Headwinds for real estate: Interest rates tend to pick up

Inflation in Vietnam is likely to climb in the next months, leading to higher interest rates and a negative impact on house purchases.

Higher interest rates will put a negative impact on house purchases.

Inflation pressure is increasing

In April 2022, headline inflation in Vietnam reached 2.6 percent year on year (vs. 1.9 percent in 1Q22 and 2.4 percent in March 2022). Inflation is expected to rise in the second half of 2022, according to VNDirect, as a result of the Russia-Ukraine issue. Price increases in input materials such as coal, steel, copper, and aluminum may have an impact on manufacturing costs in Vietnam, while price increases in fertilizers and agricultural commodities (wheat, corn, and barley) may put upward pressure on domestic food and food-related prices. As a result, it anticipates inflation to pick up in the next month, with CPI expected to average 3.1 percent yoy in 2Q22F. (vs. 1.9 percent yoy in 1Q22).

However, VNDirect remains optimistic that the government will be able to keep inflation under control in order to reach the government's goal of keeping the average CPI below 4% yoy in 2022. This year, the government has implemented effective anti-inflation measures, such as lowering environmental taxes on fuel to cut domestic gasoline costs and altering the prices of public services such as tuition fees. Overall, it keeps its average CPI prediction for 2022 at 3.4 percent yoy.

Mortgage rates to heat up

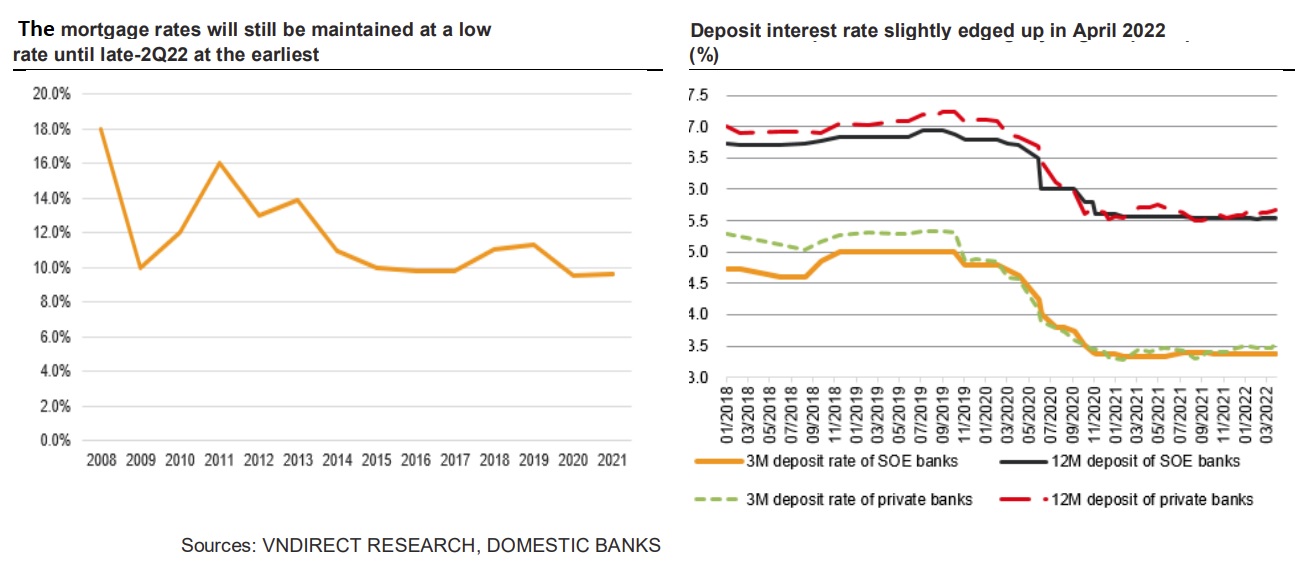

State-owned banks' 3-month term deposit rates and 12-month term deposit rates remained unchanged as of April 26, 2022, compared to the end of 2021, while private banks' 3-month term deposit rates and 12-month term deposit rates increased 14 basis points and 13 basis points, respectively, compared to the end of 2021. As a result, according to VNDirect, the average mortgage rate from local banks remained virtually steady in 1Q22.

The deposit rate is unlikely to remain at a historic low and could increase 30-50 basis points in 2022 for the following reasons: (1) higher demand for fund raising as credit accelerates, (2) inflation pressure in Vietnam will pick up in 2022; and (3) competing more fiercely with other investment channels such as real estate and securities to attract capital inflow.

"We see the 12-month deposit rates of commercial banks climbing to 5.9–6.1%/year at the year-end of 2022 (currently at 5.6%/year), which is still lower compared to the pre-pandemic level of 7.0%/year," VNDirect said.

The commercial banks are likely to raise lending rates on other conventional loans to offset the increase in deposit rates, especially in the context of the central bank's tightening controls over the credit offered to the real estate market.

"We expect mortgage rates in 2022F to fluctuate in the range of 9.5%-10.0%, still lower compared to the pre-pandemic level of 11-11.5%/year. We keep our view that mortgage rates are at a still low rate in 2022F, and as such, do not expect condo transactions to be negatively affected in 2022F", VNDirect said.