Geopolitical risks: Impacts on global real estate

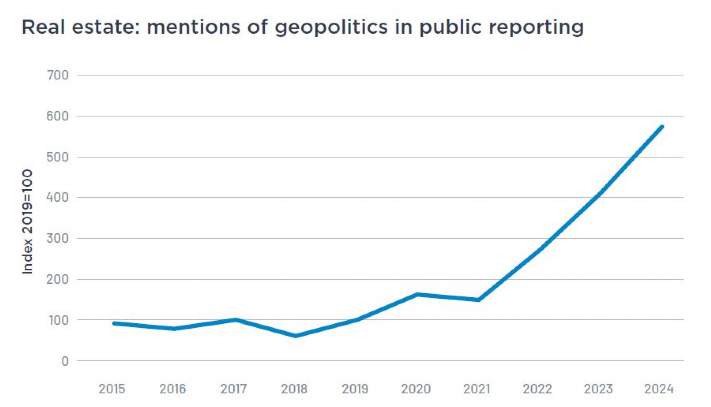

Geopolitical risk is no longer a peripheral factor; it has become a defining force shaping global economic, financial, and investment decisions. In this context, the real estate market, characterised by its large scale, long-term nature, and strong correlation with macroeconomic fluctuations, is now at the centre of this transformative landscape.

.jpg)

Geopolitical risks and effects on a global scale

According to the Savills Impacts 2025 report, across Asia Pacific, Europe, and North America, respondents put geopolitics in the top three issues affecting global real estate investment.

This uncertainty has led many investors to adopt a wait-and-see approach rather than making immediate investment decisions. Emma Steele, Savills Director of Global Cross Border Investment, says that geopolitical risk can cause investors to pause activities and adopt a ‘wait-and-see’ approach. “But that said, we continue to see good demand in the real estate market and have seen a series of investors actually taking an even more positive stance on the prospects for real estate,” she says.

First, the impact of geopolitical risk is evident, although it is difficult to predict. Shocks such as economic sanctions, supply chain disruptions, or cyberattacks often have a direct effect on financial markets, leading to asset devaluation, higher risk premiums, and increased caution among investors, households, and businesses.

Economic studies indicate that each escalation in geopolitical tension is typically accompanied by short-term declines across equity, bond, and commodity markets. However, the more concerning long-term consequences lie in the disruption of corporate capital flows. Businesses tend to delay investments in fixed assets, such as factories, infrastructure, or real estate, which require significant capital, offer long-term returns, and involve a high degree of uncertainty.

Second, simultaneously, global foreign direct investment (FDI) has declined. In 2023-24, FDI to the 20 largest recipient countries averaged around 1.3% of GDP, the lowest proportion since 1996 and well below the long-term average of 2%. National governments are also tightening restrictions on inward investment, particularly in strategic sectors such as semiconductors, defence, and energy, which have further reinforced the trend of reshoring production or shifting supply chains closer to end markets.

Third, for capital-intensive markets such as real estate, the trend of geographic consolidation is having profound effects. As companies seek to build supply chains closer to end-consumption markets, the global investment landscape is being reshaped. According to UNCTAD’s World Investment Report 2024, traditional manufacturing hubs in Europe and North America are increasingly being prioritised over low-cost but high-risk markets. However, a key downside of geopolitical fragmentation is a decline in overall global economic efficiency: supply chains become less agile, capital no longer flows to its most optimal destinations, and the global economy loses the competitive edge it once gained through trade liberalisation and specialisation. Additionally, rising risk aversion is shaping a new generation of investors and entrepreneurs who are more cautious and conservative.

Stability amid uncertainty, opportunity amid risk

Amidst global volatility, Viet Nam has emerged as a bright spot for regional potential, supported by a stable macroeconomic foundation, strong long-term growth prospects, and a consistent open-door policy. Moreover, the country is undergoing a period of significant reform, most notably in improving its legal framework and issuing guiding regulations to create a transparent investment environment aligned with international standards.

In a polarised world, Viet Nam is regarded by many multinational corporations as a strategic destination due to its neutral stance, political stability, and comprehensive partnerships with key global players, including the United States, China, Japan, and the European Union. As a result, Viet Nam is progressively appearing as a new regional supply chain hub, driving strong demand for industrial real estate, logistics facilities, and housing for foreign professionals.

Macroeconomic financial factors also play a significant role. Foreign investors are highly sensitive to exchange rate volatility and the cost of capital, which can erode returns when repatriating funds. Domestic credit policies and benchmark interest rates have a direct influence on project development capacity and purchasing power in the local market. While Viet Nam continues to maintain stronger macroeconomic stability compared to many other emerging markets, in a globally uncertain environment, FDI inflows demand greater caution and clear forward-looking signals.

Real estate investment trends in Viet Nam

First, pursuing transparency and sustainability: Commenting on current investment trends, Dung notes: “Foreign investors are prioritising projects with clear legal status. They are willing to pay a premium for transparency and the ability to quickly release cash flows. In addition, many investment funds, particularly from Europe and North America, consider Environmental, Social, and Governance (ESG) criteria as a prerequisite. Projects that incorporate green spaces, use eco-friendly materials, and demonstrate strong risk management will have a significant competitive edge.”

Second, investment shifts to suburban areas: Moreover, there is a clear shift in investor preference from urban centres to satellite regions. With limited land supply and high prices in major cities such as HCMC and Ha Noi, investors are increasingly exploring opportunities in nearby provinces like Hung Yen, Bac Ninh, Hai Phong, Binh Duong, and Long An, areas that are witnessing significant infrastructure and transportation investments.

Real estate is easily exposed to geopolitical risks. However, every challenge also presents an opportunity, requiring investors and enterprises to remain agile and adaptive. For Viet Nam, external uncertainties serve as a test of the country’s economic resilience, the effectiveness of legal reforms, and its capacity for policy implementation.

Main forces driving FDI into Viet Nam's real estate

Three key drivers are expected to support foreign capital inflows into Viet Nam’s real estate sector in H2/2025: the completion of a more robust legal framework, a proactive economic diplomacy strategy, and a market trend toward emerging segments and flexible investment models.

First, regulatory reforms: Notably, new legal documents such as the 2024 Land Law, the 2023 Real Estate Business Law, along with guiding decrees including Decree 96/2024/ND-CP, 102/2024/ND-CP, and 103/2024/ND-CP, have significantly contributed to resolving longstanding legal bottlenecks. These reforms are laying the groundwork for a more transparent, stable legal environment that aligns with international standards. They will create favourable conditions to attract foreign capital, particularly in high-end residential, urban development, industrial, and resort real estate segments.

Second, a proactive economic diplomacy strategy: Furthermore, Viet Nam’s efforts to formulate its Comprehensive Strategic Partnerships with multiple countries continue to strengthen its position in the eyes of global investors. Despite the ongoing impacts from U.S. trade protectionist policies, Viet Nam has maintained strong diplomatic momentum. Since the beginning of the year, numerous countries, including France, Spain, Brazil, the Czech Republic, Poland, Hungary, Thailand, Indonesia, Singapore, and New Zealand, have elevated bilateral relations with Viet Nam. In addition, the country has served as host to major international events such as P4G, UNCTAD, and the ASEAN Future Forum.

Third, new segments and flexible investment models: Finally, the market is being shaped by developing segments and more flexible investment models. For example, the data centre segment is experiencing rapid growth, with Viet Nam showing strong potential to become a regional data storage hub. Corporations such as Nvidia, Gaw Capital, Viettel IDC, and CMC Telecom are accelerating their investments in this sector.

In summary, with a progressively refined legal foundation and a proactive economic diplomacy strategy, Viet Nam is steadily establishing itself as an increasingly attractive destination for international real estate investment.