Corporate bonds: The need for liquidity risk oversight

In the first half of November 2025, a number of businesses continued to report principal and interest payment delays on corporate bonds that had passed their due dates.

The Government Inspectorate’s publicized conclusions on compliance with laws on private corporate bond issuance and the use of proceeds—covering the period from 1 January 2015 to 30 June 2023 for 67 issuers—revealed multiple violations

According to disclosures on HNX’s corporate bond portal, Dai Thinh Phat Construction JSC announced a delay in paying interest on the bond batch DPJ12202. The batch has a par value issuance of VND 471.7 billion and a 12.5% annual coupon, with interest due in November. The delayed interest amounts to more than VND 5 billion. The company has notified investors and is arranging funds to make payment in the near future.

As of the end of October 2025, total outstanding corporate bond debt reached VND 1.406 quadrillion (2.5% MoM), reflecting stability in issuance activities and sustained investor demand.

Helios Investment and Services JSC also announced delays in paying principal and interest for batch HISCH2124001. The batch carries a par value issuance of VND 3 trillion, with an 11% coupon and a scheduled payment of over VND 81.3 billion due since March 2025; however, the company only disclosed abnormal information on 13 November 2025. According to the announcement, the payment agent has been unable to arrange the necessary funds. The issuer is currently negotiating with investors.

Instances of delayed principal and interest payments are not new. Several companies continue to face funding constraints and must negotiate with bondholders.

Earlier, in October, despite reporting profits and maintaining around VND 300 billion in cash at the end of Q3 2025, Hoa Binh Construction Group JSC (HBC) failed to pay VND 12.4 billion in principal for bond batch HBCH2225002 on 31 October 2025—a notable case.

According to VIS Rating experts, this incident highlights a significant liquidity gap: accounting profits or cash balances on financial statements do not fully reflect a company’s actual repayment capacity.

“Although HBC has announced plans to implement a substantial workload, most new projects only began in Q3–Q4 2025, which limits short-term cash inflows while liquidity pressures remain high.

The delay in principal repayment underscores the importance of deeper analysis of issuers’ liquidity dynamics and cash flows, especially for large companies with complex operating cycles,” VIS Rating experts emphasized.

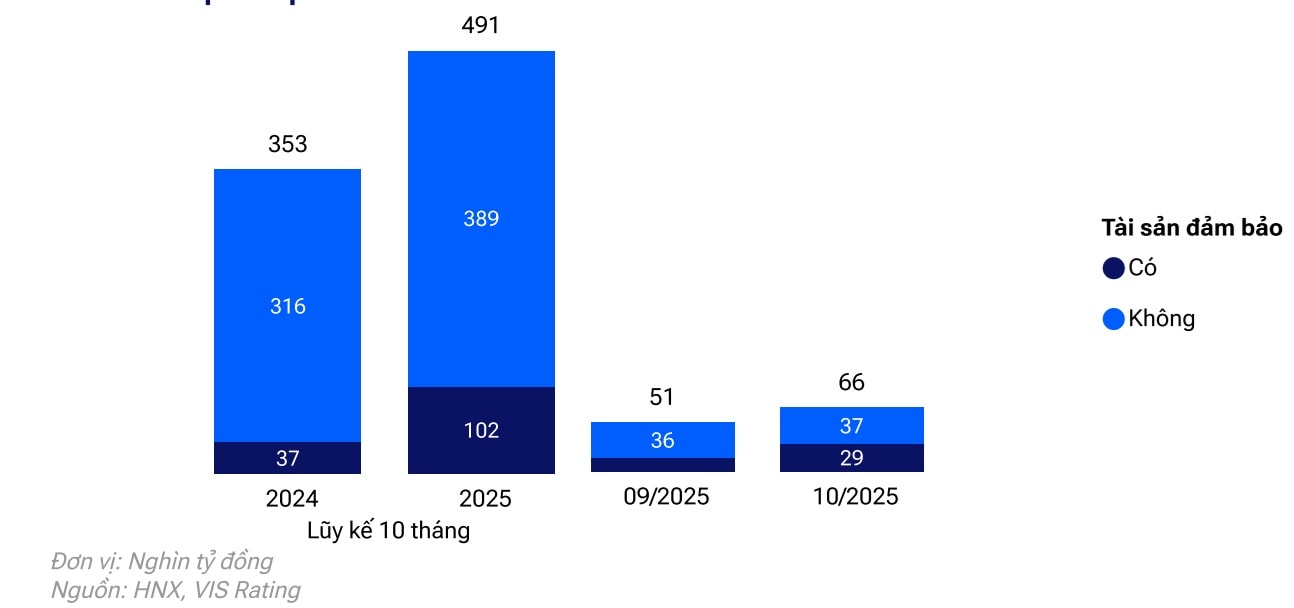

The share of secured bonds in the market remains relatively low

Vietnam’s corporate bond market also saw a strong recovery in October, with total new issuance reaching VND 66 trillion—up 30% from the previous month—marking six consecutive months of growth.

The real estate sector led this rebound, with five major deals ranging from VND 3.8 trillion to VND 7.65 trillion. In contrast, issuance by banks slowed, falling 15% from the previous month.

Notable issuances during the month include: Hung Thinh Invest Hanoi (VND 7.650 trillion); New Era T&T (VND 5.550 trillion); Truong Minh Real Estate Investment & Development (VND 4.500 trillion); Thai Son Construction (VND 4.000 trillion); Hai Dang Real Estate Investment & Development (VND 3.800 trillion); Vietnam International Bank – VIB (VND 3.000 trillion); TN Development (VND 2.950 trillion); Maritime Bank – MSB (VND 2.500 trillion); and New Era T&T (VND 2.500 trillion).

October also recorded a recovery in public bond issuance, totaling VND 2.3 trillion, primarily from Lien Viet Post Bank (LPB, A Stable), Viet A Bank (VAB, A- Stable), and DNSE Securities.

Both LPB and VAB issued 7-year Tier 2 unsecured bonds with initial coupon rates of 7.03% and 7.6%, respectively. According to VIS Rating, the 57-basis-point spread between the two issuances indicates rising market sensitivity to credit ratings, reflecting a clearer trend of credit-risk pricing in bank bond investments.

For Q4—including October and the remaining two months of 2025—S&I Ratings estimates that bond maturities will remain high at around VND 62 trillion. However, pressure on the real estate sector will ease as its maturing volume declines 49% from Q3, to an estimated VND 19.3 trillion.

Some issuers, such as Hung Thinh Land, have announced partial principal payments for multiple bond codes using alternative assets in early November 2025—demonstrating efforts to fulfill contractual obligations.

Nevertheless, maturity pressure and instances of delayed repayment highlight the need for stronger liquidity-risk oversight in the corporate bond market. Particularly in 2026, according to S&I Ratings, maturity pressure is expected to cool in early Q1 but rise again toward the end of the year, with total maturities estimated at VND 233 trillion—up 26% from 2025. This will be a challenging year for the real estate sector, as a record volume of bonds will come due, especially in the last three months of the year, estimated at VND 141 trillion—an 81% increase from 2025.