Gold price next week: three big leverages

Gold prices have climbed dramatically during the last three years, owing to three primary drivers. How will gold prices move next week?

This week, worldwide gold prices rose dramatically, from $2,228/oz to $2,330/oz, before closing at $2,328.

In the Vietnamese gold market, the price of SJC gold bar quoted by DOJI group has risen substantially, from VND 80.7 million to VND 82 million.

Many analysts believe that three primary factors are pushing gold prices to climb dramatically above forecasts. Central banks' purchases of gold, their rate reduction, and, lastly, exceptionally high geopolitical tensions on several fronts, including the Middle East crisis and the Ukrainian-Russian war.

The Middle East war is the most worrisome of these issues, as Iran is expected to react for Israel's suspected bombing of the Iranian Embassy in Syria. This increases the safe-haven status of gold. Furthermore, central banks' gold purchases will offer long-term leverage for gold prices, particularly as BRICS central banks seek for gold to safeguard their own payment systems and reduce dependence on the US and the West. Furthermore, when central banks, particularly the Fed, begin lowering interest rates, the price of gold will rise.

Surprisingly, the U.S. labor market expanded rapidly in March, with non-farm payroll (NFP) data hitting 303,000 jobs, well above Reuters' projection of about 200,000 jobs. This will encourage the Fed to decrease interest rates for the first time in June, following a long string of rate rises.

According to Robert Minter, Chief Investment Strategy Officer of Abrdn, historically, when the Fed cuts interest rates, the price of gold rises consistently, with gold appreciating by 57%, 235%, and 69% in 2000, 2006, and 2018 correspondingly.

Gold prices have grown by 17% since early 2024, after surpassing $2,000 per ounce in mid-February. Thus, compared to the aforementioned rises, it will have plenty of room to rise even more when the Fed lowers interest rates this year.

The release of vital US inflation statistics next week is expected to have a significant influence on gold prices.

According to forecasts, the US CPI will climb by around 0.2% in March. According to many analysts, if the statistics are as expected, or even lower than 0.3%, it would be good news for the gold price next week, since it will strengthen the Fed's intention to decrease interest rates in June. On the contrary, a rise in the CPI of 0.4% or more in March would be cause for concern. This allows the Fed to continue postponing plans to lower interest rates, which will have a negative influence on gold prices next week.

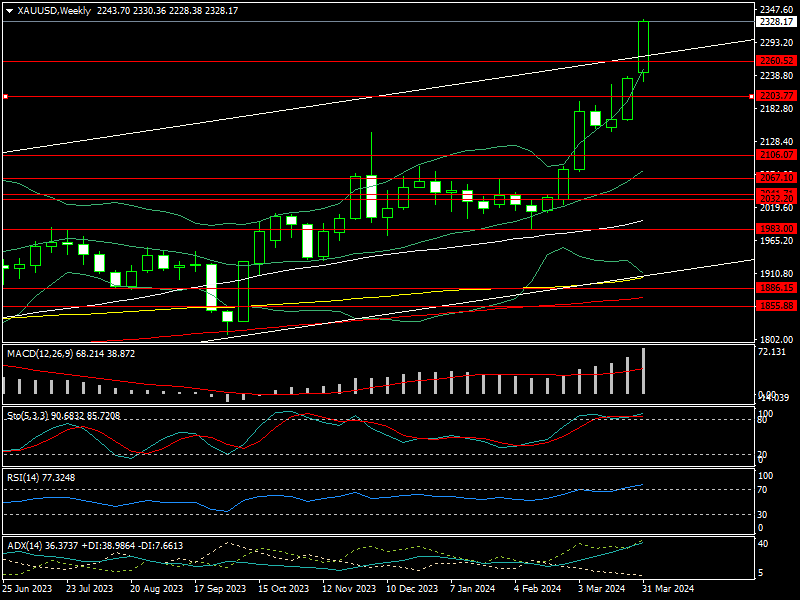

According to technical analysis, a rise in gold prices above the medium-term uptrend channel on the weekly chart is a bullish indicator, implying that the medium and long-term gold price rise will continue. However, the RSI and Stochastic are in the overbought zone. This might have a short-term impact on gold prices. Accordingly, the major support levels for gold next week will be $2,260-$2,204-$2,107/oz. Meanwhile, the $2,400/oz level will pose significant resistance.