How does the U.S. interest rate impact financial markets?

Increases in U.S. interest rates driven by reaction shocks are associated with adverse movements in Emerging Markets and Developing Economies (EMDE)’s financial markets, said WB.

Real shocks to U.S. interest rates tend to be followed by benign short-term movements in EMDE financial markets, including an increase in capital flows, an increase in equity prices...

>> The outlook for monetary policy among central banks

This includes significant increases in 10-year yields and sovereign spreads (EMBI), declines in capital flows, and depreciation of real exchange rates. In addition, short-term interest rates rise and equities decline, although those movements are not statistically significant. Inflation shocks are also followed by increases in 10-year yields, lower capital flows, depreciating real exchange rates, and depressed equity prices. However, WB said that with the exception of the last of these, the movements are not statistically significant.

In contrast, real shocks to U.S. interest rates tend to be followed by benign short-term movements in EMDE financial markets, including significant declines in sovereign spreads, an increase in capital flows, an increase in equity prices, and an appreciation of the real exchange rate. Ten-year government bond yields rise, but this is to be expected, since bond markets are integrated globally, and the bond yields of advanced economies tend to move together closely as well.

In summary, the dislocations in EMDE financial markets experienced during the Fed’s most recent tightening cycle are consistent with the predictions of the estimated models.

WB said the reaction shocks would exert large and significant effects on the likelihood of EMDE financial crises within one year, especially currency crises. By comparison, inflation shocks are associated with only small and insignificant effects. Real shocks reduce the likelihood of EMDE debt crises, consistent with their benign effects on financial markets, and perhaps reflecting their positive implications for EMDE exports and capital inflows; while they raise the likelihood of currency crises, they do so by much less than reaction shocks.

>> Which central banks will pause rate hikes?

“In the average EMDE, the probability of facing a crisis of any type in any one year (when the explanatory variables are at their sample mean) from 1985 to 2018 was 3.5 percent. If 2-year yields in the U.S. were to increase by 25 basis points driven by reaction shocks, then the estimated probability of crisis about doubles, to 6.6 percent”, said WB.

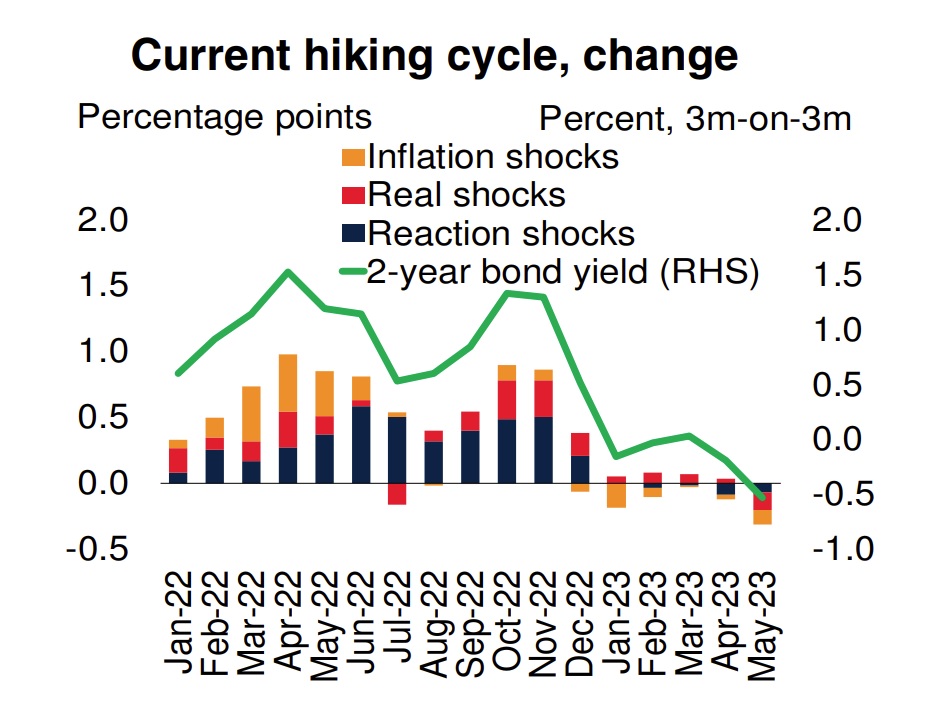

In the 12 months ending in mid-May 2023, reaction shocks accounted for a 72-basis-point increase in 2-year Treasury yields, which indicates a substantial increase in the probability of a financial crisis in EMDEs. Based on the model estimates, the probability of a financial crisis in the average EMDE increased 15 percentage points, to about 19 percent, assuming all other variables remain at their sample averages.

In particular, the probability of a currency crisis jumped to 26 percent in WB’s view. This large increase is explained by the non-linear relationship between the interest rate shock and the probability of financial crisis: a doubling of the interest rate shock leads to a more-than-doubling of the rise in the crisis probability.

To be sure, a very large confidence interval must be placed around the estimate, as no rise in yields as large and fast as what took place in 2022 occurred during the 1985-2018 estimation period. That said, there have indeed been various incidences of financial stress in 2022, with six EMDEs experiencing full-fledged currency crises (based on the definition in Laeven and Valencia 2020), several governments defaulting on their debts, and 21 EMDEs reaching agreements with the IMF for additional financing.