How does the VND depreciation impact investment channels?

With deposit interest rates expected to rise by about 100 basis points by the end of the year, the impact on the stock market is minimal; in the meantime, investors can still take advantage of low interest rates to purchase property, according to Michael Kokalari, CFA, Chief Economist and Head of Macro and Market Research at VinaCapital.

Exchange rate and measures with the gold market

Last week, Federal Reserve Chair Jerome Powell stated that the fight against inflation in the United States is "taking longer than projected," prompting speculation that the Fed may not lower interest rates in 2024. This is a major shift from the beginning of the year, when the mainstream forecast was for six Fed rate decreases in 2024, beginning in March. Furthermore, Powell's statements, as well as those of other Fed officials, contradicted the European Central Bank's warning two weeks earlier that it may begin decreasing Euro interest rates in June.

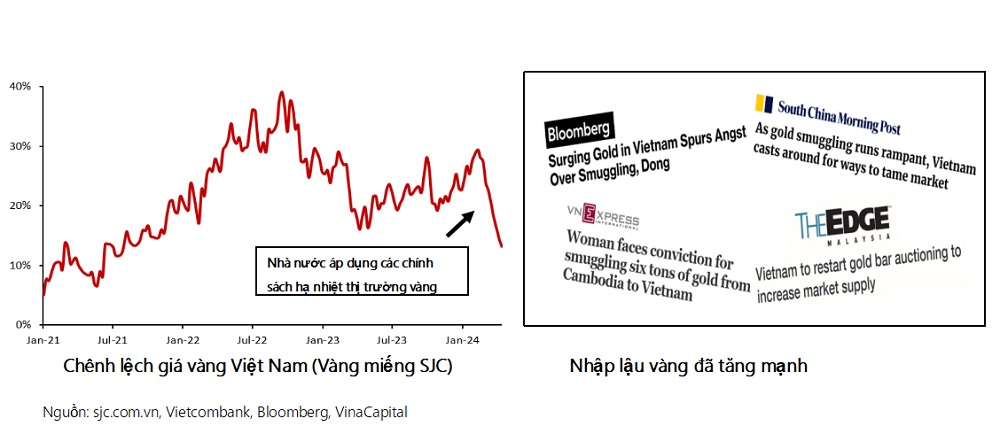

Price difference of Vietnam gold (SJC gold bars) - Gold smuggling has increased - Source: sjc.com.vn, Vietcombank, Bloomberg, VinaCapital

The combination of Fed officials' messages, stronger-than-expected U.S. retail sales data (in both February and March), and escalating Middle Eastern tensions helped lift the USD/JPY exchange rate above the psychologically important "155" level for the first time in more than 34 years, and pushed the USD/VND exchange rate up nearly 2% last week. In reaction to the strong dollar, the governments of South Korea, Japan, and the United States released a unified declaration on currency stability. Meanwhile, the Central Bank of Indonesia raised its policy rate by 25 basis points, while the State Bank of Vietnam sought to sell USD to local commercial banks.

Finally, rising geopolitical tensions serve to explain why both gold and the US dollar have increased in value. However, central bank gold purchases (including those of China and Middle Eastern countries) are a major driver of gold prices, as are concerns that governments around the world (particularly in the United States) will print money to address their massive debt burdens (the UK government bond crisis in late 2022 sparked the current gold market).

For more than a decade, the Vietnamese government has limit ed gold imports, causing SJC gold bars to consistently trade at much higher rates than world gold prices. The current price differential between SJC gold bars has risen to extraordinarily high levels, owing to local investors entering the increasing global gold market. In contrast, high gold prices in Vietnam are driving up gold smuggling across the Vietnam-Cambodia border.

Unofficial gold imports are draining USD from the nation, as stated in the "mistakes and Omissions" part of Vietnam's balance of payments (the SBV estimates that Vietnam's mistakes and omissions will be around 4% of GDP in 2023). The SBV has declared that it will arrange gold auctions (a portion of Vietnam's foreign reserves) and that it may formally import gold into Vietnam for the first time in 11 years. These pronouncements, together with other less noticeable actions, have helped lower the price differential between SJC gold and other precious metals to around 15% (although it remains rather large in comparison to prior levels).

According to the expert, the amount of gold that has to be imported to eliminate the price differential in Vietnam would have a substantial impact on foreign reserves. However, if gold prices in Vietnam are much higher than worldwide prices, gold smuggling will occur, removing USD from the Vietnamese economy.

Impact on investment markets

The VND devaluation (approximately 4.5% up to April 26), together with objective repercussions and regulatory decisions/interventions, might result in a 100 basis point increase in bank deposit interest rates in Vietnam by the end of the year. Higher deposit interest rates make it more appealing to invest in banks than in the stock market. Higher mobilization rates also result in higher financing rates and capital expenses for businesses, limit ing profitability. Higher interest rates often have a negative influence on the stock market.

Interest rate increases do not have a major impact on the economy, profit growth, or the stock market this year. (Illustrative photo)

However, the present depreciation pressure on the VND, which is driving VND interest rates to rise, is mostly due to the strength of the US economy, and the strong US economy is increasing Vietnam's exports and GDP development. For this reason, the VinaCapital expert group is not concerned that a 100 basis point increase in deposit rates in Vietnam will have a significant influence on the economy, profit growth (estimated to be about 20% in 2024), or the stock market this year.

Furthermore, the expected interest rate hike in Vietnam is assisting in the recovery of the country's real estate market by encouraging potential buyers to purchase property as soon as possible in order to take advantage of the existing cheap loan rates. The majority of mortgages in Vietnam are 15-year variable rate loans, however rates may now be locked in at a low 6% for the first two years (or 7% for the first three years), and most potential purchasers do not anticipate such low rates to stay much longer.

Kokalari also pointed out that the United States' "higher for longer" interest rates may be helping rather than harming the economy, as projected. This paradox arises from the fact that savers in the United States (particularly "Baby Boomers") are earning considerable interest on their savings for the first time in many years, and they are spending this unexpected money.

As a result, higher U.S. interest rates are a double-edged sword for Vietnam; the depreciation pressure on the VND is pushing up Vietnam's interest rates, but the strong U.S. economy is also boosting Vietnam's export recovery to the United States, which has increased from a 21% decline in the first quarter of 2023 to a 26% increase in Q1 2024.

Thus, the USD/VND exchange rate has risen by more than 4% since the start of the year, a level at which the State Bank of Vietnam normally takes additional efforts to support the VND (the largest depreciation of the VND during the last eight years has been 3.5%). The dong has depreciated due to an unusually large gain in the US dollar and local savers purchasing gold, despite Vietnam's significant trade surplus and FDI inflows supporting the VND exchange rate.

Experts predict Vietnam's deposit rates, which have been declining since early 2023, to climb by 50-100 basis points by the end of the year. This hike looks unlikely to have a significant influence on the stock market, but it will drive real estate purchasers to move quickly to take advantage of the existing cheap house loan rates, providing fuel to Vietnam's embryonic real estate market recovery.