Headwinds for Vietnam’s steel makers

In the third quarter of 2018 compared to the corresponding period in 2020, Vietnam's total steel sales volume decreased by 11%.

HPG recorded its first deficit since the fourth quarter of this year in the third quarter, losing VND1,776 billion.

>> What is the outlook for HPG?

Sluggish performance

In 3Q22, all steel businesses saw negative financial performance. The three largest listed steel businesses in 3Q22 (HPG, HSG, and NKG) suffered a 25% year-over-year loss in revenue and an 18% quarter-over-quarter decline due to weak steel demand, which decreased both sales volume and selling price.

In addition, a number of steel companies had net losses in the third quarter of 2012 as a result of higher borrowing costs, rising interest rates, and a declining VND. Notably, the biggest steel firm in Vietnam, HPG, which benefits from economies of scale, recorded its first deficit since the fourth quarter of this year in the third quarter, losing VND1,776 billion.

According to Mr. Tran Ba Trung, an analyst at VNDirect, as decreased input costs take effect in the fourth quarter of this year, the gross margin (GM) of the steel industry would increase. Steel companies have reduced their inventory levels since the end of June this year, going from four to five months to roughly two to three months in 4Q22. This would reduce the possibility of any bookings coming about as a result of the stocking of inventory. While this has been happening, spot prices for raw materials like coking coal, steel scrap, and iron ore have also leveled out. As a result, steel companies' earnings are poised to peak. The speed of recovery is, however, only moderate because the demand is now weak.

>> Hard-hit steel producers need governmental push to pick up: insiders

Drop in steel demand

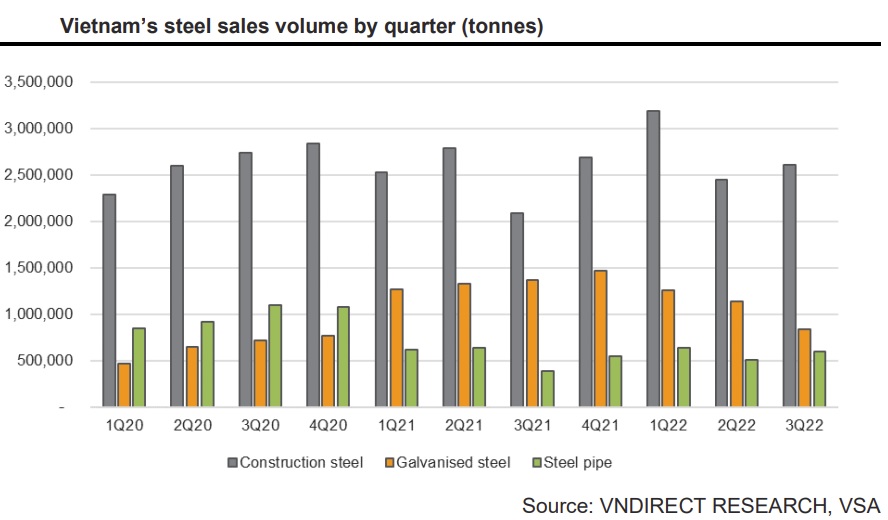

Due to a slowdown in the world economy as well as weak global demand and concerns about the continuation of the Chinese lockdown, steel prices worldwide decreased in the third quarter of this year across all product categories. The Vietnam Steel Association (VSA) reports that from a low base in 3Q21, total steel volume in Vietnam (including construction steel, steel pipes, and galvanized steel) increased by 5% yoy to 4.05 million tonnes in 3Q22.

Vietnam's residential real estate industry has slowed down since 2Q22 as a result of some tycoons being arrested for breaking corporate bond issue rules, a lack of adequate financing for real estate, and increased loan rates that decreased housing demand. The domestic steel sector is also being harmed by other causes, such as (1) expensive inputs (such as coking coal and steel scrap) and (2) ongoing inflationary pressures, which have tightened financial conditions in many major countries and dampened hopes for global development. As a result, the demand for steel declined globally, which made it challenging for Vietnamese steel companies to export their goods.

Mr. Tran Ba Trung predicts that the overall domestic steel demand would drop by single digits in 2023F, despite the fact that state investment disbursement is anticipated to quicken in the near future. In such case, sales of construction steel and galvanized steel in Vietnam will decline by 3% annually in 2023F.

Since the end of September, various production reductions have been announced, including Southern Steel Company Limited's reduction of workload and production output during 4Q22 and Pomina Steel Corporation's (POM VN, HOSE) closure of its blast furnace-POM 2 factory effective September 25, 2022.

“If demand continues to fall further towards the end of the year, HPG would consider shutting down one more (the fifth blast furnace) in Dec 2022. With massive shutdown plans for five out of seven blast furnaces at two steel complexes, this sends a negative message regarding HPG management’s view on steel demand in the short-term (maybe till the end of 2022 and 1Q23F)”, said Mr. Tran Ba Trung.

That being said, Mr. Tran Ba Trung see a few signals that could be frontal passages for wind change: (1) coking coal prices is forecasted to ease from an average US$420/tonne in FY22F to US$258-220/tonne in FY23-24F; (2) the reopening of Chinese economy will reboot the global steel demand, and (3) the acceleration in Vietnam’s infrastructure development will drive up the demand, partially offset the stagnant residential property market.