ETF Monitor: Time to review international ETFs

On September 2, 2022, FTSE will disclose the results of their portfolio review for the FTSE Vietnam 30 Index (FTSE VN ETF) and FTSE Vietnam Index (FTSE VN ETF).

Many investors are waiting for the portfolio review of some ETFs.

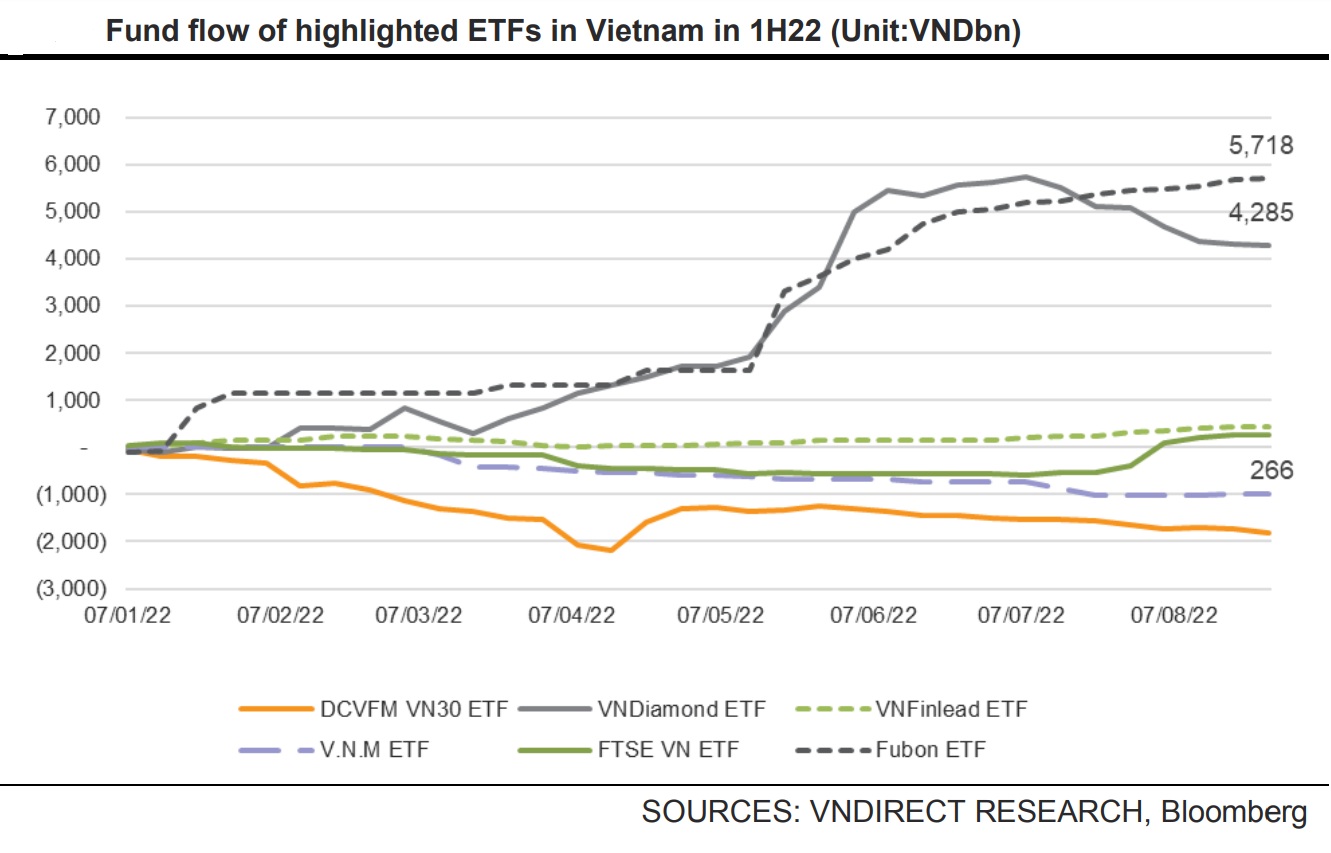

While the VNDiamond ETF was discontinued during the same time period, the Fubon ETF (which tracks the FTSE Vietnam 30 Index) continued to experience capital inflows, overtaking it to become the leading ETF in Vietnam with net inflows of VND5,718 billion in 8M22. With a value of VND14,254 billion, Fubon ETF continues to have the second-highest net asset value among ETFs investing in Vietnam (only behind ETF VNDiamond).

The FTSE VN ETF, meantime, had a reversal in capital movement from mid-July to August 22, resulting in an inflow of VND286 billion in the first eight months of 2022. With an outflow of VND983 billion in 8M22, the V.N.M ETF has continued to experience net withdrawals.

The FTSE Vietnam Index and the FTSE Vietnam 30 Index are among the new FTSE's indices that will be released on September 2, 2022, and they will go into force on September 19, 2022.

Based on data through August 25, 2022, Mr. Vu Manh Hung, an analyst at VNDirect, predicts that SSB and DGC will be added to the FTSE VN30 index in this review because they meet all of the requirements for the index and have market capitalizations that place them 11th and 18th, respectively, according to the FTSE VN30.

While HDB failed the screening process, notably failing to meet the criteria that the headroom must be larger than 10% for members, HSG and HDB are likely to be excluded from the FTSE VN30. Additionally, SSB and DGC benefited from inclusion in the FTSE Vietnam 30 basket while HSG, which has the lowest capitalization among the Top 40, would be left out.

Fubon ETF and FTSE VN ETF, two FTSE index-tracking ETFs, each with a net asset value of VND14,254 billion and VND7,191 billion, respectively, will rebalance their portfolios on the prior trading date (16 Sep 2022).

Mr. Vu Manh Hung estimates Fubon will buy about 25 million SSB shares and 3.5 million DGC shares, equivalent to about VND811.2 billion and VND343.0 billion, respectively. Meanwhile, Fubon will sell about 4.7 million HSG shares and 9.3 million HDB shares, equivalent to about VND103.7 billion and VND246.9 billion, respectively.

For FTSE Index rebalancing, SHB will likely to be included into the index and it will not remove any stocks in this review.

“According to our calculations, the FTSE VN ETF will sell around 308.000/231.000 shares of VHM/VIC, or VND184 billion/VND150 billion, respectively, while purchasing approximately 1.0 million/0.5 million shares of SHB/STB, or VND162 billion/VND136 billion in this review”, said Mr. Vu Manh Hung.

New MVIS indexes basket, which V.N.M ETF tracks on will be announced its new basket 08 Sep 2022 and will come into effect on 19 September 2022.

Base on data until 25/08/2022, Mr. Vu Manh Hung estimates that SAB and THD will be excluded out of V.N.M ETF in this rebalancing period since they did not meet the liquidity requirements of the index.

“With a total of 41 Vietnam-related stocks, we anticipate that Vietnam will continue to represent 82% of the index's country weight. We predict that during this rebalancing period, V.N.M ETF will sell approximately 0.9 million/0.2 million shares of THD/SAB, or VND49 billion/VND39 billion, and purchase around 4.0 million/0.9 million shares of SHB/KDH, or VND63 billion/VND33 billion”, said Mr. Vu Manh Hung.