Did gold prices bottom out in the short term?

The gold market is stumbling into this weekend once more after suffering an almost 4% decline as a result of the sell-off in gold. Will gold prices drop next week?

The price of SJC gold has also decreased on the Vietnamese gold market, from VND 68.85 million per teal to VND 68,25 million per teal.

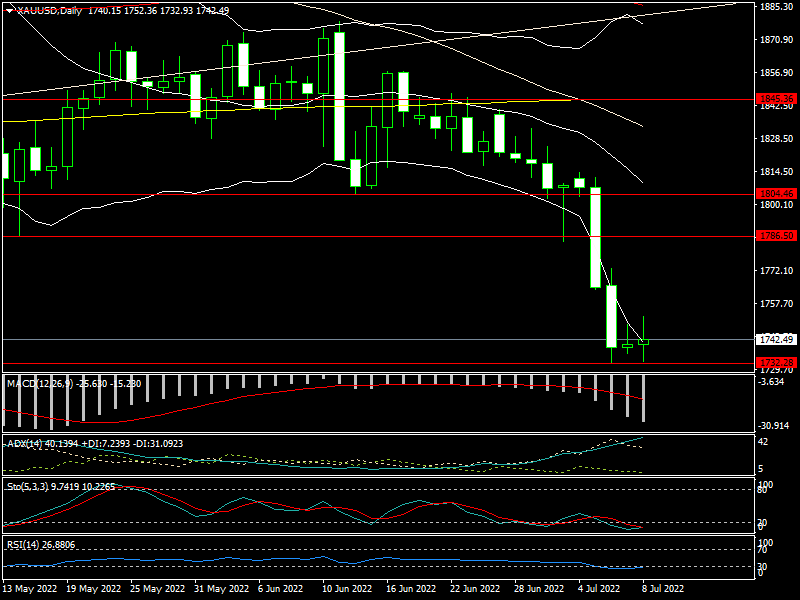

The price of gold fell from $1,811 per ounce to $1,732 per ounce on the global market before closing at $1,742 per ounce.

The price of SJC gold has also decreased on the Vietnamese gold market, from VND 68.85 million per teal to VND 68,25 million per teal. Due to the continued large premium between the price of gold in SJC and that in global gold price, there is little demand for SJC gold.

The price of gold has decreased for several reasons. First, the Federal Reserve (FED) will continue to rapidly hike interest rates, which is the largest challenge the precious metal confronts.

Markets had anticipated that the Federal Funds rate would increase by an additional 75 basis points later this month. These predictions have increased bond yields back above 3 percent and drove the U.S. dollar to a 20-year high.

Little stands in the way of FED's robust stance against inflation. Fears of a recession were reduced on Friday when data from the US economy revealed that 372,000 new jobs were added in June, above predictions.

Even while worries haven't totally disappeared despite a minor decline, FED will continue to work to manage inflation despite this. FED's June monetary policy meeting minutes, released this week, show that the FOMC anticipated potential credibility problems.

Second, India, the second-largest consumer of the precious metal, has increased its basic import duty on gold from 7.5 percent to 12.5% in an effort to reduce the trade deficit. Such an action would reduce the need for physical gold.

In actuality, this has been a poor season for physical gold demand. The physical market appears to be getting priced out of reach for individual investors. According to U.S. Mint data, only 44,000 ounces of gold were sold in June, down 76 percent from the same month previous year. The unexpected decline occurs despite a strong bullion demand for the majority of the year.

Gold prices may be vulnerable between $1,650 and $1,675 because that's where purchasers tend to go back.

Some analysts claim that the physical gold market's supply/demand imbalance is what keeps premiums high. Lower prices, according to analysts, might rebalance the market.

Third, while gold had a bad week, oil had a worse one, momentarily falling below $100 per barrel. Although oil has partially rebounded, the market may find it difficult to maintain current levels if a recession is on the horizon. Due to concerns about the recession, gold will probably trend lower along with crude oil prices until oil prices stabilize and the downtrend is broken.

More negative risk is anticipated for gold, according to analysts, who note that prices might touch $1,700 and possibly even $1,650. But with investors likely returning to the metal at those prices, that low will probably stand as the bottom for prices.

Edward Moya, a senior market analyst at OANDA, said: "The selling pressure was intense this week once $1,800 was broken. What more can we expect to see? Still keeping an eye on a market where gold may be exposed to a $1,700 test. If things turn bad, gold prices may be vulnerable between $1,650 and $1,675 because that's where purchasers tend to go back. Gold is susceptible to this fall. That is the crucial stage. The important gold resistance level to the upside is $1,770".

US inflation report in June will be the only data point to pay particular attention to the next week. According to market predictions, the U.S. annual CPI will increase from May's 8.6 percent pace to 8.7 percent. "A stronger CPI reading should confirm market predictions of a 75 bp Fed rate hike at the FOMC meeting on July 27. The market has firmly priced it as well as a further 50bp for September ", said Chris Weston, head of research at Pepperstone.