Hedging against exchange rate risk

The currency rate band has been widened by the State Bank of Vietnam (SBV), enabling more flexible exchange rate swings in response to supply and demand. Enterprises must protect themselves against exchange rate risk because there is still a sizable degree of exchange rate pressure.

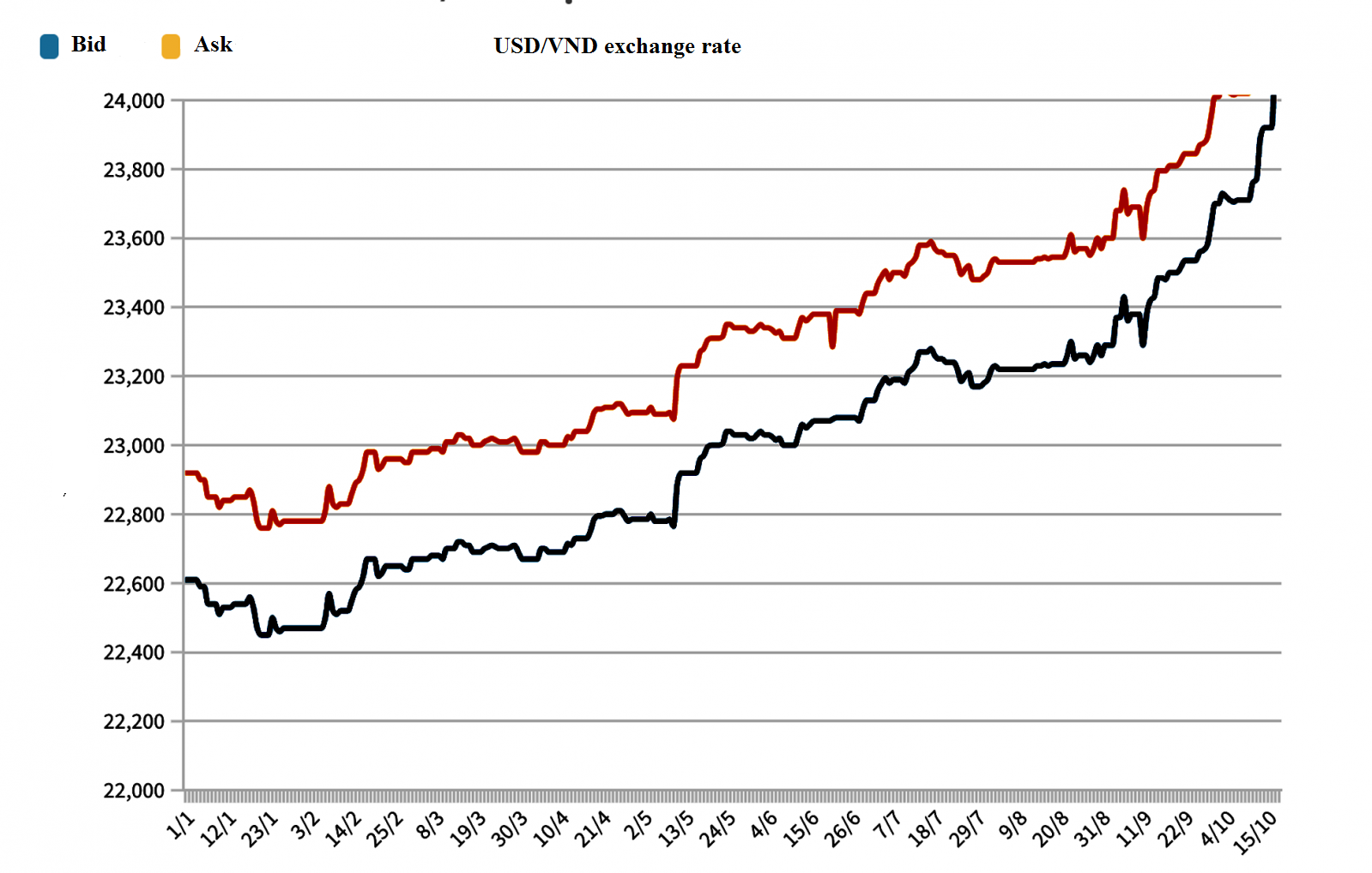

Many commercial banks displayed the selling price of USD at 24,600 dong/USD during the trading session on October 19

The USD/VND spot exchange rate band was adjusted by the SBV from ±3% to ±5%.

>> Exporters advised to minimise headwinds of currency volatility

Reasonable move

After the FED consistently raised rates, the USD is strongly gaining. As a result, the JPY fell 40%, the EUR and GBP fell 30%, and the CNY fell 8%. VND, on the other hand, has only lost 4-5% of its value since the start of this year. But when the SBV must sell a sizable portion of its FX fund in order to intervene in the FX market, the cost is not insignificant.

Many analysts believe that expanding the exchange rate band is a sensible move given the decline in foreign currency reserves.

" Exchange rates move in a larger range as a result of the expansion of the exchange rate band, ensuring that there is a balance between FX supply and demand at year's end," said Dr. Nguyen Huu Huan – University of Economics Ho Chi Minh City. HCM assessment.

>> State Bank of Vietnam faces pressure on exchange rate

Dr. Nguyen Huu Huan believes that this action also prevents the SBV from having to sell foreign currency in order to intervene in the FX market, preserving foreign exchange reserves. "The FX market will stabilize once again as the demand for foreign money declines during the hectic period. "This resource will be lost if the FX reserve is used to intervene in the FX market”, Dr. Nguyen Huu Huan highlighted.

Big pressure ahead

In the remaining months of this year, there will continue to be significant upward pressure on the exchange rate. In fact, after the SBV decided to extend the exchange rate band, the reference exchange rate was regularly adjusted up with a wide band. The reference currency rate for the trading session on October 19 was set at 23,663 VND/USD, up 518 VND/USD from the start of the year, or a gain of 2.23%.

Commercial banks are now able to fix currency rates that are higher than in the past because to the widening of the exchange rate band. In reality, many commercial banks displayed the selling price of USD at 24,600 dong/USD during the trading session on October 19, which is about 940 dong above the reference exchange rate (about 0.4 percent higher).

Prior to this, Mr. Ngo Dang Khoa, Country Director of HSBC Vietnam Capital and Capital Market Division, advises companies to employ FX derivatives, such as forward contracts and swap contracts (SWAP), to protect themselves against currency rate risk.

"Import-export enterprises need to pay special attention to risks of cash flow, interest rate, and currency rate through risk hedging products not only in the context of large exchange rate changes but also in normal times," stressed Mr. Khoa.