Did gold prices bottom out?

The possibility that the Fed will continue to raise rates may cause the price of gold to fluctuate next week.

SJC gold bar price has been almost flat this week.

The price of gold fell further this week, reaching USD 1,640/oz and closing at USD 1,645/oz. SJC gold bars were selling for between 66.45 and 66.60 million dong per tael on the Vietnamese gold market, with very little trading activity.

When the Fed increased interest rates by 0.75% this week, gold prices didn't decline significantly since the rate hike was already factored into gold prices last week.

Although inflation has decreased for two months in a row and the US economy is technically in a recession, the Fed confirmed that it will continue to hike interest rates at its next meetings. The Fed increased its funds rate to 4.4% at the end of 2022 and to 4.6% in 2023 after hiking rates by 75 basis points for the third consecutive time. This might result in another 75-basis-point increase for markets in November and a further 50-basis-point increase in December.

FED’s rate hile not only help real rates, but also shock financial investors' mentality, which led them to keep offloading safe assets like gold…

However, a lot of experts think that the FED might keep making policy errors while accelerating rates. Since cost pushing was primarily responsible for the sharp rise in inflation, the Fed's sharp increase in interest rates not only made it challenging to reduce inflation, but also led the US economy to contract even more rapidly. The Fed previously erred by assuming that inflation was only temporary and was not in a rush to hike interest rates. To make up for this error, the Fed is now quickening the pace of monetary tightening.

The US economy is also more precarious now than it was in the 1970s. In the 1970s and the early 1980s, its public debt to GDP was a small portion of what it is now, around 30 or 40 percent. It currently ranges from 120 to 130 percent. The ability of the US Treasury to service its debt could be hampered if the Fed were to raise interest rates.

Mr. John Hathaway, Senior Portfolio Manager at Sprott Asset Management, said "Every 1 percent rise in the interest rate paid on that $30 trillion of debt adds $300 billion to the budget deficit. There are real constraints.

The possibility that the Fed will continue to raise rates may cause the price of gold to fluctuate next week.

Many economic data, including durable goods orders, consumer confidence, personal consumption expenditures (PCE), and revised Q2 GDP, will be made public in the US throughout the course of the upcoming week. In which, the market pay the closest attention to the revised Q2 GDP statistics. The likelihood of a FED rate hike and the price of gold next week won't be impacted if this data remains negative by 0.9%. The FED might reconsider the next rate hike if Q2 GDP is negative by more than 0.9%, which would be good news for gold prices nex week. The price of gold will continue to decline the next week even if the second quarter's GDP is negative by less than 0.9%, as the FED is expected to keep raising interest rates sharply.

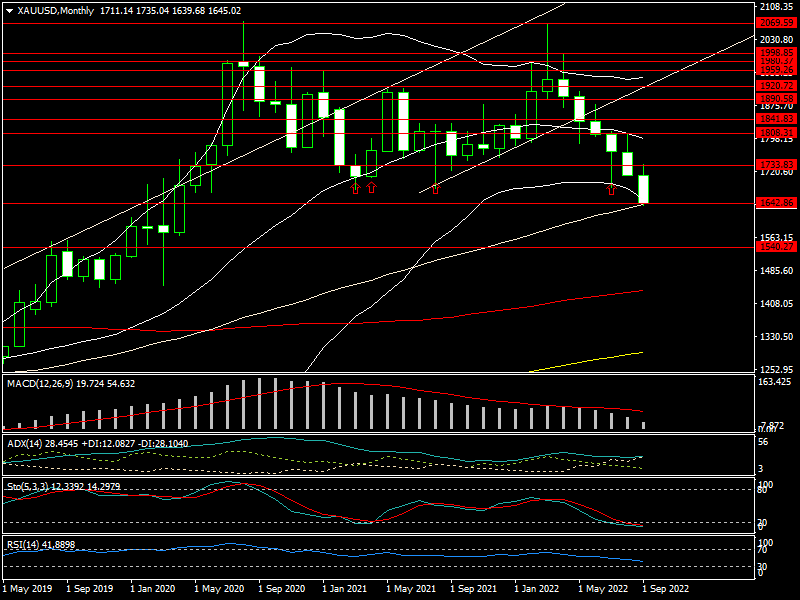

The monthly chart's MA50 was touched by the gold price this week at $1,640/oz, according to technical analysis, before a minor recovery. In the current technical setting, this level is crucial. Gold price next week may challenge the $1,600/oz zone and further to $1,540/oz if it fails to hold above this level. The price of gold will continue to rise back to the $1,696–1,731/oz if it closes above this level again the following week. Because some indicators, including the Stochastic and RSI, have entered the oversold zone, the technical recovery scenario is highly valued.