Headwinds for KDC

Cooking oil costs have risen 27.2 percent year on year, putting pressure on KIDO Group's (KDC) gross margin in FY22-23F.

KIDO's bakery brand is only sold at Chuk Chuk stores and online, with no presence in modern or traditional retail outlets.

The consequences of the Russia-Ukraine conflict

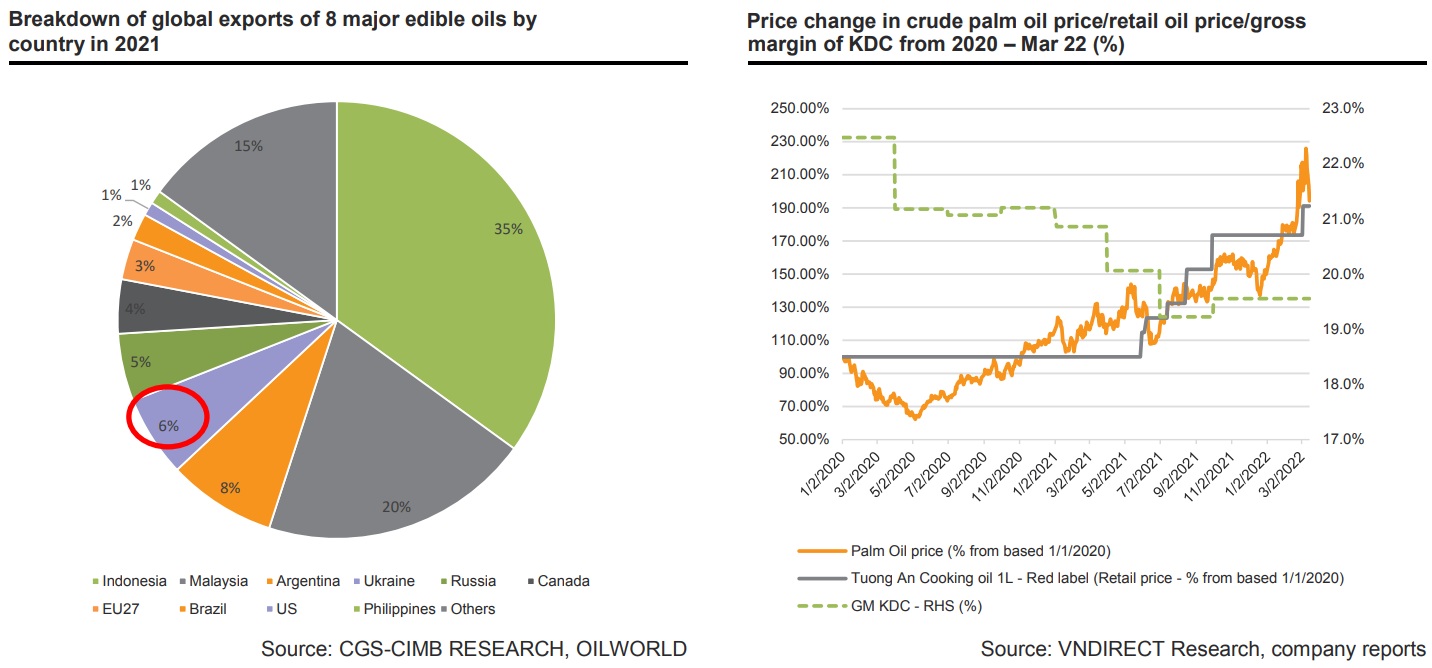

The sunflower oil supply chain from Ukraine has been disrupted as a result of the Russia-Ukraine crisis. According to Oilworld, Ukraine is the world's largest producer and exporter of sunflower oil (47 percent of global exports) and has a 6% share of the global edible oil export market, with India and Europe as the key destinations.

Consumers have moved their demand for edible oil to alternate goods such as crude palm oil and soya oil as a result of the supply disruption. The average price of crude palm oil in 3M22 climbed by almost 30% compared to the average price in 2021, according to data from trade economics. According to Mr. Phan Nhu Bach, a VNDirect’s analyst, the price of edible oil would stay high in FY22F due to a long-term supply chain interruption.

Due to a focus on luxury products, KDC increased its retail edible oil pricing by more than 20% in March 2022 compared to July 2021 to deal with the increase in edible oil prices. As a result, VNDirect lowered its gross margin forecasts for FY22 and FY23 by 1.4 and 1.7 percentage points, respectively, while boosting sales forecasts by 5.7 and 8.5 percent over the same period.

More time for Chuk Chuk and KIDO’s bakery

KIDO's bakery brand is only sold at Chuk Chuk stores and online, with no presence in modern or traditional retail outlets.

According to Mr. Phan Nhu Bach, the confectionary segment's poor start was caused by COVID-19's impact on KDC's new production lines, which resulted in the value of in-progress machines reaching more than VND165 billion (x4.1 times yoy) in End-21. However, he expects that when the confectionary lines are relocated to Vietnam after the logistical disruption, KDC will be able to expand output in 2022F. In FY22/23F, KDC's bakery will continue to provide a little contribution to the company's earnings, accounting for 2.2 percent /2.4 percent of revenue and 4.1 percent /4.3 percent of gross profit.

KDC has opened 25 Chuk Chuk stores in less than 5 months, accounting for 12.5 percent of the aim of 200 Chuk Chuk stores by 2023F. Mr. Phan Nhu Bach anticipates that the Chuk Chuk chain will continue to expand in FY22F, once the economy has recovered from the pandemic. Chuk Chuk boosts chain promotion through sale programs, enhances interaction through its Facebook fan page, and increases online sales through stores at e-commerce sites, in addition to physical stores. "We have not yet included Chuk Chuk in our model due to its little contribution to total revenue, according to our estimates." Mr. Phan Nhu Bach expressed his thoughts.

Changes in FY22-23F earnings forecasts

Mr. Phan Nhu Bach based VNDirect's forecast changes for KDC in FY22F and FY23F on the above outlooks:

First, compared to the previous report, revenue climbed by 5.7 percent and 8.5 percent, respectively, as KDC raised the price of their retail edible oil products.

Second, due to the high raw edible oil price, which was extended by the Russia-Ukraine situation, gross margin declined by 1.4 percent/1.7 percent compared to the previous report.

Third, SG & A expenses declined by 0.6 percent in FY22F, as we expect KDC to lower SG & A expenses after merging with TAC, but climbed by 5.3 percent in FY23F, as we expect them to accelerate the expansion of Chuk Chuk and Kido's bakery.

Fourth, on Jan. 22, KDC released its FY22F guidance, forecasting sales and pretax profit of VND14,000 billion and VND900 billion, respectively. Due to the conflict in Ukraine, which has had a direct influence on the edible oil supply chain since February 22, VNDirect predicts that edible oil prices will continue to grow strongly until 2022. As a result, its revenue and pre-tax profit forecasts are only 86 percent and 76 percent of KDC's estimate, respectively.

Mr. Phan Nhu Bach lowered KDC to a hold rating with a target price of VND 61,700, citing a headwind from rising edible oil and the need for additional time to prove the viability of KDC's new initiatives. Following the decline in FY22/23F net profit by 0.9 percent to 3.4 percent compared to the previous report, he reduced the P/E valuation by 2.3 percent to VND 62,605 per share.