Lingering risks in corporate bond maturities

The volume of corporate bonds maturing in August has hit a record high for 2025, nearly matching the peak in December 2024.

About VND 36 trillion worth of bonds are due this month — the largest monthly maturity amount of the year.

According to VIS Rating, VND 1.2 trillion worth of these bonds are at high risk of first-time delayed repayment. These bonds were issued by two real estate companies with “Extremely Weak” credit profiles.

VIS Rating also notes that 9 out of 27 issuers with bonds maturing in August 2025 have weak or lower credit profiles. Of these, 7 issuers have already recorded delays in principal and/or interest payments, and 4 are linked to Van Thinh Phat Group.

Additionally, VND 14.4 trillion worth of maturing bonds have already faced delayed coupon payments, including VND 10.5 trillion from four Van Thinh Phat–related companies. Other delayed bonds were issued by Novaland, Trung Nam, and Hai Phat — all currently undergoing debt restructuring.

In July, the market recorded several issuers with payment delays: Sai Gon Glory delayed VND 304 billion against total bond debt of VND 5.062 trillion; Trung Nam Solar delayed VND 55 billion (bond debt: VND 4.386 trillion); and Trung Nam Dak Lak Wind delayed VND 25 billion (bond debt: VND 9.029 trillion).

According to VBMA data, July saw seven bond codes with delayed interest and/or principal payments totaling VND 881 billion.

Combining bonds maturing in July and August, approximately VND 109.458 trillion in bonds are set to mature in the remaining five months of 2025, with real estate bonds accounting for VND 55.893 trillion, or 51%.

In July alone, about VND 19.2 trillion in bonds matured, meaning the rollover pressure remains heavy at around 80%. For the remainder of the year, the real estate sector will bear about 30% of the outstanding maturities in its category.

With many issuers — especially property developers and energy project developers (both within and outside shared corporate ecosystems) such as Van Thinh Phat, Novaland, and Trung Nam — still facing difficulties, repayment risks remain significant. Novaland, in particular, is still undergoing intensive financial restructuring, while newly restarted projects have yet to generate significant revenue.

In July, companies repurchased VND 16.054 trillion in bonds before maturity, down 52% year-on-year, according to VBMA.

In July, companies repurchased VND 16.054 trillion in bonds before maturity, down 52% year-on-year, according to VBMA.

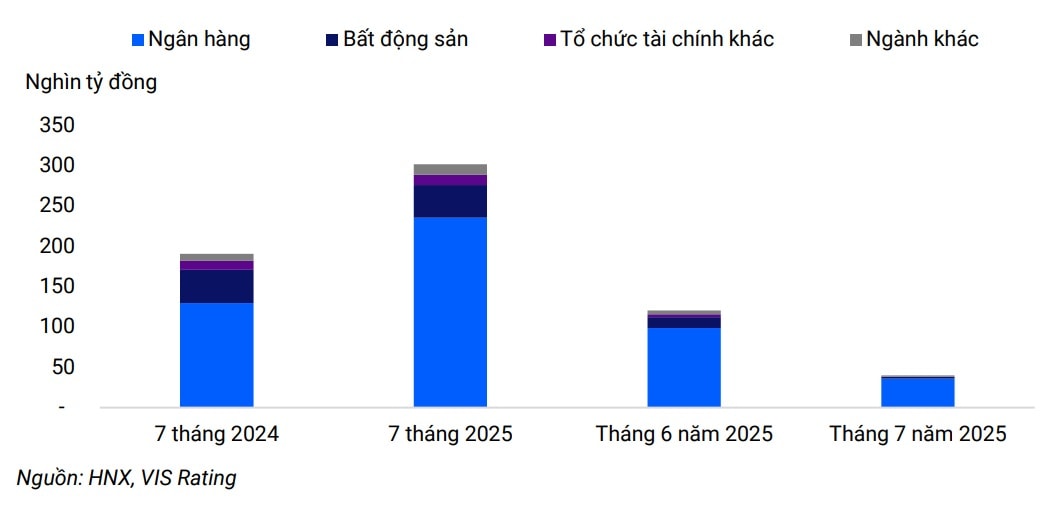

For new issuances, July recorded 31 private placements worth VND 27.294 trillion and one public offering worth VND 2.649 trillion. The largest issuances came from Agribank, VPBank, OCB, SHB, BIDV, MBBank, and Vietjet. Banks continued to dominate the new issuance market, reflecting the need to restructure capital sources, raise Tier-2 capital, and boost lending capacity amid rising credit demand and tight liquidity.

Since the beginning of 2025, VIS Rating estimates total public bond issuance at VND 41 trillion — the highest in recent years. In July 2025, SHB and Agribank issued subordinated public bonds with 7- and 10-year tenors, respectively, at floating rates tied to the average 12-month deposit rates of four state-owned banks, with spreads of 300 and 180 basis points.

The surge in public issuance reflects the effectiveness of policies aimed at stabilizing and developing the corporate bond market in a balanced and sustainable way, as investor confidence gradually returns. However, it also underscores that more favorable conditions are still needed to attract professional individual investors into this crucial medium- and long-term funding channel for businesses.