Economic growth scenarios ahead of tariff negotiation outcomes

According to Ms. Bùi Thị Thao Ly, Head of Research and Analysis at Shinhan Securities Vietnam (SSV), based on recent government dialogues and actions, it is expected that Vietnam will reach a tariff agreement in the range of 10% to 20%.

The Shock of U.S. reciprocal Tariffs

On April 2, 2025, the United States unexpectedly announced reciprocal tariffs on over 180 countries, sending global financial markets into turmoil. Stocks plummeted due to panic selling, while gold prices surged amid recession fears.

Exports to the U.S. remained the main driver of Vietnam's exports in May, as many experts had predicted an export acceleration ahead of the 90-day deadline.

Among the affected countries, 57 with which the U.S. has a trade deficit were subject to high tariffs of up to 50%. Unfortunately, Vietnam was hit with a 46% tariff—one of the highest rates.

The Trump administration accused U.S. trade partners of unfair practices, including tariff barriers and other trade restrictions, which have weakened U.S. manufacturing capacity and increased dependence on imports. As the world’s largest importer and holder of the biggest trade deficit, the U.S. faces rising public debt. The imposition of countervailing tariffs aims to reduce the trade deficit and bring manufacturing back to the U.S.

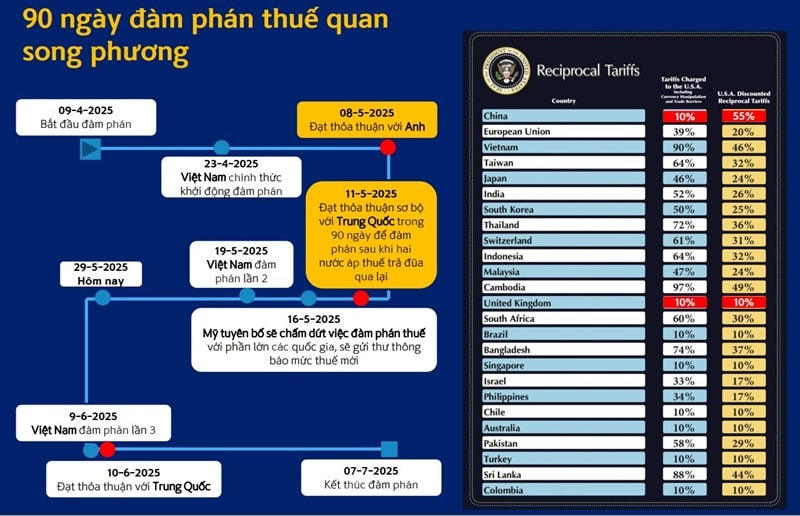

In response to the global market shock, the Trump administration later postponed the implementation of the higher tariffs for 90 days, with negotiations beginning on April 9, 2025.

90 Days of Bilateral Tariff Negotiations

The U.S. has so far reached agreements with the U.K. and China. Vietnam officially began negotiations with the U.S. on April 23, and there have been positive developments in two detailed negotiation rounds in May and June.

Regarding bilateral negotiations between the U.S. and its partners, it should be noted that the President has the authority to determine the negotiation content and impose tariffs on imports from countries with disproportionate tariffs—without needing Congressional approval, under the U.S. Reciprocal Trade Act. As a result, the content of these negotiations is confidential, and countries willing to offer favorable terms may secure lower tariffs, even below the 10% general rate.

The 90-day negotiation window will close on July 7, after which the U.S. will send official tariff notifications to countries that haven’t reached an agreement. There is strong hope that Vietnam will secure a favorable deal with the U.S. in the coming days.

The U.S. remains a critically important partner for Vietnam, with the trade surplus reaching a record high of $106 billion in 2024—equivalent to 22% of Vietnam’s GDP.

SSV conducted an analysis of the major trade goods between Vietnam and the U.S. and estimated average tariff levels by product group. Vietnam currently imposes higher tariffs than the U.S. on traditional exports such as apparel, footwear, and seafood, with differences ranging from 6% to 10%. These are sectors where the U.S. lacks a competitive advantage, and Vietnam imports little from the U.S. in return. However, for automobiles and spare parts, Vietnam’s tariffs are significantly higher. If Vietnam reduces auto import tariffs from the U.S. from 65% to 0%, U.S. cars would become much more competitive than ASEAN counterparts—benefiting Vietnamese consumers.

Given that U.S. and Vietnamese goods are largely non-competing, and the U.S. aims to boost chip and defense manufacturing—rather than footwear or garments—there is strong belief that a positive agreement can be achieved.

Based on recent government dialogues and actions, there is optimism that Vietnam will secure a lower tariff rate than the initial 46%, potentially between 10% and 20%.

In return, Vietnam would need to:

- Ensure a sustainable trade balance by increasing imports of U.S. strengths.

- Guarantee product origin as “Made in Vietnam,” and address intellectual property and copyright issues.

- Create a favorable investment environment for U.S. businesses in Vietnam.

Impact of reciprocal Tariffs

Regardless of the scenario, the impact of tariffs on Vietnam’s economy is inevitable.

According to the IMF, U.S. countervailing tariffs could reduce global trade growth by 0.2 percentage points and global GDP growth by 0.8 points. Vietnam will likely be more severely affected, given its highly open economy, with trade equivalent to 165% of GDP. Importantly, both the U.S. and China—central figures in the tariff dispute—are Vietnam’s largest trading partners.

Vietnamese exports will face direct pressure, with the U.S. accounting for 30% of total export revenue. While electronics and machinery (over 90% of which are produced by FDI firms) dominate, sectors such as seafood, garments, and wood products—where local firms are active and labor needs are high—will also suffer.

FDI companies contribute over 70% of Vietnam’s export value. As exports decline and FDI weakens, industrial parks will be affected. The incomes of over 3.7 million industrial workers could decline, weakening consumer sentiment and impacting domestic sectors like retail and real estate.

In the event of a trade war, loans to exporters, individuals, and SMEs are at risk, potentially increasing non-performing loans for banks.

The garment sector is expected to face significant challenges, with the U.S. accounting for 43% of its market. Meanwhile, 65% of input materials are imported—mainly from China.

Textile firms will need strategies to increase localization, diversify markets, and maximize FTAs that Vietnam has signed. Beyond traditional markets, expanding exports to CPTPP members holds promise—especially since major competitors like China, Bangladesh, and India are not CPTPP members. To meet origin requirements, South Korea and India are considered promising suppliers: South Korea for high-quality fabrics and India as a top global yarn producer. Importing U.S. cotton for garments destined for the U.S. is also a practical option.

Although less dependent on the U.S. (18% market share), the seafood industry must also pursue market diversification. New markets with high consumption potential, such as the Middle East and Brazil, should be explored in addition to traditional ones like the U.S., EU, and China. Vietnam is also negotiating an FTA with the South American common market, with Brazil positioned as the gateway into the world's fifth-largest economic bloc.

Vietnam's competitiveness in attracting FDI may decline due to high tariffs. While low labor costs have long been a strength, that advantage is fading. Overall, production costs in Vietnam remain about 25% lower than the Southeast Asian average—but are still higher than in Bangladesh (a textile competitor) and India (a tech rival). Therefore, a tariff level of 25% or more would pose a serious obstacle to Vietnam's exports.

Vietnam still holds an edge in cheap industrial electricity—among the lowest globally—allowing it to attract energy-intensive tech FDI. Future FDI strategies focus on technology, semiconductors, AI, smart manufacturing, logistics, and seaports. These align with Vietnam’s national industrial park development plan approved in 2024, which emphasizes coastal provinces with strategic locations to better integrate into global supply chains.

Economic Growth Scenarios

SSV presents three economic growth scenarios for 2025, based on potential tariff agreements. The worst-case 46% tariff is unlikely. A base case of 20–25% and a positive scenario of 10–15% are considered more probable.

The Vietnamese government targets GDP growth of over 8% in 2025. To support this, public investment is projected to rise by 38% year-over-year, and the nationwide credit growth target has been increased to 16%—above the usual 14%. Inflation targets are also being raised to 4.5–5% to create room for economic expansion. Regardless of scenario, the government is committed to accelerating public investment disbursement to support growth. Tariffs mainly affect exports and FDI, thereby impacting production and consumption.

In the negative scenario, recession risks are high, and GDP growth could fall to 3%. In the base and positive cases, GDP growth is projected at 6–7% annually—still below the 8% target. Tariffs had not yet impacted Vietnam’s economy in the first five months of 2025. On the contrary, imports surged ahead of expected tariffs, driving strong trade activity and increasing USD demand, thereby exerting pressure on exchange rates.