How did Yeah1 get over obstacles?

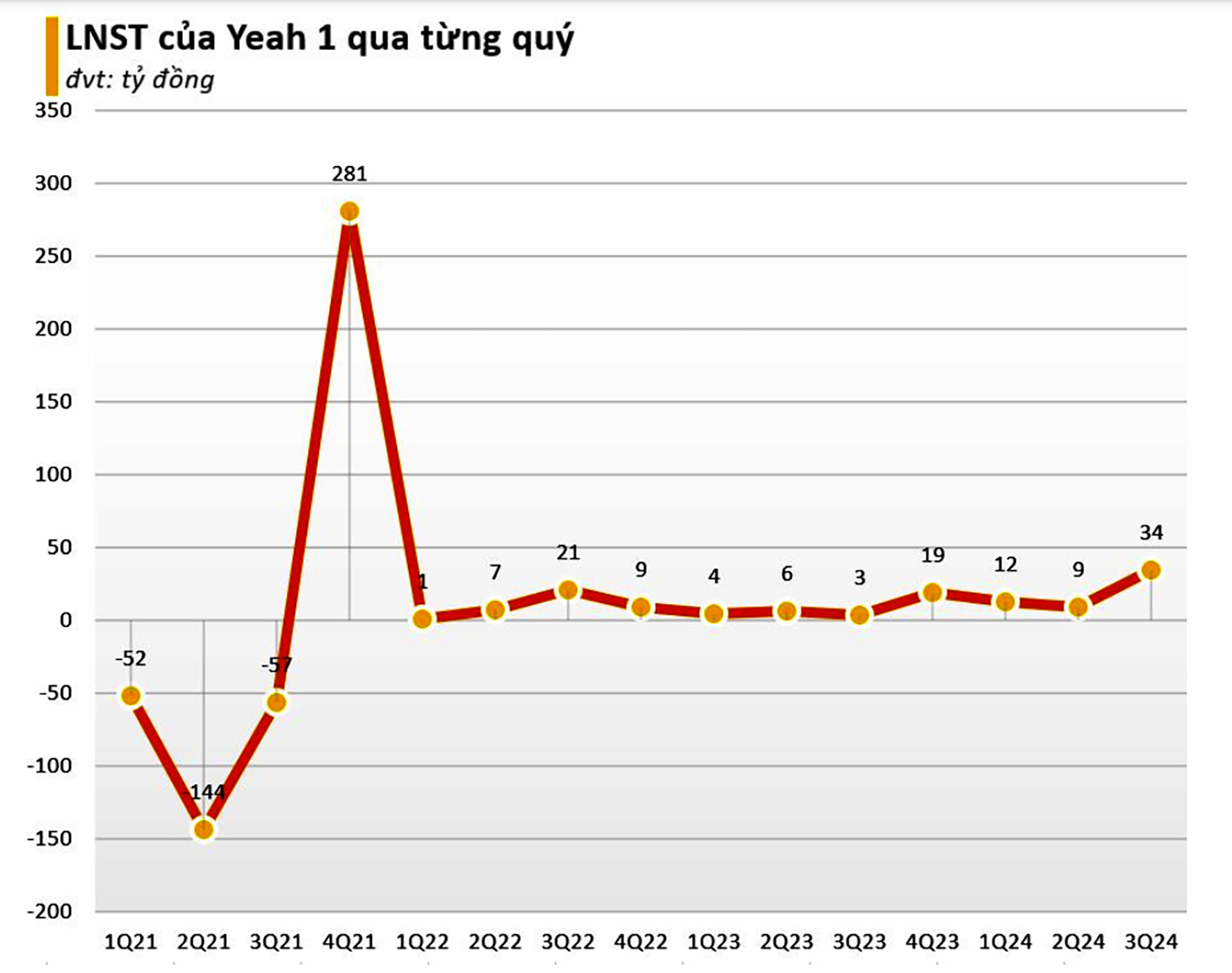

Yeah1 Group JSC (HoSE: YEG) continues to reap the rewards of its investment in reality music programs after a prolonged period of losses.

However, YEG's shares remain volatile, trading within the small-cap group at around 14,000 VND/share.

However, YEG's shares remain volatile, trading within the small-cap group at around 14,000 VND/share.

Music Show "Rescues" Yeah1

Yeah1 recorded its greatest quarterly revenue since Q4/2020 in Q3/2024, with over 345 billion VND in revenue, more than double that of the same period the previous year. In comparison to Q3 2023, the company's net profit increased 11 times to 34 billion VND. Yeah1 said that the main reason for this notable increase in after-tax profit was a spike in revenue, which in turn caused a rise in gross and net profit.

Yeah1's revenue in the first nine months of 2024 was over 629 billion VND, which is 2.5 times greater than the previous year. The company's after-tax profit increased 4.5 times to around 56 billion VND. This corresponds to 86% of its profit aim and 79% of its yearly revenue target. However, compared to the same period in 2023, the parent company's standalone financial report revealed a 17 billion VND loss in after-tax profit, which was ascribed to a decline in financial revenue.

Yeah1 is the producer of the popular reality music show “The Brothers Overcoming Challenges," which has been competing head-to-head with DatVietVAC’s “The Brothers Say Hi." The competition extends beyond audience attention to securing sponsorships and advertisements. Major sponsors of Yeah1's show include Diamond Sponsor Techcombank, Gold Sponsor Bupnon Tea365 (Masan), and Silver Sponsors An Cường, Malloca, and BA HUÂN.

Additionally, “The Brothers Overcoming Challenges” gained traction with VinFast as its Bronze Sponsor, serving as the exclusive transportation sponsor for its concerts. The participation of leading brands from sectors like banking, automotive, consumer goods, and furniture has helped Yeah1 turn its financial performance around in 2024.

.jpg)

Volatile Stock Performance

Short-term receivables dominated Yeah1's asset structure in Q3 2024, accounting for 1,132.5 billion VND, a 34% increase from the start of the year (out of a total of about 2,423 billion VND). Additionally, the business reported a sharp increase in short-term borrowings.

In particular, Yeah1's total liabilities climbed by 107% since the beginning of the year to over 988 billion VND. In comparison to the previous quarter, short-term borrowings increased by 300 billion VND, nearly tripling to about 500 billion VND.

Financial analysts suggest these short-term loans were used to finance the production of programs, with repayments expected from receivables. While this is not a major concern for program producers with secured sponsors and non-flop programs, risks may arise regarding repayment capacity or reassessment from sponsors and advertisers for individual programs.

The "shift" of VinFast from sponsoring “The Brothers Say Hi” to expanding its sponsorship for “The Brothers Overcoming Challenges”, alongside VPBank joining “Our Song Vietnam” after the success of Techcombank and VIB with other major music programs, highlights the intense yet lucrative competition in the sponsorship market for reality shows.

Yeah1 is also producing the second season of “Sisters Riding the Wind and Breaking Waves 2024”. However, according to observers, the show does not seem to generate the same buzz as its male counterparts. The program is expected to compete with “The Sisters Say Hi” from a rival producer next year.

After rising over par value in late October, YEG's stock nevertheless varies within the small-cap band even after overcoming recent business difficulties. With a 6.91% increase to 17,800 VND/share as of December 19, YEG's stock demonstrated strong market sentiment fueled by its financial results. This was the third consecutive session that the stock hit the ceiling price, and it had increased by nearly 95% over the previous two months.

Additionally, the business has been actively reorganizing, selling off five affiliated businesses: Global River JSC, Ting Vietnam Technology JSC, Yeah1 Edigital JSC, Netlink Vietnam Media Technology JSC, and Vietnam Entertainment Investment JSC.

The saying "Only time will reveal the long-term value of great programs" might serve as a measure of future potential that Yeah1 needs to prove to investors for its stock to reflect their expectations. This also poses a challenge for music show producers in maintaining the momentum of fast-rising stars in Vietnam’s competitive entertainment market.