China’s re-opening: A boost for tourism

Sunday 8 January marked China’s long-anticipated re-opening. Above all, the most direct impact is on ASEAN’s sizeable tourism sector.

Sunday 8 January marked China’s long-anticipated re-opening.

>> China reopening will boost Vietnam’s GDP by 2% pts in 2023: Vinacapital

After two years of hardship, ASEAN has made substantial progress to lure back tourists, with the last border restrictions and quarantine requirements removed in March/April 2022. Tourist arrivals in 2022 rebounded to 25-30% of 2019’s levels, a significant jump from only 1% in 2021. Thailand has regained the crown as the most popular destination in the region, attracting around 11 million tourists.

When it comes to specifics, intra-ASEAN tourism was the primary driver of the tourism recovery.Malaysia saw an 80% recovery as of 3Q22 (though a lion’s share came from Singapore). Tourists from the US, EU and the rest of Asia recovered to around 15-35%, showing there’s room for improvement. That said, the elephant in the room was that tourists from mainland China were not able to return in the past three years. In 2022, the number of mainland Chinese tourists only accounted for 1-3% of those in 2019, leaving a huge hole to fill. "Mainland Chinese tourists alone account for a large share of tourism across much of ASEAN, in particular in Thailand and Vietnam, each with around 30% share in normal times", said HSBC.

As a result, though the extent varies across the region, mainland China should provide a powerful boost to ASEAN's tourism sector. Thailand no doubt is a notable beneficiary, as Chinese tourists not only accounted for the largest share, but also were the biggest spenders per capita. Recall that tourism receipts represented close to 12% of Thailand’s GDP, of which 3ppt came from mainland China alone. After China’s decision to lift all quarantine restrictions, the Tourism Authority of Thailand forecasts a return of at least five million Chinese tourists, lifting its total tourist projection to 25 million in 2023 – 60% of 2019’s level.

Indeed, shortly after China’s announcement, outbound ticket bookings to Thailand surged by 400% on Trip.com, making Thailand one of the top five popular destinations among Chinese travelers. HSBC estimated that if Chinese tourists would return to their pre-pandemic levels and spend all their money on locally-produced goods, Thailand could add a maximum of 1.8 percent to GDP growth, a hefty boost to the economy.

Elsewhere, China’s re-opening will also meaningfully boost Vietnam’s tourism revival, as it is similar to Thailand, where Chinese tourists used to make up c30%. While Vietnam’s economy is not as heavily dependent on tourism as Thailand's, the significance of the sector to its job market cannot be underestimated. In Vietnam, around 25% of the workforce works in the food, beverage, and accommodation-related sectors. In fact, the proportion of broader tourism-related employment is the lowest in Vietnam, with the share significantly higher in the Philippines, Malaysia, and Indonesia. This also partly explains why the labor market recovery has not yet reached pre-pandemic levels in some markets. For example, Indonesia’s tourism sector lost 1.4 million jobs in two years. Moreover, we also need to consider the sheer size of ASEAN’s informal labour market. Vietnam’s informal job market is even more sensitive to tourism, such as for those working in restaurants and entertainment.

Even for Singapore, which is not as heavily reliant on tourism per se, China’s border re-opening will support its MICE sector (i.e. meeting, incentives, conferences, and exhibitions) along with the aviation industry. Changi Airport fell from the world’s 7th busiest airport in 2019 to 58th in 2020. However, thanks to Singapore's push for re-opening, the airport will have reached 75% of its pre-pandemic weekly passenger traffic by the end of 2022, with the remaining lag caused by a lack of visitors from mainland China.

The Philippines will also benefit, but the return of Chinese tourists should only give a small boost when we weigh the tourism recovery against GDP. If all of what tourists spend goes toward locally produced goods, we estimate that the return of Chinese tourists to pre-pandemic levels will only add a maximum of 0.4ppt to growth.

>> Hanoi eyes tourism breakthrough in 2023

In addition, the continuation of a strong recovery in tourism should also bring benefits to ASEAN’s current account position: Indonesia and Malaysia have been handsomely benefiting from high global commodity prices, whereas Thailand and Vietnam suffered from sizeable current account deficits due to a collapse in tourism receipts. In the case of Thailand, the current account briefly swung back into a surplus in October, thanks to an influx of tourists, but it came too late and was too small to reverse the deep deficit for most of 2022.

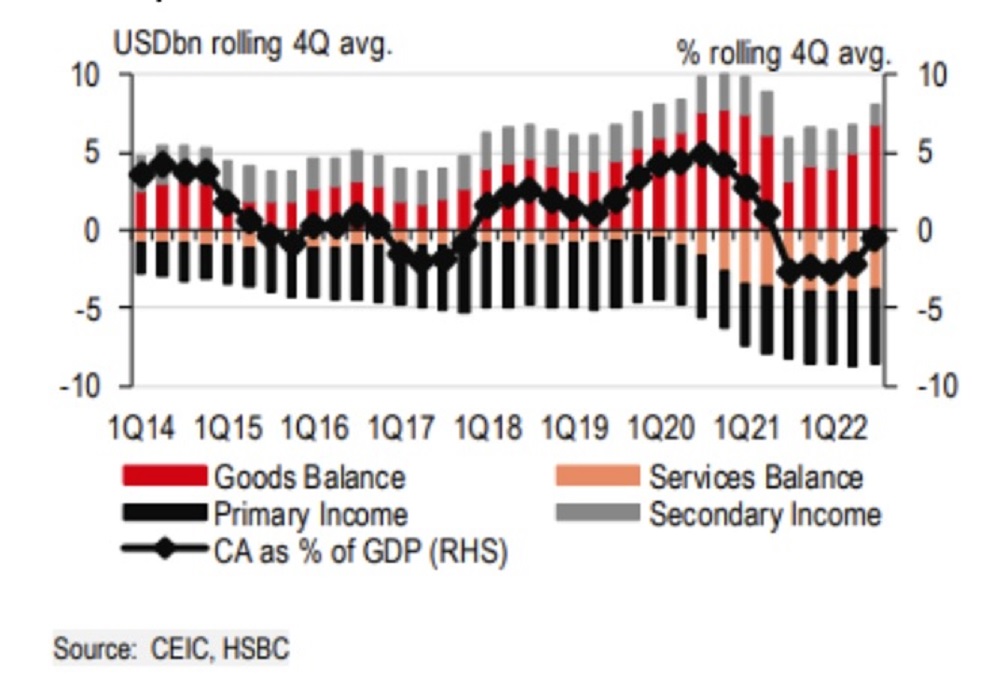

Vietnam also saw c/a deficit, albeit small, due to a lack of tourists

In Vietnam, its larger service deficits, a result of a lack of tourism receipts, have been a major drag on the country’s current account. More tourist receipts will thus provide further FX inflows and reduce Vietnam’s services deficit, though HSBC expects only a small rebound in 2023e.

And while there’s light at the end of the tunnel for tourism, uncertainty around regional tourism remains. How quickly Chinese tourists will return depends on several factors, such as how quickly international flights will be restored and when travel will be normalized. While the long-awaited reopening started on January 8, the rapid surge in COVID-19 cases prompted some countries, including the US, EU and Japan, to re-introduce testing requirements for travelers from mainland China. Although no ASEAN countries have followed suit, many are watching the evolution closely.