EVNFinance under restructuring pressure

Electricity Finance Joint Stock Company (EVNFinance, HoSE: EVF) is reinventing its vision and business strategy, improving ESG, and maybe selecting strategic shareholders.

These are some of the elements of EVF's restructuring plan, which is scheduled to be presented at the 2024 General Meeting of Shareholders.

Changes in Foreign Ownership

FTSE Russell confirmed EVF and OCB as part of the FTSE Vietnam Index basket in early March 2024. According to Phu Hung Securities, the FTSE ETF, which references the FTSE Vietnam ETF, will buy 7.3 million EVF units, accounting for 1.52% of the portfolio.

By the end of February 2024, EVF's shares had gained by 160% over the same period last year. Foreign investment in EVF is likely to drive the stock's growth.

Furthermore, there are indications that an Asian investment institution is interested in acquiring a large number of EVF stocks, which might boost their price.

Interestingly, this information corresponds to the "response" move in one of the restructuring elements relating to bad debt management for the years 2021-2025, as suggested by EVF to the General Meeting of Shareholders. Foreign investors now possess 50% of EVF, but the Board of Directors considers capping their stake at 15%. This action is regarded as limit ing foreign investment in order to encourage strategic domestic shareholder engagement.

Challenges and Obstacles for EVF

According to the restructuring plan, EVF is pursuing a business strategy that incorporates sustainable components. Based on the existing scenario, the firm intends to implement a responsible financial corporation model with three major pillars: sustainable development management, sustainable risk management, and a framework for sustainable goods.

Regarding the restructuring and bad debt management plan, EVF claims that keeping bad debts below 3% for several years has helped the firm reach Basel II standards to assure safety. By the end of 2023, EVF's bad debt was at 1.08%.

However, EVF confronts hurdles and dangers, such as tougher capital raising laws than commercial banks, which limit the diversity of EVF's funding sources. As a result, EVF must struggle to maintain and preserve its customer base, which can result in periods of high deposit concentration.

Aside from basic market obstacles, EVF's credit activities encounter greater hurdles than those of commercial banks since clients are unable to create payment accounts with EVF. Furthermore, bad debt collection, which is always tough, becomes considerably more so in a terrible economic environment.

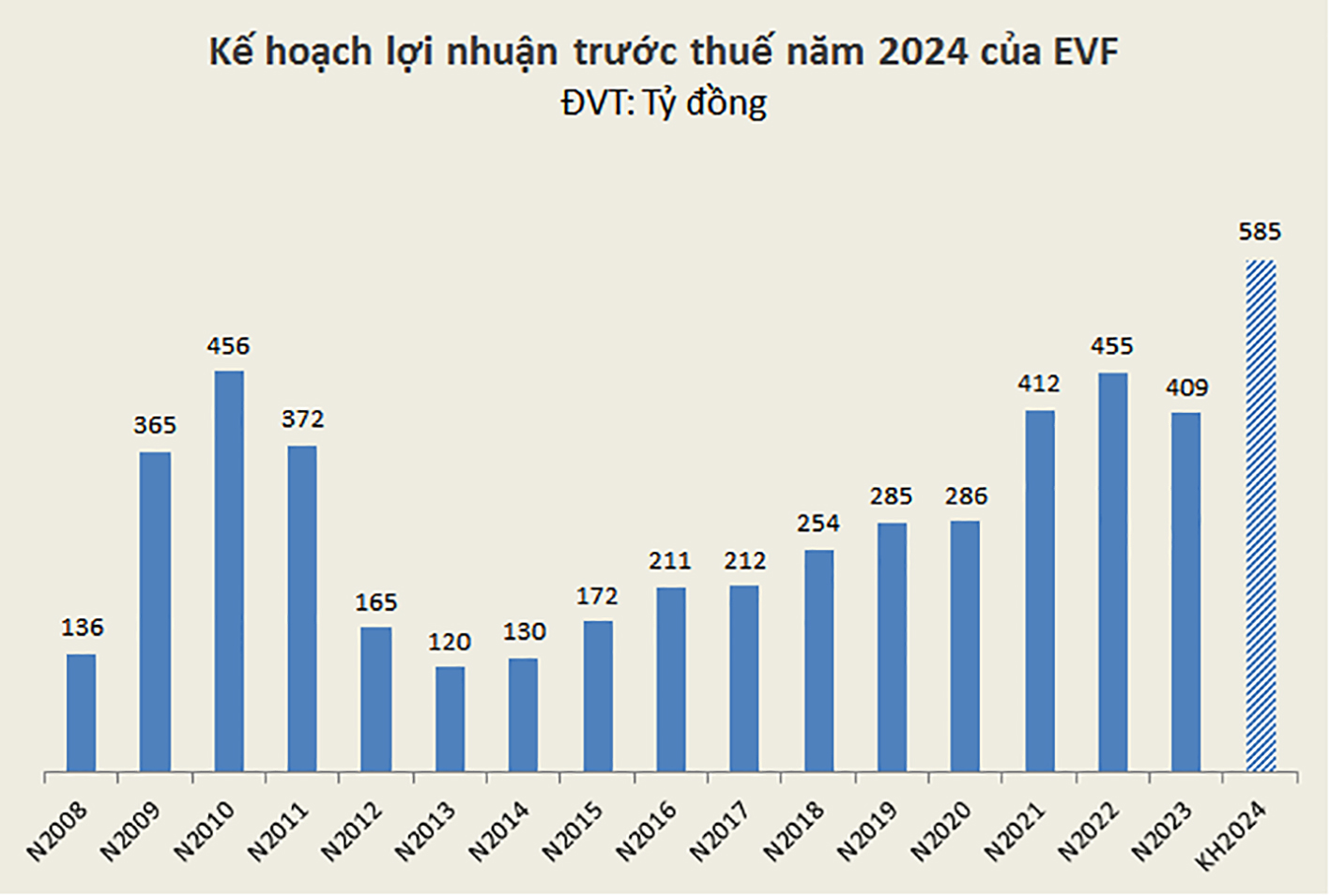

In 2024, EVF plans to expand its charter capital by 638.4 billion VND. Furthermore, EVF aims to achieve a total asset of 54,500 billion VND and a pre-tax profit of 585 billion VND, an increase of 10% and 43% over 2023, respectively.

To achieve these objectives, it is clear that EVF will need to make significant efforts to overcome the challenging market context, especially given that the consumer lending market has yet to show clear signs of recovery from negative impacts, particularly in light of negative news about consumer credit and debt recovery in general.