Car loans during the pandemic: Easy to borrow but difficult to repay

Car loans are considered a potential credit segment of many banks. But under the impact of the Covid-19 pandemic, banks were anxious because it was difficult for customers to repay loans while collateral assets were difficult to liquidate.

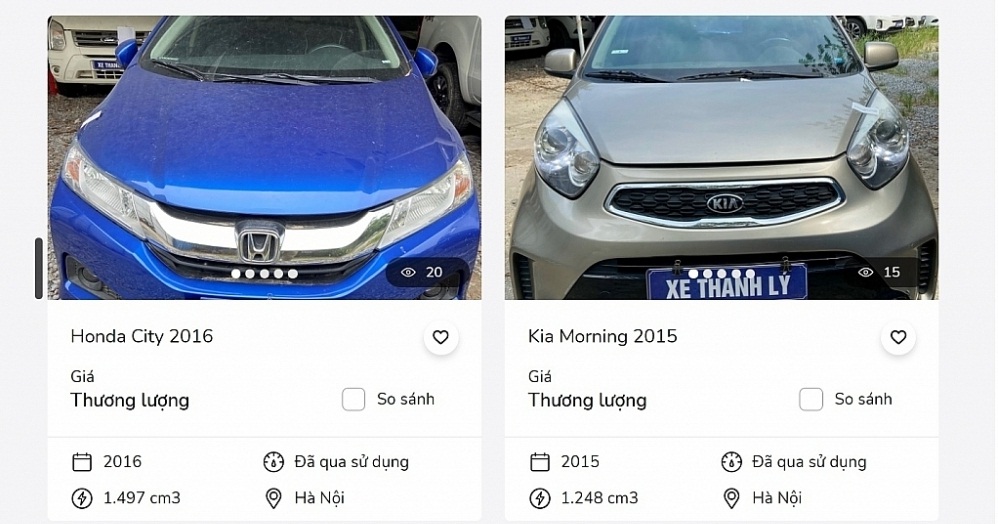

The bank constantly sells liquidated assets such as cars

Low interest rate, quick disbursement

In the past few years, consumer credit has been the growth engine of many banks, including the car loan segment.

In fact, the need to own a car is increasing, but because the value of a car is too high, people often choose to borrow more from a bank. According to statistics of auto dealers, about 50% of car buyers need to pay in installments. Therefore, banks have launched a series of incentives on interest rates, loan terms, loan procedures to attract customers.

Currently, the five banks that hold the largest market share in auto loans are VIB, Shinhan Bank, Techcombank, VPBank and TPBank. The initial fixed interest rate that many banks are applying currently ranges from 6.99-11%/year, depending on the loan term and the preferential mechanism of each bank.

Typically, BIDV offers a car loan interest rate of 8%/year. The loan period lasts up to seven years, supporting up to 100% of the car value. TPBank supports customers who need a car loan with a term of up to 72 months, a fixed interest rate in the first six months of only 6.8%, a fixed interest rate of 8.9%/year.

Meanwhile, Techcombank accepts loans to buy new and used business vehicles (with a usage period of up to three years) with a fixed interest rate from 8.29%/year for the first six months with a loan limit of up to 70% of the value of collateral.

Not only preferential interest rates, but many banks also provide fast disbursement services.

For example, VPBank provides the car loan market with a loan package with the outstanding advantage of disbursing within four hours after the customer submits a complete application.

The car loan interest rate at VPBank is only 9.49%/year with a maximum loan term of up to 84 months (seven years), the collateral is the purchased car or real estate, the loan limit is up to 80% of the car value (up to VND4 billion) and free early repayment from the 2nd year of the loan.

Out of money to pay the debt

At the beginning of 2020, Mr. Nguyen X.D. (Cau Giay, Hanoi) borrowed money from a bank in the form of installments to buy a car with a value of nearly VND600 million to register to drive a taxi.

Therefore, every month, Mr. D. must pay the bank VND10 million, both principal and interest.

However, due to the impact of the Covid-19 pandemic, Mr. D.'s income decreased, and the monthly debt payment became extremely difficult. Mr. D. said that from the beginning of 2021, he was no longer able to repay the debt, so the bank had taken back the car as collateral.

In fact, in the first quarter of 2021, the bad debt ratio of many banks has increased. Experts of VCBS Drilling Securities said that although the car loan product incurs a higher bad debt ratio than the home loan product. However, profits are still high when the bank requires higher interest rates to offset the costs incurred. Moreover, collateral is a car which is also easier to recover than real estate when customers need confirmation from the bank for annual registration.

In addition, a leader of a commercial bank said that facing the common difficulties of many customers in the context of the pandemic, the bank has restructured loans for some car loan customers in the direction of extending debt or reducing the monthly repayment, extending the loan period to match the current income of the customer. In cases where it is deemed that they are no longer able to pay, and there is a risk of capital loss, the bank will recover the assets and liquidate them to handle the debt.

However, in the current context, the liquidation of collateral assets such as automobiles is facing many difficulties. According to experts, the market is quiet, plus many people and investors also have difficulty in cash flow, so it is difficult to perform transactions. The selling price offered by the bank is the starting price, the winning price may be higher, the buyer is not supported in installments because it is the main liquidation asset, so the customer is less interested in it.

In addition, many people are still afraid of buying a liquidated car because they do not understand the procedure for transferring the name as well as issues related to the bank.

According to a representative of a bank in Hanoi in charge of managing assets and debts recovered since the beginning of the year, the number of recovered cars from customers has increased rapidly. The bank collected hundreds of cars but did not liquidate much, causing the bank's parking lot to be full, many cars were broken, there were many cars that were auctioned 4-5 times but no one bought them, even though each auction decreased 5% in price, on the 4th time the price dropped 20% from the original valuation.

A survey on the information pages of some banks showed that, from 2020, the number of cars for sale and liquidation by banks has increased.

At TPBank, from the beginning of June until now, this bank has issued 10 notices to select an asset auction organization that is a variety of vehicles with different prices.

VPBank since the beginning of June has also announced 44 cars for sale, with a starting price of VND240-400 million. As for VIB, from the beginning of the year, hundreds of cars have also been sold, liquidated, auctioned by the bank, many of which have a starting price of more than VND160 million.

Credit activities in the context of the Covid-19 pandemic still face many difficulties. Therefore, banks recommend that borrowers need to balance their debt repayment ability, carefully read the terms of interest rates to borrow and repay. As for banks, the supervision and monitoring of credit activities needs to be enhanced, especially in consumer loans to avoid the risk of bad debt.