Draft law to raise LNG power offtake guarantees will help unlock new investments

The Vietnamese government is drafting a new law to raise the guaranteed offtake (Qc) for LNG power from 65% to 75% of the annual electricity output of LNG projects.

A LNG project in Vietnam

This move is designed to strengthen investor confidence and speed up the signing of new Power Purchase Agreements (PPAs). If approved, the new policy will build on recent reforms, helping to secure financing and accelerate the execution of LNG projects. The urgency is clear. Currently, nearly a quarter of the 21 LNG projects in Vietnam’s Power Development Plan 8 (PDP8) lack investors, and over half face construction delays. Beyond offtake negotiations, progress hinges on resolving complex infrastructure bottlenecks - particularly LNG seaport terminals and grid transmission. VIS Rating expects these constraints to be eased once the new provincial governments become fully operational from Q4/2025.

Recent policy changes have improved the investment landscape for LNG power projects. Decision 1313/2025 issued in May 2025 sets an annual ceiling price for LNG power generation, providing investors with a transparent benchmark for PPA negotiations with Vietnam Electricity Corporation (EVN) - the main offtaker. Decrees 56 and 100/2025 further de-risk projects by allowing fuel price pass-throughs and guaranteeing a Qc of 65% of annual power output for 10 years. These reforms have already catalyzed substantial investments: in Q3/2025, POW secured VND 7.3 trillion in new equity and a VND 2 trillion credit line for Nhon Trach 3&4 project, while Vingroup injected VND 10 trillion into VinEnergo for the Hai Phong project.

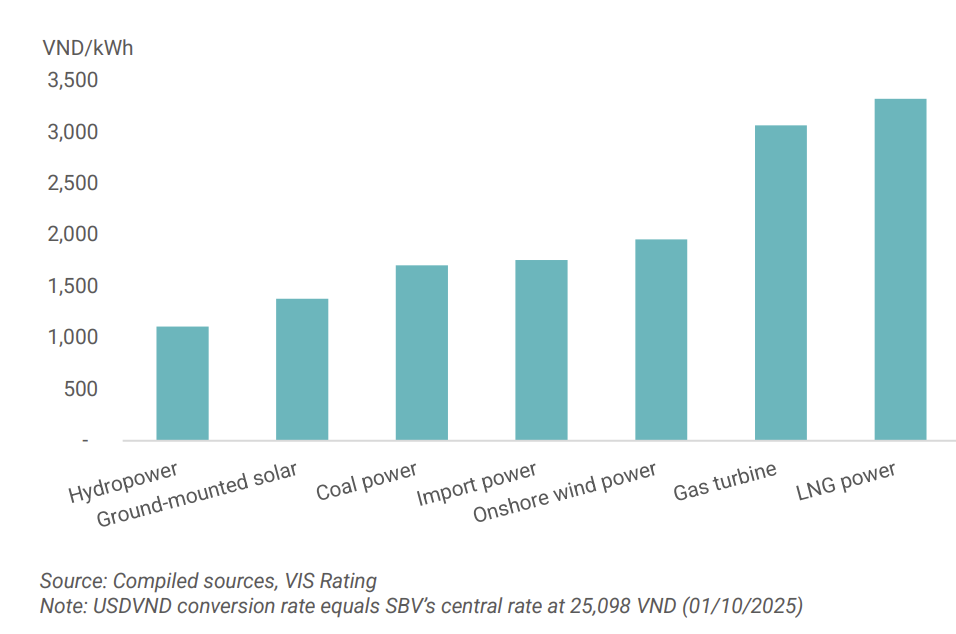

Further enhancements of offtake guarantee will boost investor confidence and unlock greater LNG investment. Under current ceiling price regulations, LNG power remains more expensive than coal, hydro, solar, and natural gas (Exhibit 1), limiting its competitiveness in Vietnam’s wholesale electricity market (VWEM). The upcoming National Assembly resolution proposes to raise Qc to 75%, yet some investors are seeking even stronger terms—such as extending guarantees to 20–25 years—to improve cash flow certainty and project profitability.

Ceiling electricity selling price of LNG power is the highest among power sources, making it less competitive in VWEM.

“We view that Vietnam’s 75% Qc policy proposal is both attractive and pivotal for accelerating new investments, as no other ASEAN market offers comparable incentives. Moreover, investors retain flexibility to negotiate higher offtake commitments with EVN under PPAs, strengthening the investment proposition”, VIS Rating said.

Infrastructure and regulatory bottlenecks remain major hurdles for LNG power projects in Vietnam, delaying timelines and constraining project viability. Most projects require integration with LNG seaport infrastructure (Exhibit 2), adding significant complexity to master planning and permitting. Consequently, projects such as Hai Lang 1, Quang Ninh, and Ca Na have been held up by local planning revisions, land clearance issues, and the lengthy handover process for land and marine areas. Additionally, grid transmission planning and construction lag in several provinces, further limiting project progress. VIS Rating expects these bottlenecks to ease gradually as newly provincial authorities become fully operational from Q4/2025.

Vietnam’s PDP8 positions LNG as a strategic pillar for energy security after 2030, requiring accelerated project development and access to new financing from 2026 onward. Vietnam targets 25,600–36,000 MW of LNG power capacity by 2030–2035, equivalent to over 10% total of national capacity (Exhibit 3), up from zero before 2025.

Given typical construction timelines for LNG power projects of 4-5 years and current policy incentives will require projects to begin commercial operation before 2031, VIS Rating expects project development to accelerate from 2026 onward. Financing will follow a typical 30:70 equity–debt structure, driving strong bank loan demand as projects improve bankability and advance toward PDP8 milestones.