary of HUBA.

Necessary Solutions

According to HUBA, for credit promotion programs to be effective, banks should consider increasing the collateralization ratio of these assets and expanding contract-based lending, including future assets and rights.

Banks could be flexible and proactive in advising businesses on how to secure loan funding based on contracts and future revenues. Photo: C.T.

Furthermore, Mr. Nguyen Le Ngoc Hoan, a financial specialist, believes that when the market progressively recovers, banks should not devalue secured assets, but rather retain their values and ask companies to replenish them.

On the other hand, for new loans, banks may be more flexible and aggressive in advising firms on how to acquire loan funding based on contracts and projected income. To achieve this, enterprises must enhance market access, create goods, and promote commerce in order to win particular contracts and orders.

"From hardship springs wisdom" – sometimes to increase market access, businesses also need to have working capital. Nowadays, it is not uncommon for businesses to have significant total debt, with most operating expenses needing to be proposed through the bank for approval to be paid from the loan account to "move forward." Accordingly, the more difficult it is for a business, the more it must prioritize filtering and cutting unnecessary costs, which cannot be immediately monetized, but at the same time, it must also prioritize filtering for the bank to finance short-term investments that can secure contracts and stimulate the market. Based on this, businesses can be approved for larger loans based on contracts.

The issue of businesses running out of assets to use as collateral and the decreasing value of secured assets, which requires real compensation plans, occurs not only with bank credit but also on the debt capital market. However, Mr. Nguyen Le Ngoc Hoan emphasizes that for businesses that can raise funds without assets, if they have a strong business foundation, the debt capital market remains a venue for them to explore issuing securities.

Emphasizing solutions to seek preferential capital sources, Mr. Nguyen Quang Thanh, Deputy General Director of HFIC, said that for projects and businesses "hitting" priority sectors in Ho Chi Minh City, they can access capital from HFIC and HUBA programs. These programs allow a maximum loan of 200 billion VND per project, with the city budget supporting 50%, 100% of the interest, depending on the sector. The support period is up to 7 years. "Although the conditions for accessing capital are strict, any business can learn about and contact us for advice to seize the best opportunities," the HFIC representative stated.